Table of Contents

Home / Blog / Blockchain

Asset Tokenization: Navigate Physical to Digital Asset Conversion

September 1, 2023

September 1, 2023

The latest surge in the cryptocurrency market has channeled significant capital, fostering the growth of a robust global decentralized framework.

Investors have strategically injected an impressive $94 billion into up-and-coming Web3 ecosystem enterprises. In response, the industry has leveraged revolutionary technological and financial solutions.

Innovations such as blockchains, tokens, smart contracts, and crypto wallets now streamline peer-to-peer transactions, optimize trading, enhance transparency, and ensure immediate atomic settlement, benefiting a wide range of sectors.

Central to this wave of financial evolution, new avenues have emerged that were once inaccessible via conventional platforms. Prominent among these is the notion of asset tokenization on the blockchain.

As per reports from the Boston Consulting Group, the tokenization of assets could potentially yield annual savings of up to $20 billion solely in global clearing and settlement expenses. Projecting forward to 2030, there’s an opportunity to tap into a $16 trillion market for tokenized illiquid assets, representing a small fraction of the overall notional value of both public and private holdings.

Given these prospects, a multitude of institutions are actively venturing into the rapidly maturing market of asset tokenization, discerning its potential to be a trillion-dollar endeavor.

For a comprehensive insight into blockchain asset tokenization, including its varied types, inherent advantages, and the sectors poised for its integration, we encourage you to continue reading this article.

What is Asset Tokenization and Its Types?

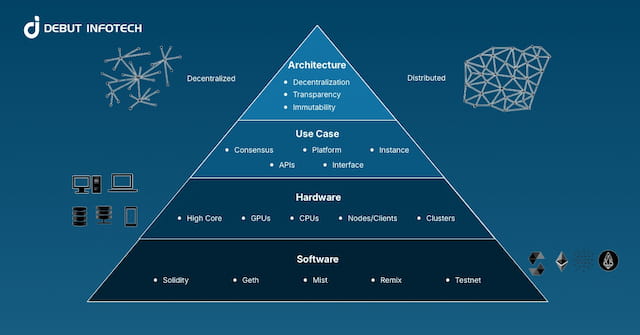

Asset tokenization involves converting ownership rights of an asset into digital tokens on a blockchain. Leveraging cryptographic methods, these tokens are securely logged on a distributed ledger. Each token represents a portion of the actual asset, promoting fractional ownership and allowing a wider pool of investors to partake.

While it might evoke thoughts of Securitization and Fractional Ownership, there are notable distinctions between them, which we’ll elucidate before venturing further into the realm of tokenization and exploring the various token variants.

Tokenization vs Securitization

The primary difference between tokenization and securitization is that while the former transforms tangible assets into readily tradeable digital tokens, the latter turns less liquid assets into more accessible securities for open market and direct trading.

Tokenization vs Fractional Ownership

In contrast to tokenization, Fractional Ownership allows disparate entities to come together for collaborative trading in a digital space.

(Must Read- Fractional NFTs: A New Era of Shared Digital Ownership)

Now that you have a foundational grasp on commodity tokenization, let’s delve into the diverse token classifications within the blockchain framework.

Different Types of Tokens Harnessed in Blockchain World

For maximizing the benefits derived from investing resources in tokenized asset development, tokens can be primarily classified based on two criteria.

Based on Inherent Characteristics

- Tangible Assets

These encompass assets possessing monetary value and typically manifest in physical form.

- Fungible Assets

These digital assets are constructed such that each token mirrors its counterpart. For instance, one bitcoin equals and can be exchanged with another bitcoin.

- Non-Fungible Assets

These are uniquely crafted and aren’t exchangeable on a one-for-one basis.

Based on Functional Intent

- Currency Tokens

These digital entities represent monetary units.

- Utility Tokens

Such tokens are issued to fund the creation of a cryptocurrency and can subsequently be used to acquire specific goods or services provided by the cryptocurrency’s issuer.

- Security Tokens

Serving as a modern adaptation of traditional securities, these tokens digitally echo conventional investment instruments.

Now, having acquainted ourselves with the categories of tokens in the domain of blockchain technology, it is apt to delve into the advantages offered by this innovative procedure.

Advantages Derived from Tokenization of Assets

Asset tokenization, the process of converting the ownership rights of a physical asset into a digital token on a blockchain, brings several advantages.

- Enhanced Liquidity

Asset Tokenization stands as a foremost solution to the challenge of liquidity enhancement. Currently, the marketplace for privately owned corporations is characterized by its lack of liquidity.

This scenario often extends the duration for prospective buyers and sellers to discover one another and understand the offerings on the table.

Furthermore, significant effort and time are dedicated to navigating the intricacies of establishing business synergies, engaging legal representation, and coordinating with other intermediaries to formulate execution contracts.

However, the integration of asset tokenization provides a more refined and efficient approach. This innovation leverages a blockchain framework where tokens act as surrogates for securities of private companies.

These tokens are then made accessible to a select group of participants, who have been rigorously assessed to ensure they are qualified investors with the necessary capital resilience for potential risks.

Such participants have the liberty to transition out of the platform at their discretion by trading their tokens in secondary markets with minimal friction. The conventional challenges and costs associated with early redemption become obsolete in this setup.

Collectively, this mechanism is poised to attract the attention of affluent individuals and entities, fostering greater investments in the securities of private enterprises. This, in the grand scheme, aims to establish a comprehensive international marketplace for these specialized securities.

- Heightened Transparency

Transparency stands as a significant benefit of tokenization. In the domain of asset tokenization, the contractual details encapsulate both the rights and obligations of the token-holder.

This is paired with a thorough record of ownership, offering clarity about the entities involved, their respective authority, and the origin of their token acquisition.

Such factors collectively enhance the transparency of the entire procedure.

- Increased Accessibility

Accessibility stands out as a primary advantage of asset tokenization on the blockchain platform. Implementing asset tokenization on the blockchain facilitates the division of assets into the smallest viable units, represented as tokens.

This enables investors to acquire a fractional portion of shares, broadening opportunities for various investors and reducing the requisite minimum investment duration and sum.

- Cost-Efficient and Expedited Transactions

Leveraging Smart contracts for token-related transactions introduces a heightened level of process automation. By reducing intermediary involvement and streamlining administrative procedures, this approach ensures expedited and cost-optimized transactions, accentuating the inherent benefits of asset tokenization.

- Immutable Records

On the blockchain, data integrity is held in the highest regard, ensuring that entries are impervious to alterations, deletions, or corrections.

As a result, participants within the token trading sphere can place unwavering trust in the authenticity of both asset-specific details and transaction records, given their permanent and validated status once committed to the blockchain.

- No Intermediaries

Harnessing the capabilities of Smart contracts, coupled with intrinsic attributes like immutability, tokenization has refined transactional processes, significantly diminishing the need for intermediaries.

While we’ve outlined the general advantages of tokenization, it’s imperative to delve deeper into its business implications and understand its significance across diverse sectors.

Sectors that Are Adopting the Concept of Asset Tokenization

Asset tokenization has garnered significant attention across various industries, given its potential to enhance liquidity, streamline processes, and democratize access to certain asset classes.

Some industries that are actively embracing the concept of asset tokenization include.

- Finance

Tokenization, an innovative application of blockchain in fintech sector, is significantly transforming various facets of the industry, including margin lending, product structuring, investments, and payments.

This paradigm allows financial institutions to convert assets into digital cryptocurrencies, facilitating seamless transactions.

Additionally, it offers retailers a sophisticated alternative to retaining actual credit card numbers in Point-of-Sale (POS) devices, enhancing data protection measures. Consequently, the market experiences heightened liquidity and a reduction in security breaches.

Moreover, the tokenization of equity shares presents a multifaceted security measure. For a single credit card, multiple tokens can be generated. Therefore, even if a token used on an e-commerce site is compromised, reverse engineering to discern the genuine credit card number becomes profoundly challenging.

Leading the charge in embracing and championing this innovative approach within the industry is the renowned business, OmiseGo.

Related Read- Blockchain in Mortgage Industry

- Real Estate

Real estate is an industry that stands to greatly benefit from the advancements in tokenized asset development.

Real estate asset tokenization refines the investment process by eliminating intermediaries, thus streamlining and economizing transactions between buyers and sellers. Furthermore, it democratizes investment, allowing participation with any amount, which cultivates a more inclusive marketplace.

One salient advantage of this evolution is the substantial reduction in fraud risks. This heightened security and transparency are underscored by the anticipated tokenization of 66 million buildings on the Ethereum Blockchain in an unprecedented deal.

In the domain of real estate, several asset tokenization platforms have emerged as frontrunners, delivering unparalleled services.

Notable among them are Harbor, Slice, and Meridio.

Related Read- How to Build An Ethereum NFT Marketplace

- Healthcare

The healthcare sector is progressively recognizing the potential of tokenization to address some of its prevailing challenges.

Tokenization safeguards sensitive patient information, such as PANs, NPPI, and ePHI, by replacing them with unique, non-sensitive values, consequently mitigating data breach incidents.

Additionally, it shifts the control over sensitive data creation, access, and sharing from intermediaries, like insurance firms, to the hands of patients and medical institutions.

This transformation not only empowers patients to ensure the accuracy of their information but also realizes considerable savings that would otherwise go to these third-party entities.

Clincoin exemplifies the profound potential of tokenization and the token economy within healthcare. As a blockchain-driven platform, Clincoin not only bridges users, providers, and developers but also incentivizes users with rewards for healthy behaviors. These tokens can subsequently be exchanged for digital tools, products, and services within a decentralized marketplace.

(Also Read- How Blockchain In Healthcare Simplies Medical Record Management?)

- Art & Collectibles

Blockchain technology has the potential to democratize the art & collectibles industry, making artworks and collectibles more accessible to both enthusiasts and creators.

By tokenizing their creations, artists can globally market and sell their works without the need for intermediaries.

A notable instance that caught media attention was the tokenization of Andy Warhol’s masterpiece, “14 Small Electric Chairs (1980)”. This multi-million dollar artwork was primarily tokenized to evaluate the Dutch auction mechanism and to gauge the efficacy of combining art tokenization with blockchain technology.

In the domain of collectibles, blockchain has similarly revolutionized ownership and trading.

For example, digital collectibles, such as CryptoKitties, have gained immense popularity, enabling users to buy, sell, and breed virtual cats as unique tokens on the blockchain.

(Related- Maximizing Artistic Value: Best NFT Marketplace for Artists Unveiled)

- Supply Chain

Asset tokenization in the supply chain offers an innovative solution for enhanced transparency, traceability, and operational efficiency.

By translating tangible assets into digital tokens on blockchain platforms, each transaction or product movement is securely monitored and authenticated. This not only minimizes risks of counterfeiting but also refines inventory management, fostering streamlined workflows.

Leading enterprises such as Maersk, a global shipping magnate, and De Beers, known for its diamond traceability platform “Tracr”, have adopted asset tokenization in their supply chain processes. These industry giants’ adoption signifies the transformative potential of tokenization in redefining conventional supply chain practices.

(Also Read- Blockchain in Supply Chain– Challenges, Benefits, Use-Cases & Considerations)

- Gaming

The utilization of asset tokenization in gaming is revolutionizing the industry by allowing gamers to have true ownership of in-game assets.

Through blockchain technology, in-game items, such as weapons or characters, can be tokenized into unique digital assets, providing traceability, security, and the potential for real-world value.

This fosters new economic ecosystems within the gaming world, where assets can be traded, sold, or leveraged. Renowned enterprises like Decnetaland & AxieInfinity have explored this frontier.

Moreover, the integration of smart contracts ensures secure, automated transactions, and interoperability can allow assets to move seamlessly between different gaming environments. Such advancements are adding depth and tangible value to the gaming experience.

(Also Read- Practical Implications of Blockchain in Gaming: What it Can Offer and What it Can’t!)

- Sports

The sports industry is witnessing transformative advancements with the advent of asset tokenization.

Leveraging blockchain platforms for asset tokenization decentralizes the sports marketplace. This not only facilitates investors and enthusiasts to channel their funds into favored sports personalities and clubs but also provides an avenue for trading the associated benefits. Such a mechanism empowers sports entities and athletes to address their financial requisites, thereby optimizing performance and profitability.

Several sports entities and organizations have already begun exploring this avenue, with many more poised to adopt this innovative approach.

A testament to this burgeoning trend is the recent collaboration between Manchester City and Superbloke.

- Music & Entertainment

The fusion of asset tokenization in the media & entertainment industry is redefining value creation, empowering entertainment sectors by offering artists and creators greater control and monetization opportunities for their work.

Utilizing blockchain technology, artists can tokenize their creations, ensuring unique digital representation, enhanced copyright control, and streamlined royalty distributions.

This paves the way for more transparent revenue streams, reducing intermediaries and fostering direct fan-to-artist transactions.

Companies like Audius and Myco are trailblazing this movement, enabling artists to tokenize and sell their works directly to fans.

(Related Read: Capitalizing on Music NFTs: A New Era of Monetization for Artists)

- Enterprise Adoption

Businesses are increasingly tapping into the benefits of tokenizing real-world assets as they transition to Blockchain. This strategy allows them to penetrate new markets, assess employee contributions, optimize resource distribution, establish improved incentive structures, and enhance transparency in organizational operations.

Furthermore, companies are rolling out distinct tokens for specific tasks to offer a customized experience. They allocate rewards based on the number of tokens, providing a tangible measure of significance that goes beyond traditional labels like ‘high-priority’ and ‘urgent’, which were previously used by product managers.

The management of tokenized assets is poised to permeate various industry sectors. With the global tokenization market projected to expand from $1.9 billion in 2020 to $4.8 billion by 2025, growing at a CAGR of 19.5%, integrating this approach into one’s business seems to be a prudent move.

Potential Challenges to Embrace Tokenization of Assets

The rapid emergence of asset tokenization, powered by blockchain technology, has promised transformative shifts in asset ownership, liquidity, and accessibility.

However, with these advancements come a set of challenges that institutions, investors, and regulators must confront. While the potential benefits of tokenization are vast, successfully integrating it requires navigating through a labyrinth of complexities.

Here are some of the prominent challenges

- Vulnerability to Cyber Threats

Despite its touted security, blockchain is not exempt from hacker threats. In 2020, cybercriminals executed 122 attacks on blockchain, leading to a loss of $3.78 billion.

However, a silver lining is observed in the data; there was an 8% decrease in the number of attacks from 2019, where 133 incidents were reported. While this reduction isn’t dramatic, it does indicate a gradual enhancement in blockchain’s security measures.

- Regulatory Challenges

A significant portion of the hurdles in asset tokenization arise from regulatory complexities and technological limitations. The inherently borderless nature of blockchain presents vast potential for enterprises and individuals. Yet, a standardized set of regulations applicable across multiple countries remains elusive.

Such regulatory ambiguity is typical for emerging global technologies. It necessitates collaboration between regulators, policymakers, and technologists to chart a comprehensive legal framework. This framework would ideally address the nuances of tokenized assets and affiliated activities.

Moving forward, we’ll delve into the factors warranting consideration adopted by blockchain development service providers, such as Debut Infotech, in token design, and methodologies.

Factors to Ponder Before Venturing into the Token Economy

For businesses eyeing the asset token economy, it’s crucial to evaluate regulatory compliance, align tokenization with business goals, ensure robust security measures, gauge market demand, and assess liquidity potential.

Thorough preparation can navigate challenges and harness the transformative potential of tokenized assets.

- Business Strategy Framework

Navigating the evolving landscape of asset management requires strategic decision-making, especially in determining an appropriate business model influenced by several factors.

- Opting to serve as an advisor on token creation or as a guardian of the token.

- Deciding between capitalizing on the role of a custodian to facilitate life cycle transactions through distributed ledgers, or integrating smart contracts in the realm of tokenization.

- Choosing to function as a central hub offering access to multiple tokenization platforms or managing individual cryptocurrency user accounts.

- Integration Protocol for Platforms

Based on the chosen business model, various operational frameworks can be employed. This entails selecting the appropriate platform for user engagement and collaboration.

Such decisions hinge on multiple considerations, including:

- The kind of products or services provided,

- The characteristics and magnitude of the intended audience,

- The underlying infrastructure, and

- Applicable regulatory guidelines.

- Cybersecurity Protocols

As businesses increasingly adopt cryptocurrencies, the threat of cyberattacks amplifies. While distributed ledgers inherently bolster security through consensus methods and cryptographic techniques, vulnerabilities persist.

Therefore, it’s essential for companies to integrate robust security protocols when tokenizing intellectual property across various stages.

- Regulatory Adherence

Business transactions are direct, rapid, and irreversible within the token economy.

Given these characteristics, it’s essential to establish operational protocols in line with regulations. Introducing new players, such as KYC utilities and blockchain analytics software providers, can enhance these protocols.

By addressing the mentioned considerations, tokenizing loans and assets can yield improved outcomes. It can carve out novel opportunities and offer solutions to current challenges, paving the way for a progressive asset management future.

How Can Debut Infotech Incorporate Asset Tokenization in Your Business Model?

As a leading blockchain development company, Debut Infotech recognizes that designing and managing tokenized assets tailored to your business requirements is influenced by multiple elements (which we will discuss earlier in this piece). We strategize, set up the optimal framework for the tokenization endeavor, and subsequently introduce an asset within the blockchain sphere, ensuring it’s accessible for diverse transactions.

We trust this article sheds light on real-world asset tokenization and its transformative effects across sectors.

In case you still have any doubts, please reach out to our seasoned blockchain consultants who will elucidate the intricacies of asset tokenization and guide you on pivotal considerations before immersing in the token economy.

FAQs: Real World Asset Tokenization

A. Asset tokenization is the process of converting tangible or intangible assets into digital tokens on a blockchain. At Debut Infotech, we leverage cutting-edge blockchain technologies to offer seamless and secure tokenization services tailored to each client’s specific needs.

A. Tokenization provides increased liquidity, accessibility, transparency, and security. By adopting our tokenization services, businesses and individuals can tap into new investment opportunities and simplify asset management.

A. Virtually any asset can be tokenized, including real estate, artworks, intellectual property, or even company shares. Our team at Debut Infotech, a leading blockchain development company can guide you in selecting the best assets for tokenization based on your goals.

A. We prioritize security in every phase of our tokenization process. By using advanced blockchain technologies, we ensure that tokenized assets are tamper-proof and transactions remain confidential and immutable.

A. Absolutely! We are committed to staying updated with global and regional regulations. Our tokenization processes are designed to adhere to relevant regulatory standards, ensuring that clients remain compliant while benefiting from the advantages of tokenized assets.

A. Asset tokenization is the process of converting the rights to a tangible or intangible item into a digital token on a blockchain. Here’s a simplified breakdown of how it works:

Selection: Choose tangible or intangible assets.

Verification: Confirm asset ownership through relevant documents.

Representation: Use smart contracts to convert asset value into digital tokens.

Issuance: Distribute tokens to investors, representing fractional asset ownership.

Trading: Tokens can be traded on secondary markets, providing liquidity.

Redemption: Tokens may be exchanged for a portion of the underlying asset or its value.

Transparency: All transactions are securely recorded on a blockchain, ensuring immutability and transparency.

Benefits: Democratizes asset ownership, boosts liquidity, and opens novel investment avenues.

Our Latest Insights

Leave a Comment