Get Your Hands on the Turnkey Crypto Exchange Software

Our white label crypto exchange software is fully built, market-tested, and ready for deployment—allowing you to launch a high-performance trading platform under your brand in record time. Every component, from trading engine to liquidity modules, has been engineered for scalability, security, and smooth user experience.

While we deliver the complete technical foundation, our experts also assist you through the compliance process—helping you connect with trusted KYC/AML partners, understand licensing pathways, and ensure your exchange meets jurisdictional standards before launch.

Launch Your Own Crypto Exchange with Our Pre-built Solution within 6 weeks

What’s New? AI-Driven Add-Ons for Crypto Exchanges

Smarter Trading, Safer Systems, Scalable Futures

As exchanges evolve, many are beginning to explore how AI-driven tools could reshape trading experiences—making platforms more adaptive, secure, and efficient. While not always part of the initial rollout, these innovations can be introduced as exchanges mature, aligning capabilities with market demands and growth priorities.

AI-Powered Trading Bots

Automate strategies and optimize trade execution with market-responsive bots.

Fraud & Risk Detection

Enhance trust with AI systems that monitor and flag anomalies in real time.

Intelligent Chat Support

Strengthen customer support with AI assistants that handle queries quickly and efficiently.

Predictive Market Analytics

Use AI-driven insights to anticipate shifts in liquidity and pricing.

Personalized User Journeys

Shape tailored trading experiences through adaptive recommendations and portfolio suggestions.

Compliance Automation

Streamline oversight with AI monitoring for KYC/AML adherence.

Exploring AI for your exchange?

We align white label crypto exchange development with tomorrow’s requirements, building pathways for smarter, safer trading ecosystems.

Advanced Trading Infrastructure Designed for Every Market Type

Engineered for institutional-grade precision, our trading infrastructure supports every market – from spot to derivatives with high availability, deep liquidity, and performance optimized for regulated trading environments.

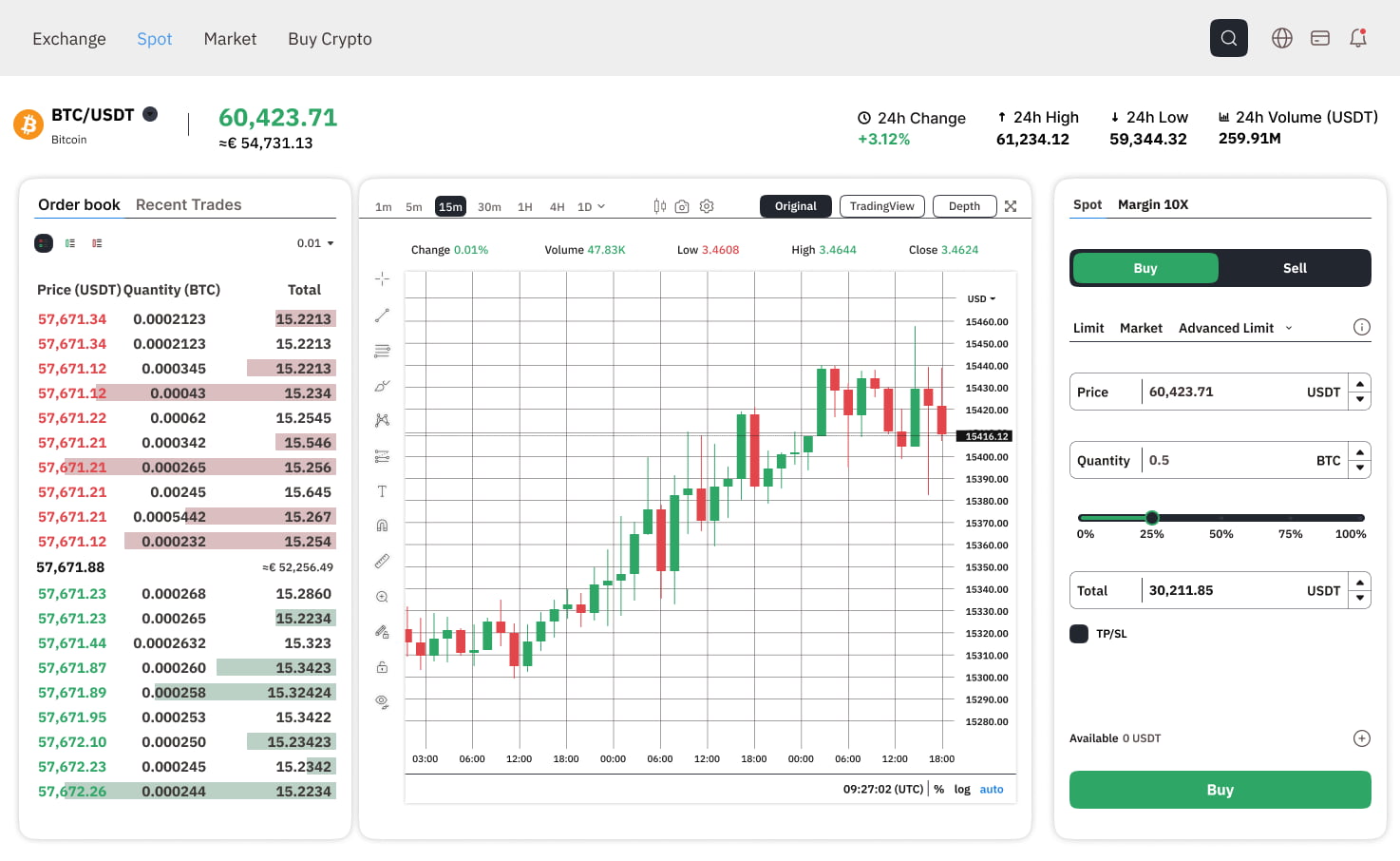

Spot Trading

Facilitate instant buying and selling of digital assets at live market prices. Enable traders to execute orders in real time with deep liquidity and minimal slippage. Designed for precision, transparency, and speed—ideal for both retail and institutional participants.

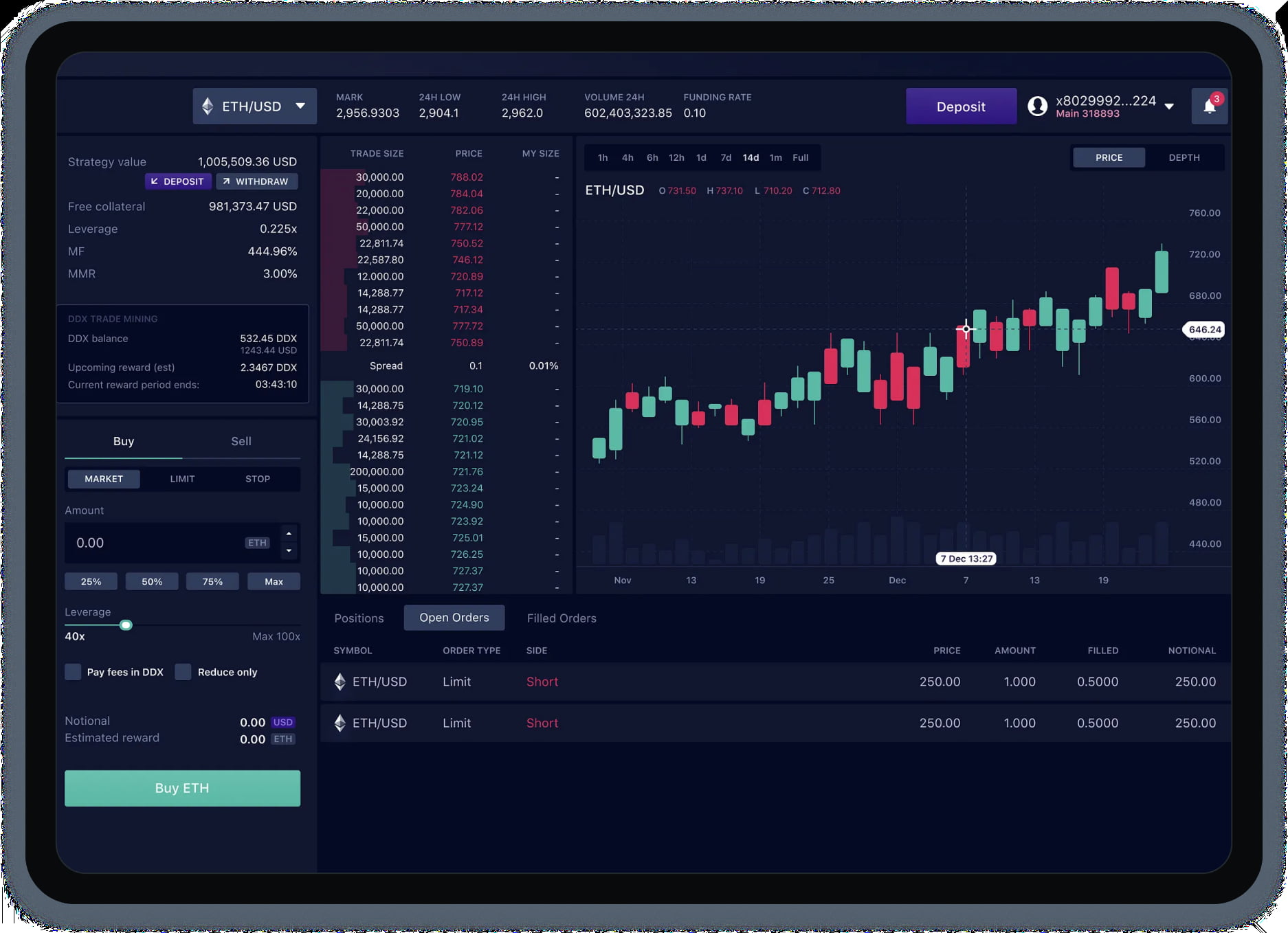

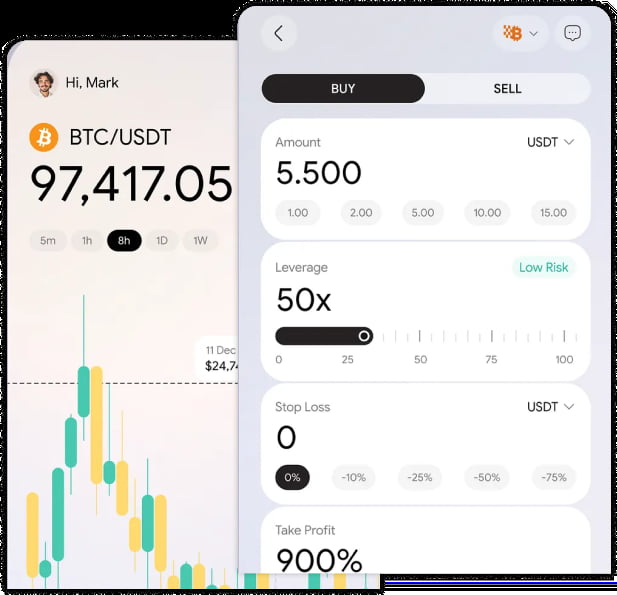

Futures Trading

Empower traders to lock in prices and manage market volatility through futures contracts. Our exchange framework supports high-performance order matching, advanced leverage controls, and automated settlement for smooth derivative operations. Perfect for hedging and strategic speculation.

Options Trading

Offer traders flexible exposure to market movements with call and put options. Our platform supports customizable strike prices, expiry dates, and automated premium management—delivering risk-managed opportunities for sophisticated investors.

Enable leveraged trading for users seeking amplified exposure with minimal capital outlay. Built-in risk engines monitor collateral ratios, liquidation levels, and margin calls in real time to ensure a safe, balanced trading environment.

Perpetual Futures (Perpetual Swaps)

Deliver uninterrupted trading with no expiry contracts using dynamic funding rates. Our perpetual swap module maintains price parity with the spot market, providing continuous opportunities for traders to speculate or hedge positions effectively.

CFD (Contract for Difference) Trading

Allow traders to speculate on asset price movements without actual ownership. Seamlessly manage long and short positions across crypto, forex, and commodities while optimizing capital efficiency and lowering operational complexity.

Arbitrage Trading

Give users the power to identify and exploit price discrepancies across multiple exchanges. Real-time data aggregation and smart order routing tools ensure optimal trade execution, maximizing profit potential with minimal latency.

Copy / Social Trading

Empower retail traders to automatically mirror strategies of proven professionals. Build community-driven engagement and transparency through leaderboards, verified track records, and customizable copy ratios for better portfolio diversification.

Key Features that Make Our White Label Crypto Exchange Unbeatable

As a leading white label crypto exchange development company, we equip businesses with in-demand features that cater to current market trends. Our platform offers advanced security, high liquidity, and extensive customization, enabling you to outshine your competitors and capture market share with ease.

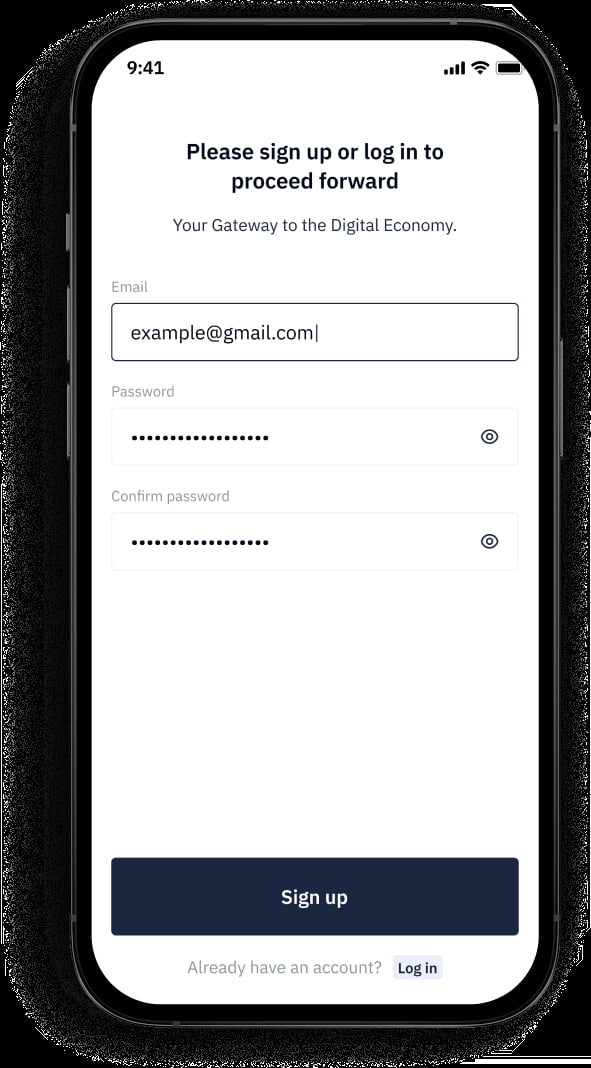

User Registration & Authentication

Enable quick onboarding with secure sign-up flows, 2FA, and biometric login. Deliver a seamless user experience while keeping exchange platforms compliant and safe. Reduce drop-offs, prevent unauthorized access, and build trust from the very first login.

KYC/AML Onboarding

Automate verification with document scans, biometric checks, and sanction-list screening. Integrated KYC/AML modules ensure your crypto exchange platform meets regulations, minimizes fraud, and builds long-term credibility with investors, all while keeping user onboarding fast, smooth, and frictionless.

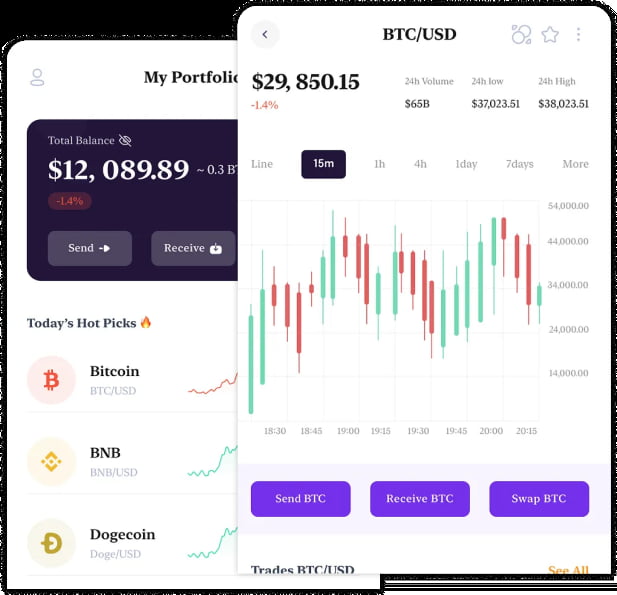

User Dashboard

Offer an intuitive dashboard that consolidates portfolio value, transaction history, and open orders. Enhance user interface design to deliver clarity, simplify navigation, and empower users to make better trading decisions in real time with zero complexity.

Crypto & Fiat Wallets

Integrate secure hot and cold wallets with multi-signature authorization. Support both crypto and fiat currencies, giving users flexibility in managing funds. Strengthen trust by providing robust custody, instant withdrawals, and complete control over digital assets across payment gateways.

Deposit & Withdrawal

Provide seamless crypto and fiat transfers through integrated payment gateways. With near real-time settlement and multi-currency support, users gain flexibility to move assets freely while exchanges boost liquidity and deliver a smooth financial experience across borders.

Trading Engine

Leverage a low-latency trading engine designed for high-frequency crypto trading. Handle thousands of orders per second with precision, ensuring users experience zero lag and tight spreads. This drives market trust, competitive performance, and a frictionless trading platform experience.

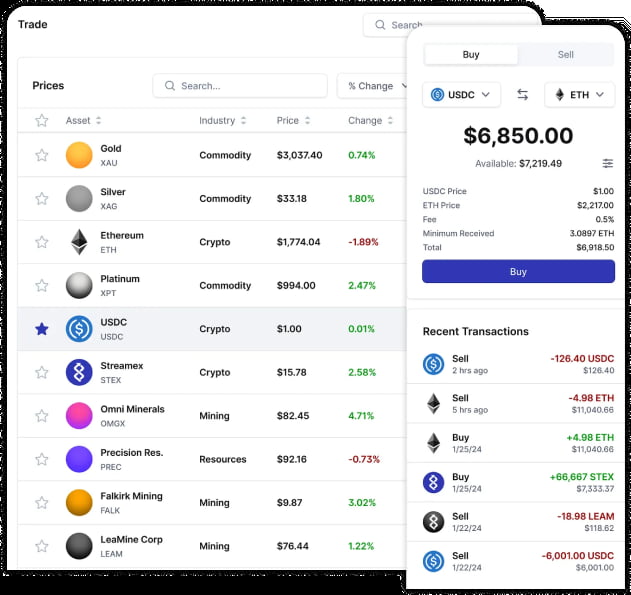

Order Types

Support multiple order types—market, limit, stop-limit, and OCO. Equip traders with flexibility to manage risk and maximize profits. Sophisticated order options make your white label crypto exchange development competitive against top-tier global platforms.

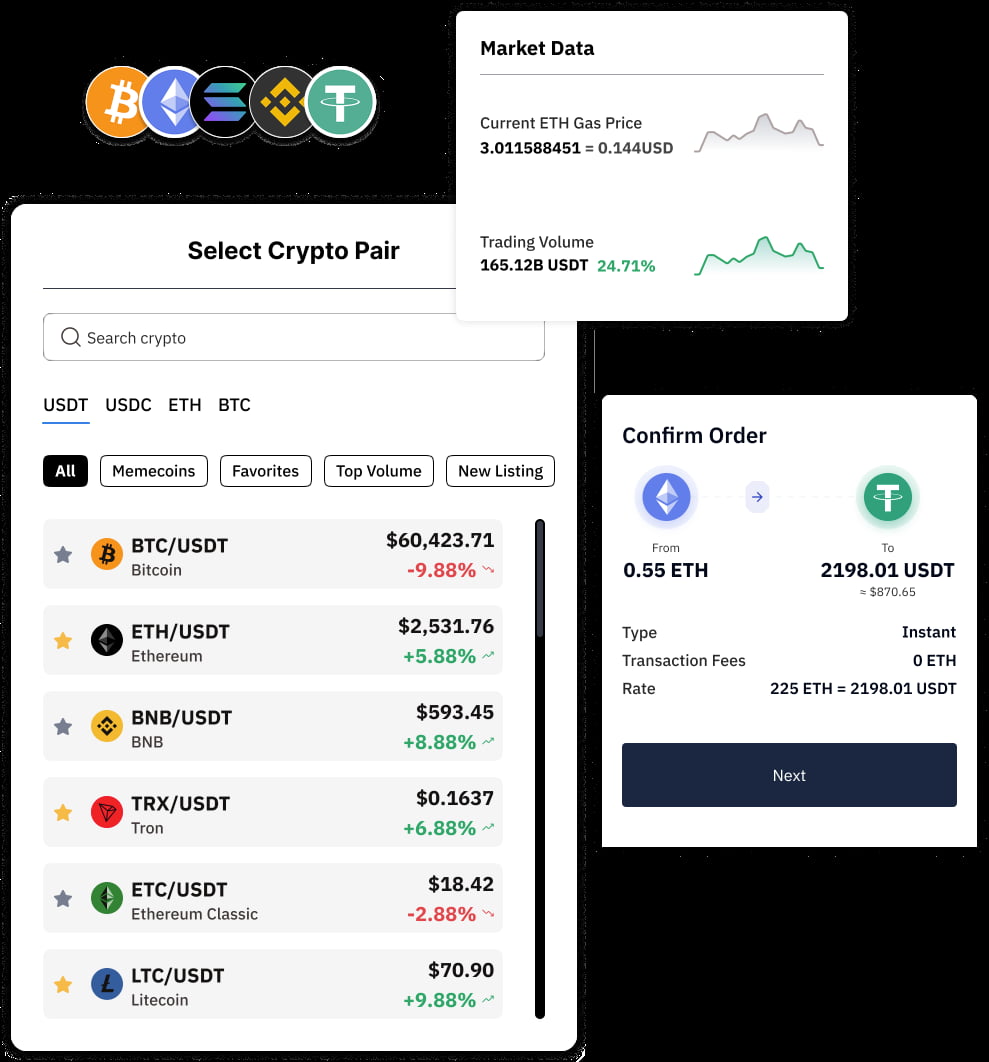

Trading Pairs

Offer a wide variety of trading pairs across crypto-to-crypto and fiat-to-crypto. A diverse marketplace attracts more users, increases liquidity, and positions your exchange as a preferred trading platform for both retail traders and institutional clients.

Market Data & Charts

Deliver advanced market data, interactive charts, and technical indicators. Real-time analytics help traders identify opportunities, minimize risks, and refine strategies. By providing sophisticated charting, your platform becomes a serious choice for professional cryptocurrency trading.

Notifications & Alerts

Offer customizable push notifications for trade execution, deposits, withdrawals, and price movements. Keeping users informed in real time improves retention, enhances user experience, and boosts trading activity across your crypto exchange ecosystem.

AML Screening

Leverage automated AML tools to monitor transactions, detect suspicious patterns, and comply with FATF standards. This proactive approach prevents money laundering risks and keeps your exchange trusted by regulators and users alike.

Multi-Signature Wallets

Increase fund protection with multi-signature approvals, reducing risks of single-point breaches. Essential for institutional investors and high-value traders, this adds a powerful layer of security to your crypto exchange platform.

10 years of long expertise in building blockchain-based digital‑asset infrastructure.

15+

clients powered across 20 countries.

50k+

traders using platforms built by Debut Infotech

40%

faster time-to-market compared to industry average

Can't-Miss Security Features of Our White Label Crypto Exchange

We’ve fabricated our white label crypto exchange software with unbeatable security features that reassure your users and strengthen your reputation. Our solution delivers the trust and safety your business needs to attract and retain users, making your exchange a go-to platform in the market.

Anti-Distributed Denial of Service (DDoS) Protection

Our platform is fortified against Distributed Denial of Service (DDoS) attacks. By detecting and mitigating attack patterns in real-time, we ensure continuous platform availability. This robust protection keeps your exchange reliable and operational, even during attempted disruptions, providing a consistent user experience.

CSRF Security Mechanism

To prevent Cross-Site Request Forgery (CSRF) attacks, we implement a token-based security system. By issuing unique tokens for each session, we secure user actions and ensure that only authorized commands are executed. This protection safeguards your platform from unauthorized actions by authenticated users.

Jail Login

Our jail login feature enhances security by temporarily blocking login attempts after multiple failed attempts. This delay deters unauthorized access and effectively mitigates the risk of brute force attacks on user accounts. It adds an extra layer of protection to keep your platform secure.

Two-Factor Authentication (2FA)

We bolster account security with two-factor authentication (2FA). By requiring users to verify their identity through two independent methods, 2FA ensures that even if one factor is compromised, unauthorized access is significantly hindered. This additional security layer protects user accounts and builds trust.

Anti-Denial of Service (DoS) Protection

Our system proactively safeguards against Denial of Service (DoS) attacks by detecting and managing excessive request loads. This protection ensures uninterrupted access for legitimate users and maintains high service availability. Your platform stays reliable and accessible, even under attack.

Token-Based HTTP Authentication

Our platform ensures that only authorized users gain access to sensitive areas through secure user authentication mechanisms like OAuth. With token-based authentication, we issue session-specific tokens, significantly reducing the risk of unauthorized access and data breaches, keeping your exchange secure and trustworthy for all users.

Data Encryption

We prioritize protecting sensitive user information and credentials by utilizing advanced encryption standards like AES-256. Encrypting data both in transit and at rest safeguards it from unauthorized access, ensuring confidentiality and integrity. This robust encryption gives your users peace of mind, knowing their data is secure at all times.

SSRF Protection

We protect against Server-Side Request Forgery (SSRF) attacks that target internal network vulnerabilities. Our SSRF protection detects and blocks malicious requests, preventing potential data breaches and unauthorized access to sensitive internal systems. This safeguard keeps your internal networks secure.

Award Winning

Witness the Brilliance: Explore Our White Label Crypto Exchange Interface

A Compliant Blockchain Platform for Real Estate Tokenization

RVA

RVA Crypto Exchange highlights how leveraging a proven exchange framework can dramatically reduce build time while maintaining absolute control over security, compliance, and scalability. By customizing our pre-engineered exchange core to match RVA’s operational and regulatory requirements, we delivered a fast, resilient trading environment with automated workflows and enterprise-grade safeguards — giving RVA the acceleration of a ready system with the refinement of a tailored build.

Outcomes

100% enhancement in security posture with multi-layer protections

85% increase in order execution and transaction speed

75% automation of trading, monitoring, and compliance tasks

90% reduction in manual intervention across critical operations

Seamless integration of custodial wallets and advanced trading modules

A Powerful Solution for Secure and Automated Crypto Trading

NDAX Exchange

NDAX Exchange demonstrates how white label crypto exchange development can accelerate time-to-market while leaving room for innovation. We combined a proven exchange core with BOT-driven automation, advanced APIs, and layered security upgrades, giving NDAX the agility of a pre-built platform with the performance of a custom build.

Outcomes

100% improvement in security infrastructure

85% increase in transaction speed

75% boost in automation and trading efficiency

90% reduction in manual intervention

Seamless integration of DEX and CEX models

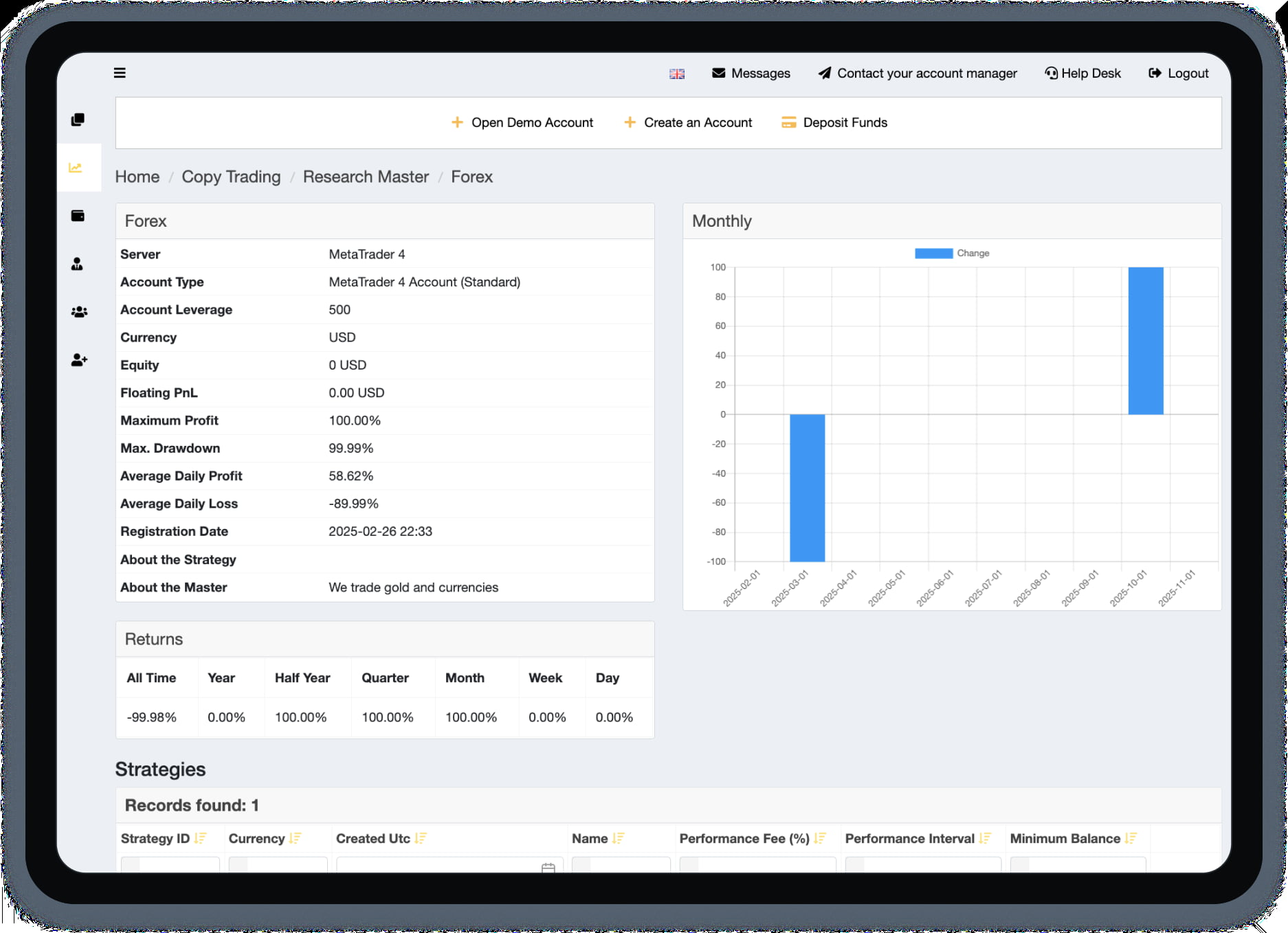

A Cutting-Edge Platform for Secure and Efficient Forex Trading

MetaTrader 4

For MetaTrader 4, we utilized elements of our white label exchange software as a foundation and layered them with advanced forex modules. By customizing trading algorithms, analytical dashboards, and robust execution systems, we modernized the platform while ensuring security and compliance were uncompromised.

Outcomes

100% enhancement in security infrastructure

90% increase in transaction speed

75% improvement in user experience

85% increase in automated trading efficiency

An Ultimate Hub for Secure, Seamless Crypto Trading and Exploration

DebutDX

DebutDX, developed by Debut Infotech, is a next-gen decentralized exchange that blends white label crypto exchange development frameworks with custom DeFi enhancements. Leveraging reusable core modules accelerated deployment, while bespoke integrations—like liquidity pools and governance tools—enabled a differentiated market presence.

Outcomes

100% enhancement in security protocols

90% increase in transaction speed

75% improvement in trading efficiency

85% reduction in operational complexity

Scale Revenue with Our White Label Crypto Exchange Software

The crypto trading market keeps growing, and established platforms are capturing record fees. If you already run a trading venue—or plan to expand into digital assets—now is the time to add a branded exchange that pays off fast.

Accelerate ROI

Launch in weeks, not months, to start collecting trading and listing fees sooner and reach breakeven faster.

Increase Transaction Revenue

Aggregate global liquidity and offer tight spreads to drive higher volumes and maximize per-trade income.

Grow Without Heavy Overhead

Our infrastructure, trusted by leading exchanges, handles millions of trades daily so margins scale while operating costs stay low.

Protect Your Earnings

Built-in KYC/AML controls and institutional-grade security keep compliance costs predictable and revenue streams secure.

Capitalize on market momentum—start driving profit from your crypto exchange.

Get Started with Debut Infotech Today

Everything-in-One Mobile App

White Label Crypto Exchange Solution Models

Every business has unique goals when entering the crypto market. That’s why our white label crypto exchange development services cover multiple models tailored to your vision, regulatory needs, and growth strategy. Whether you want to serve retail traders, institutional investors, or the DeFi community, we provide flexible solutions that balance compliance, scalability, and user experience.

Centralized Crypto Exchange (CEX)

Launch a secure, compliance-ready platform with advanced KYC/AML, fiat payment gateways, and high-liquidity order books. Our white label CEX solution emphasizes regulatory alignment, robust custody, and institutional-grade trading features, making it ideal for businesses that prioritize trust, oversight, and efficient user onboarding.

Decentralized Crypto Exchange (DEX)

Cater to DeFi users with a non-custodial, transparent trading platform. Our white label DEX delivers the familiar UI of a CEX while ensuring on-chain settlement, liquidity pool integration, and governance flexibility. This model reduces custody risks while strengthening user trust in decentralized finance ecosystems.

Hybrid Crypto Exchange (HEX)

Combine the best of centralized and decentralized models. With a hybrid exchange, you gain regulatory compliance, fiat support, and custodial features of a CEX, while offering DeFi-native functionality like liquidity pools, on-chain trading, and governance modules. This model future-proofs your business by attracting both institutional and Web3-native investors.

Go Live Faster With a White Label Exchange Designed Around You

From branding to integrations, our turnkey solution cuts costs and time to market.

Who We Serve

Our white label crypto exchange development services are built to help organizations cut through complexity and seize real opportunities in the crypto market. We don’t just deliver pre-built exchange platforms—we equip you with a scalable trading platform that supports compliance, liquidity, and sustainable revenue models.

Financial Institutions & Fintech Companies

We partner with banks, wealth management firms, and lending platforms to embed crypto trading and digital asset services within existing infrastructures. With integrated payment gateways, fiat on/off ramps, and automated KYC/AML, institutions can diversify offerings and strengthen client trust.

Brokerages & Exchanges

Established crypto exchange platforms leverage our pre-built white label solutions to scale faster. With a customizable trading engine, multiple trading pairs, and modular API integrations, they can expand services, improve liquidity, and offer branded trading environments without starting from scratch.

Governments & Regulatory Bodies

We assist governments and public institutions in launching compliant cryptocurrency trading solutions, stablecoins, and digital payment rails. Our platforms prioritize security measures, robust risk management, and real-time monitoring to meet the highest standards of transparency and oversight.

Neobanks & Payment Companies

From neobanks to payment processors, our white label cryptocurrency exchange software integrates seamlessly with existing systems. Merchants gain cross-border fiat currencies support, while consumers access crypto trading through intuitive user interfaces backed by enterprise-grade security.

Web3 Startups & Innovators

Emerging companies in Web3 leverage our white label crypto exchange software to test, launch, and scale disruptive business models. With built-in customer support tools, simplified onboarding, and flexible user interfaces, startups gain enterprise-level infrastructure at a fraction of traditional white label crypto exchange cost.

Institutional Investors & Asset Managers

Funds, hedge managers, and investment firms turn to us for secure, compliant, and scalable crypto exchange development expertise. With customizable custody, automated compliance, and advanced reporting, we enable institutions to offer tokenized products and new investment strategies.

Monetize Faster with Our Ready-to-Scale Exchange Platform

A white-label crypto exchange platform is more than technology—it’s a long-term revenue engine. By enabling crypto trading, staking, and advanced financial services, businesses can capture multiple income streams while delivering users an engaging trading experience. From trading fees to premium services, here’s how you maximize profitability with our white label crypto exchange development.

Trading & Transaction Fees

Earn recurring revenue by charging 0.1–0.5% per executed trade. With high-volume users, these micro-fees compound into significant income.

Listing Fees for New Tokens

Charge projects and businesses for listing their cryptocurrencies. This positions your exchange as a launchpad for emerging digital assets.

Staking & Yield Farming

Offer staking pools or yield products and collect a commission on rewards. This retains user funds and boosts liquidity.

Margin & Futures Trading

Monetize leverage products by charging funding fees, spreads, and liquidation penalties, catering to professional traders seeking higher returns.

Subscription & Membership Plans

Create tiered plans offering lower fees, advanced analytics, or VIP support. Recurring memberships ensure predictable revenue.

Payment Gateway Charges

Apply small fees on fiat deposits, withdrawals, and stablecoin settlements. Multi-currency support adds new revenue per transaction.

White-Label Licensing

License sub-platforms to brokers or regional operators, creating recurring revenue through platform-as-a-service offerings.

API & Institutional Access

Charge institutional clients for premium API access, faster trading engines, and custom integrations.

Maximize Revenue with Debut’s Exchange Software

Our white label crypto exchange development solution is designed to monetize from day one—fast to launch, scalable, and fully compliant.

Replicate the Success of Leading Crypto Exchanges with Our Turnkey Solution

Step confidently into the competitive crypto market by utilizing our white label solutions that clone the success of market-leading crypto exchanges. Our expert services ensure that your platform mirrors the robust features and user experiences of industry giants, setting you up for success.

Binance Clone

Emulate Binance's platform to offer advanced trading options, robust liquidity, and strong security, ensuring a dependable and scalable exchange for your business.

Coinbase Clone

Replicate Coinbase’s seamless transactions, integrated fiat support, and secure trading environment, providing a reliable and efficient platform for users.

Kraken Clone

Mirror Kraken’s sophisticated trading tools, solid security measures, and professional atmosphere, delivering high performance and trust for your exchange.

Bitfinex Clone

Capture Bitfinex’s liquidity, margin trading capabilities, and detailed charting tools to create a comprehensive, trader-focused platform.

Bittrex Clone

Adopt Bittrex’s diverse trading pairs, automated systems, and rigorous security protocols to ensure smooth and secure exchange operations.

Poloniex Clone

Implement Poloniex’s high trading volume, varied asset support, and user-friendly experience to build a strong and engaging trading platform.

Huobi Clone

Leverage Huobi’s extensive asset support, advanced trading features, and reliable user experience to deliver a secure and efficient exchange.

OKEx Clone

Incorporate OKEx’s powerful trading functionalities, broad asset support, and effective security measures for an efficient and user-focused trading experience.

Gemini Clone

Integrate Gemini’s robust security protocols, fiat integration, and intuitive interface to create a trustworthy and user-friendly trading environment.

Utilizing Leading Technologies to Elevate Your Product Launch

We’re amped up with proven technologies & emerging frameworks to ensure your exchange performs flawlessly under heavy load, stays secure against modern threats, and scales effortlessly as your user base grows. Every stack we choose is production-tested, future-ready, and aligned with the demands of institutional-grade trading platforms.

Programming Languages

JavaScript (ES6+)

Python

Go (Golang)

Rust

C++

Front-End Development

React.js

Next.js

Vue.js

TypeScript

Tailwind CSS

Back-End Development

Node.js

Django

NestJS

Ruby on Rails

FastAPI

Database Management

PostgreSQL

MongoDB

Redis

Cassandra

TimescaleDB

Blockchain & Smart Contract Frameworks

Ethereum

Binance Smart Chain

Solana

Polygon

Polkadot

Security & Infrastructure

AWS

Kubernetes

HashiCorp Vault

Cloudflare

Web3.js

Our End-to-End White Label Cryptocurrency Exchange Development Approach

Fostering a culture of innovation, we integrate industry-leading practices with a tailored approach, ensuring the perfect fit for your white label cryptocurrency exchange project. Our meticulous process and

Requirement Analysis and Planning

We begin by understanding your specific business needs, goals, and regulatory requirements to create a detailed plan for a customized white label crypto exchange.

Design and Architecture

Next, we design a modular, scalable architecture using a microservices approach, ensuring flexibility for future feature additions and seamless system integration.

Development and Integration

Our team develops secure, RESTful APIs and integrates essential components like trading engines, payment gateways, and KYC/AML systems for a comprehensive platform.

Customization and Branding

We customize the platform's UI/UX to align with your brand identity, incorporating unique features and functionalities that enhance the user experience.

Testing and Security Audit

Rigorous testing, including security audits and performance assessments, ensures the platform is robust, reliable, and ready for high-frequency trading.

Deployment and Support

We deploy the exchange on secure cloud infrastructure and provide continuous monitoring, updates, and support to ensure optimal performance and compliance.

What Makes Our White Label Cryptocurrency Exchange Stand Out?

Debut Infotech stands as your reliable software partner for white label cryptocurrency exchange development, offering bespoke, ready-to-deploy solutions for businesses venturing into the cryptocurrency market. With our extensive experience, we provide a comprehensive range of services, including market research, regulatory advisory, and full-scale development.

All-Inclusive Operations Management

We manage trading operations supervision, compliance outsourcing, and full trading desk management, letting you focus on growing your business.

Tested Rock-Solid Reliability

Our solutions have been rigorously tested under extreme market conditions, and we provide detailed case reports to showcase their robustness.

Innovative Technological Legacy

Our turnkey crypto exchange incorporates extensive experience in digital trading products, offering functionality on par with major global exchanges.

Effortless Setup and Installation

Experience a seamless installation process, as straightforward as setting up a mainstream white label Bitcoin exchange.

Versatile Multi-Asset Flexibility

Whether you need a white label Bitcoin exchange or a multi-asset platform, our solution supports various business models.

High-Value 6-Figure Investment

Access cutting-edge technology backed by six-figure R&D investments, offering top-tier developments at mainstream product prices.

Frequently Asked Questions

What is a white-label crypto exchange?

A white-label crypto exchange is a pre-built, customizable trading platform that allows businesses to launch their own crypto exchange without building from scratch. It includes core features like a trading engine, order book, wallet integrations, KYC/AML compliance, and payment gateways. With white-label crypto exchange development, companies can reduce time-to-market, cut development costs, and focus on branding, user acquisition, and revenue generation.

How much does a white label crypto exchange cost?

The cost of a white-label crypto exchange depends on the level of customization, security features, and compliance requirements. On average, setup can range from $40,000 to $150,000, with additional expenses for licensing, liquidity, integrations, and ongoing support. Compared to building a crypto exchange platform from scratch—which can exceed $500,000—white-label crypto exchange development is a cost-effective, scalable option that accelerates go-live timelines.

Can I create my own crypto exchange?

Yes, you can create your own crypto exchange through two approaches: custom development or white-label solutions. Custom builds require large budgets, teams, and extended timelines, while white-label crypto exchange software provides a faster, more cost-efficient option. With a pre-built trading engine, wallets, APIs, and KYC/AML modules, businesses can focus on branding and liquidity, making it feasible for startups, enterprises, and fintechs to launch exchanges quickly.

Which exchange is good for crypto trading?

Coinbase, Binance, and Kraken are among the top exchanges for crypto trading due to their user-friendly interfaces, security features, and comprehensive cryptocurrency market offerings. For businesses, a white label crypto exchange can provide similar capabilities tailored to specific needs.

How to start a white-label crypto exchange?

To start a white-label crypto exchange, businesses first define goals, target audience, and compliance requirements. Next, they select a crypto exchange development company to deploy the platform with features like wallet integration, liquidity management, and risk controls. Post-deployment, focus shifts to licensing, liquidity partnerships, and user acquisition. White-label crypto exchange development enables companies to launch within weeks while ensuring scalability, compliance, and profitability in the crypto market.

How to build a crypto exchange?

Building a crypto exchange involves several steps: defining your requirements, choosing a white label crypto exchange development company, customizing the platform, integrating security features, and ensuring regulatory compliance. Opting for a white label cryptocurrency exchange development can streamline the process.

How long does it take to launch a white-label crypto exchange?

With a white-label crypto exchange development model, businesses can launch in 4–8 weeks, compared to 12–18 months for a custom build. The exact timeline depends on customization, regulatory approvals, and liquidity integrations. Pre-built modules like trading engines, wallets, and KYC/AML workflows significantly reduce go-live time, allowing businesses to seize market opportunities quickly without compromising on compliance or user experience.

Which crypto exchange is best in the market as of now?

As of now, Coinbase, Binance, and Kraken are considered the best in the market due to their reliability, security, and extensive offerings. For businesses looking to enter the market, white label crypto exchange development offers a competitive edge with customizable, secure platforms.

Is crypto a good investment for startups and enterprises?

Yes, crypto can be a good investment for startups and enterprises due to its high growth potential and increasing adoption in the financial sector. Investing in white label crypto exchange for startups can provide a scalable and profitable entry point into the cryptocurrency market.

How do I start a Cryptocurrency exchange business?

To start a cryptocurrency exchange business, conduct market research, choose a white label crypto exchange development agency, customize the platform to meet your needs, ensure regulatory compliance, and launch your platform. Utilizing white label cryptocurrency exchange development simplifies the process, allowing for a quicker and more efficient market entry.

Is a white-label crypto exchange secure?

Yes, white-label crypto exchanges are equipped with bank-grade security features such as multi-signature wallets, cold storage, anti-DDoS firewalls, and encryption protocols. Many also include advanced KYC/AML automation and fraud detection systems to prevent misuse. By working with a trusted white-label crypto exchange development partner, businesses can reassure users, strengthen compliance, and create a trading platform that is as secure as it is scalable.