Table of Contents

Revolutionizing the AI Agents for the Insurance Industry

July 10, 2025

July 10, 2025

The insurance industry has always been known for its administrative complexities and risk-averse approach to day-to-day operations. Not long ago, these hectic requirements necessitated a significant amount of manual labor.

However, today, major industry players are now using AI agents for insurance operations in ways that were previously impossible.

AI for insurance agents can now simulate human decision-making processes and perform complex tasks, such as underwriting, claims processing, fraud detection, and customer service, all without requiring human intervention.

The result? Faster, safer, and more efficient procedures across the board.

Drawing insights from key players like Microsoft and industry analysts like Forbes, this article aims to explore the types of AI agents being used, specific use cases, architectural innovations, and a strategic implementation roadmap. It also serves as a comprehensive guide to help experts and curious readers alike understand the innovations that AI agents are catalyzing within the insurance industry

Let’s examine how AI agents for insurance operations are revolutionizing the entire insurance industry.

Types of AI Agents in Insurance

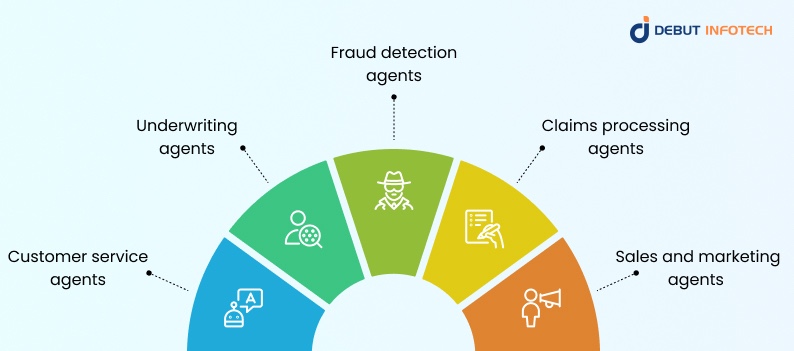

Various AI agents solve different needs within the insurance value chain.

These agents can be loosely categorized into 5 major categories:

- Customer service agents

- Underwriting agents

- Fraud detection agents

- Claims processing agents

- Sales and marketing agents

Let us explore these agents in detail.

1. Customer service agents

Customer service is central to the functioning of the insurance industry, and AI enhances customer service efficiency.

Previously, it involved human agents interacting over the phone or via email with policyholders and other key players in the insurance industry.

However, today AI agents are now present on website chat interfaces, mobile apps, and even messaging platforms like WhatsApp.

With the help of these AI agents, insurance companies can now provide live assistance and consultation to policyholders without requiring a large number of human agents.

Not only that.

Major insurance companies also use Natural Language Processing (NLP) to handle inquiries about policy details, claim statuses, and premium calculations. And when these inquiries require more detailed assistance, these AI agents have learnt how to escalate more complex queries to human agents to ensure that these are handled with care.

2. Underwriting agents

The process of assessing an individual’s risk for insurance and determining the policy’s conditions is known as underwriting. In essence, insurance firms use this to assess a person’s eligibility for a certain insurance plan.

Because of this, the underwriting procedure is usually laborious and data-intensive.

And AI agents are resolving that issue.

AI agents are ideal for gathering and evaluating data from a variety of sources due to their analytical skills. We are discussing lifestyle data collected from IoT devices, medical histories, and credit scores.

AI algorithms process manual statistical models in a matter of minutes, saving human agents time and providing the metrics they need to swiftly evaluate a candidate.

As a result, insurance firms can create complex risk profiles in a matter of minutes, assisting them in making more fair and knowledgeable policy choices.

Additionally, they maintain a constant pattern of decision-making, which lessens the possibility of human bias and oversight. Lastly, they enable the provision of dynamic underwriting models and customized pricing.

3. Fraud detection agents

A report by NASDAQ estimates that over $300 billion is lost to insurance fraud in the US annually. To curb these losses, insurance companies deploy AI agents trained for fraud detection.

These AI agents are trained using machine learning models to analyze vast datasets and flag unusual activity patterns. AI fraud detection agents can examine metadata, behavioral analytics, and verify internal databases against external ones to identify inconsistencies.

Let’s say a claimant has been involved in previous insurance scams, or there are discrepancies between the timing and geographical location of an insurance claim. The AI agents, based on their advanced models, can detect if something is off. This ability to detect fraudulent patterns makes them well-suited for counter-fraud operations.

4. Claims processing agents

To process claims, insurers typically must conduct multiple reviews and verify documents.

It’s usually a lot of paperwork, and it can be cumbersome and often time-wasting.

To simplify this process, insurers use AI agents to automate the collection and analysis of relevant information. These AI agents utilize OCR (optical character recognition) to extract data from submitted documents and integrate this data into external databases to validate claims. Some advanced systems also use computer vision to assess photographic evidence and generate repair estimates.

5. Sales and marketing agents

The insurance industry is generally considered to be moderately to highly competitive. With predictions of intense competition in the coming years, insurers are deploying AI agents to enhance customer acquisition and retention. These AI agents utilize predictive analytics and behavioral tracking to refine customer acquisition strategies.

This is a good thing because customer acquisition requires a customer-centric marketing strategy, allowing the target customers to feel seen.

If human agents were to gather enough personal data about each customer, it would require a significant amount of time and resources.

But insurance companies may spend little time and money segmenting audiences according to their requirements, behavior, and demographics with the use of AI agents. This makes it possible for insurers to target particular audience segments with offerings that are specifically designed to meet their needs. Additionally, these agents examine the data of current policyholders to find chances for cross-selling and upselling.

Related Read: Advanced AI Agent Programming Techniques For Business Needs

This application of AI for insurance agents’ development ensures that the company is providing the right insurance solutions and products to the right customers.

Seeking to Streamline Your Processes with Tailored AI Agents?

Get a custom-built AI agent designed to enhance operational efficiency and optimize workflows across your business processes.

How AI Agents are Used for Insurance Purposes: Strategic implementation and roadmap

The process of using AI agents for insurance operations is a complex one that extends beyond simply installing new software.

Therefore, companies that want to deploy an AI agent must modify their business processes, data ecosystems, and organizational culture. To do this effectively, you need to adopt a phase roadmap strategy. This will help you realize value and avoid costly missteps.

Our AI consulting services experts here at Debut Infotech Pvt Ltd recommend approaching this vital implementation process in the following phases.

Phase 1: Needs assessment and stakeholder alignment

Before designing an AI agent, it is essential to have a clear understanding of your company’s current needs and desired outcomes.

Here are some examples:

- Growing number of claims

- Cutting back on operating expenses

- Improving client satisfaction

- Managing the complexity of regulations

During this stage, you should determine which areas—such as fraud prevention, underwriting, or customer service—AI can most effectively improve operational efficiency. Interdepartmental cooperation is necessary to do this in order to guarantee alignment and get support.

Phase 2: Technology selection and vendor evaluation

Once you are clear on the objectives, the next thing is to choose the right AI tools and platforms. This includes selecting machine learning frameworks, large language models, cloud environments, and security tools.

When selecting AI tools, consider factors such as:

- Scalability

- Ease of integration with existing systems

- Compliance readiness

- Vendor support.

Phase 3: Data readiness and governance

The quality of the data used to train the model has a significant impact on how well the AI performs for insurance brokers. Thus, ensure that you allocate a significant amount of resources to data auditing, cleansing, and structuring when developing an AI agent. By doing this, you can determine the caliber of the data that will be used to train your models and, consequently, how well they will perform in actual situations.

In order to manage data protection, user consent, lineage, and access limits, you must also set up governance standards. This is especially crucial in locations with stringent data handling laws.

Phase 4: Agent development and prototyping

Once you have ascertained the quality of data you’ll be operating with, you can now start developing your AI agents, starting with their prototypes.

This phase involves creating algorithms, user flows, integration points, and fallback mechanisms. To ensure the highest quality, AI agent development companies like Debut Infotech Pvt Ltd use agile methodologies to guarantee efficient implementation. To evaluate performance, find edge cases, and enhance agent accuracy, this calls for thorough testing in controlled settings.

In order to fine-tune performance prior to a full-scale release, developers must lastly set up pilot projects that permit restricted client exposure.

Phase 5: Deployment and change management

Rolling out an AI agent in a live environment must be done in stages. This must start with low-risk areas or specific user segments. This helps you gather valuable real-world feedback and avoid major disruptions.

Change management strategies should include training programs for your employees and communication plans for customers. This guarantees a seamless transition. Finally, before going public, you should integrate A/B testing protocols and real-time dashboards to track early performances and identify potential issues promptly.

Phase 6: Continuous improvement and expansion

The work does not stop at deployment.

To make sure your agents are operating at their best, you must constantly observe and retrain them. You must create feedback loops that integrate error reports, user insights, and new data sources in order to accomplish this. Furthermore, you must compare the gathered data to key performance indicators (KPIs) including customer happiness, claim accuracy, and resolution time. This guarantees alignment with your company’s objectives.

Read also this blog: Exploring the Key Components of AI Agent Architecture

Challenges to deploying an AI agent in insurance

While AI agents in insurance offer several benefits to insurers, they also present a complex set of challenges.

So, what are the hurdles you should be prepared for as you try to build AI agents for insurance operations?

Some of them include ethical concerns and regulatory compliance, technological limitations, and workforce displacement. Let’s examine them in detail below:

1. Data privacy and security

Data is the foundation of any AI system.

In insurance, this data could include health records, income details, driving habits and other personal information that are highly sensitive.

The challenge here is that AI agents for insurance can become major targets for cyberattacks and data breaches. Malicious actors want to get access to this data, manipulate it, and use it for fraudulent purposes.

So, what can be done?

Insurance companies must implement advanced security protocols, including end-to-end encryption, strict access control, and adherence to global data protection regulations.

2. Algorithmic bias and fairness

Systematic mistakes that give preference to some candidates over others, leading to discriminating results, are known as algorithmic bias. Since the training data frequently causes this, we have underlined the significance of data preparedness and control. For instance, skewed data may unfairly penalize some minority groups in claim evaluations or underwriting.

- By adhering to various best practices, you can overcome this obstacle, including:

- Use a variety of training datasets to train your AI agent.

- Use algorithms that consider fairness.

- Use open model governance procedures.

- Perform routine audits.

- Explain and verify AI-powered judgments with SHAP and LIME tools.

3. Explainability and transparency

The majority of engineers and academics still don’t fully comprehend artificial intelligence (AI), which is currently advancing quickly. This is especially true for deep learning-based AI agents.

Consequently, there is a knowledge gap that results in a lack of transparency. As a result, issues with a customer’s insurance coverage, claim processing, or premium cost may arise.

Because of this, regulators frequently want insurers to describe the development of their AI agents and how they affect their insurance business. In order to make their models understandable to internal stakeholders, customers, and regulators alike, insurers must give explainable AI (XAI) frameworks a priority.

4. Workforce displacement and human oversight

We’ve been discussing the various ways in which the use of AI agents for insurance purposes reduces human intervention all day. Clearly, this means that insurance companies may hire fewer workers or even lay off current ones. This ultimately leads to workplace displacement and human oversight.

On the other hand, other industry experts argue that while AI agents will take over repetitive tasks, they will also create opportunities for new roles such as AI trainers, data ethicists, and compliance specialists. This dynamic presents a significant challenge that companies seeking to utilize AI for insurance purposes must consider moving forward.

5. Public perception and trust

Trust is a valuable currency in today’s world where companies do not exist simply as businesses but as brands with unique identities. Today, public perception is a key factor in customer acquisition—brands with a poor image find it hard to get new customers or keep old ones. Therefore, if customers believe that AI agents affect financial well-being negatively, they are more likely to switch providers.

To address this concern, you need to:

- Be transparent about AI usage

- Offer opt-out options where feasible

- Maintain open communication channels for providing feedback and resolving disputes.

Read Also Our New Blog: Scalable AI Agent Architecture: Benefits, Challenges, and Use Cases

Scale your insurance operations with tailored AI agents

Schedule a strategy session with our AI consultants to discover how AI can propel your insurance business forward.

Conclusion

The process of deploying an AI agent for insurance is multi-layered and necessitates thorough preparation. This is particularly important because a large portion of the public still has doubts about the application of AI.

Therefore, insurers must prioritize transparency, adhere to stringent regulatory rules, and eliminate prejudices in order to cultivate a favorable perception and, eventually, a great brand experience.

To fulfil these requirements, you’ll need an ongoing collaboration with seasoned AI agent development companies that offer comprehensive AI development services. From market research and data sourcing to model training, there’s so much the right partner can help you do. This comprehensive approach guarantees a product that fits your company’s needs, fosters transparency, and builds trust.

Debut Infotech Pvt Ltd is a leading AI agent development company that helps you build AI agents that guarantee operational efficiency while reducing operational costs, and also foster a positive customer experience across all interactions.

Frequently Asked Questions

A. Through the use of AI agents insurers can automate complex processes, improve risk modelling and improve customer experience. Additionally, AI agents help insurers to deliver personalized services, process claims faster and detect fraud more efficiently.

A. The answer to this lies in understanding what roles AI plays within the insurance industry. AI helps to handle repetitive tasks like data entry, document verification and initial customer interactions. They still lack the nuanced understanding and emotional intelligence needed to handle complex tasks.

A. Insurance agents can use AI to increase efficiency, offer tailored services and make data-driven decisions. For example, AI agents can analyze a client’s profile and suggest suitable policies and cross-selling opportunities. It can also predict when a customer might consider switching providers.

A. There are several ethical challenges of using AI in insurance. This includes concerns about fairness, transparency and data privacy. One of the biggest concerns is algorithm bias, where AI agents produce discriminatory or unfair outcomes because they were trained on biased data. Another major concern is transparency which is important in building trust and a positive brand experience.

A. It is anticipated that AI agents will become increasingly independent, managing complete processes—from underwriting to claims settlement—while adhering to legal and corporate regulations. The need for efficiency, customisation, and real-time decision-making is expected to propel the insurance industry’s rapid growth in the AI space.

Our Latest Insights

Leave a Comment