Table of Contents

Home / Blog / Cryptocurrency

Centralized Crypto Wallet: A Complete Guide to How It Works

June 19, 2025

June 19, 2025

A centralized crypto wallet is a digital tool managed by third-party providers that stores and safeguards users’ private keys and funds on their behalf. Unlike decentralized wallets, where users hold their own keys, centralized wallets offer ease of use, integrated services like fiat onramps, and enhanced support, making them popular for beginners and businesses.

However, this convenience comes with trade-offs in control and security. In this guide, we’ll dive into what is a centralized wallet, what makes a centralized wallet tick, explore its advantages and limitations, review leading centralized crypto wallet examples, and examine essential considerations for companies offering crypto wallet development services.

Expert Crypto Wallet Development Services

Partner with Debut Infotech for full-cycle development—from UX to compliance and asset support.

What Is a Centralized Wallet?

A centralized wallet is a digital custodial service in which a trusted third party—typically a crypto exchange, financial institution, or fintech provider—manages and controls users’ private keys on their behalf. In contrast to decentralized wallets, where users are solely responsible for securing their keys and assets, a centralized wallet simplifies the process by offering a user-friendly interface and back-end infrastructure to handle all key-related security tasks.

For users, this means interacting with crypto assets becomes much easier. You don’t need to remember complex seed phrases or navigate blockchain transactions directly. Instead, you log in using a standard username-password combo, usually backed by two-factor authentication (2FA). Once inside the platform, you can buy, sell, store, or transfer cryptocurrencies with minimal technical effort. These wallets are often embedded into broader ecosystems, such as exchanges, financial apps, or merchant platforms, and are favored by both newcomers and enterprises for their usability.

The advantages of centralized wallets are clear: they offer fast onboarding, seamless fiat-to-crypto conversion via banking integrations, access to multiple tokens, and often include trading functionalities. Many of these wallets also integrate features developed by a Cryptocurrency Payment Gateway Development Company, providing seamless payment acceptance for merchants and eCommerce businesses. However, there is a trade-off—users must place their trust in the wallet provider to maintain the security, privacy, and availability of their digital assets. The central party holds full custody, which can expose users to risks if the service provider experiences a breach, becomes insolvent, or is subject to regulatory action.

Key Features of Centralized Crypto Wallets

Centralized crypto wallets come equipped with robust features to improve accessibility, security, and transaction efficiency for users and enterprises alike. Below is a detailed breakdown of their core functionalities:

Custodial Management

At the heart of a centralized wallet lies custodial management, which means the platform, not the user, controls private keys. This eliminates the complexity of self-custody and offers a safer entry point for those unfamiliar with blockchain technologies. Users can access their assets using traditional login systems, and the risk of losing funds due to forgotten seed phrases is significantly reduced. Platforms typically employ advanced encryption, hardware security modules, and secure key management protocols—sometimes using MPC Wallet technology—to safeguard user funds.

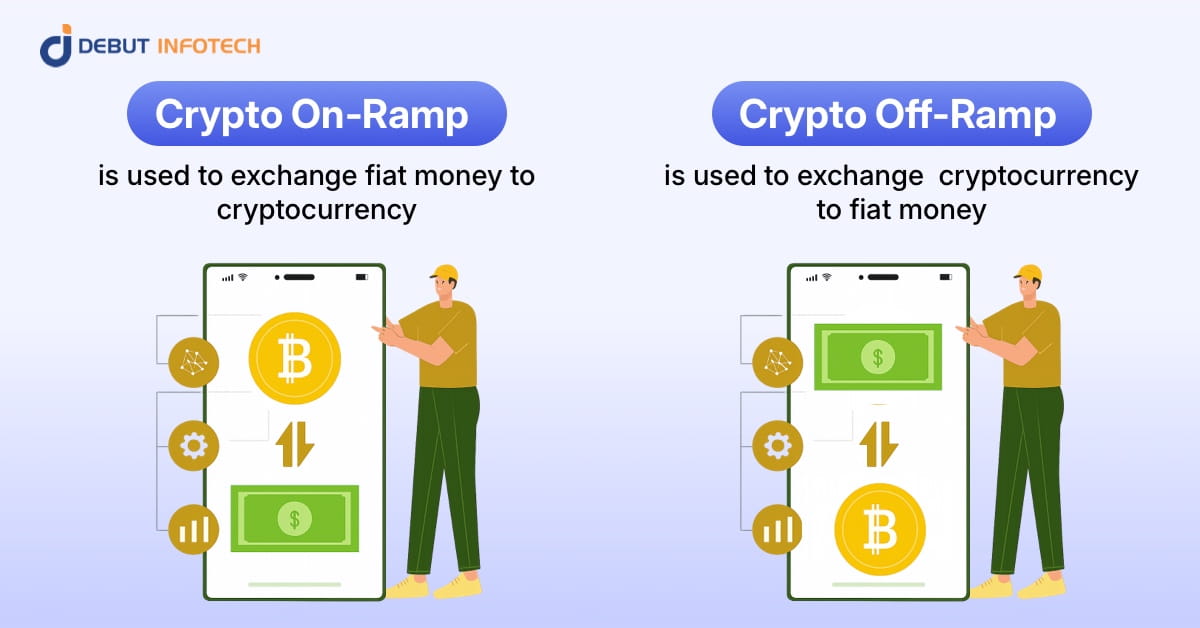

Fiat On‑Ramp Integration

Centralized wallets typically come with built-in fiat on-ramp integration, allowing users to seamlessly convert their local currency into crypto assets using credit cards, bank transfers, or third-party payment processors. These integrations are made possible by partnerships with banking institutions and Cryptocurrency Payment Gateway Development Company solutions, enabling easy deposits, withdrawals, and currency swaps.

This functionality is particularly advantageous for enterprises and startups seeking efficient fiat-crypto interoperability. Whether you’re launching a retail platform or enabling crypto donations, fiat on-ramp functionality bridges the gap between traditional finance and digital assets.

Trading and Automation

Unlike standalone wallets that only offer storage, centralized crypto wallets often integrate powerful trading and automation tools. Users can execute trades, set up recurring purchases, or deploy bots to automate strategies—all within a single platform. Many wallets now offer built-in access to crypto trading bot development tools and Crypto Trading Bots, giving retail users and businesses alike the ability to automate market actions, manage portfolios, and even engage in arbitrage or leveraged trading.

For example, a business might automate USDT-to-BTC conversions at specific price triggers, improving treasury efficiency. Traders, meanwhile, can use algorithmic bots to manage their positions without staying online 24/7.

Recovery and Support

One of the strongest value propositions of centralized wallets is user support and recovery options. Unlike decentralized solutions, where lost keys usually mean lost assets, centralized platforms provide account recovery mechanisms. Users can reset their credentials through identity verification and KYC procedures, helping them regain access quickly in case of device loss or password issues.

Dedicated customer support teams assist users with transaction failures, suspicious activity alerts, or disputes. This feature is essential for onboarding crypto novices and ensuring long-term trust in the platform.

Multi-Currency Support

Modern centralized wallets are built as multicurrency wallets, meaning they support a wide range of digital assets, including Bitcoin, Ethereum, USDT, and others, along with ecosystem-specific tokens such as TRC20 wallets and xdc crypto. This multi-asset support is particularly useful for traders, enterprises, and businesses dealing with diverse portfolios or cross-border payments.

Some wallets also offer support for asset backed crypto currencies, such as stablecoins or tokenized gold, which are increasingly used in financial settlements and hedging strategies. This flexibility enables widespread crypto adoption among institutional players and merchants.

Compliance & Security Layers

Since centralized wallets manage sensitive user data and high-value transactions, compliance and security are non-negotiable. Most platforms comply with KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR. They use fraud detection systems, transaction monitoring, and compliance automation tools to ensure safe operations.

On the technical side, secure infrastructures like MPC wallets or hardware security modules are employed to minimize the risk of internal or external breaches. Regular penetration testing, encryption, and multi-layered authentication further reinforce platform resilience.

With the growing involvement of governments and regulators, compliance isn’t just a best practice—it’s a requirement. Partnering with experienced crypto wallet development services providers ensures the development of solutions that meet both security expectations and legal obligations.

Centralized Wallet Examples

Some centralized wallet examples are:

- Exchanges like Binance and Coinbase: Store keys, integrate crypto wallet vs exchange functionality, and offer trading bots.

- Mobile Wallet Apps: Platforms featuring ewallet app development, fiat links, and payment gateway integrations.

- Institutional Custodians: Provide high-security models like multiparty MPC wallets and cold storage.

- Enterprise Solutions: Custom crypto wallet development services tailored for businesses using payment gateways or treasury functions.

Centralized Wallet List: Comparing Top Options

Choosing the right centralized wallet depends on your specific needs—whether you’re a beginner seeking ease of use, a trader requiring advanced features, or a business needing integrated payment solutions. In this section, we explore a centralized wallet list featuring some of the most trusted and feature-rich platforms available today. Each option brings a unique set of tools, security measures, and support for popular cryptocurrencies, helping you make an informed decision.

| Provider Type | Example | Use Case & Benefits |

| Consumer Exchange Wallet | Binance, Coinbase | Easy setup, fiat on/off ramps, trading features |

| Mobile App Wallet | Cash App, Crypto.com | Quick on-device access, integrated services |

| Institutional Custodian | BitGo, Fireblocks | Multi-sig and MPC; ideal for businesses |

| White-label Solutions | Private API wallets | Tailored UX and branding for enterprise clients |

Pros & Cons of Using a Centralized Wallet

Advantages

- Simplified experience—no direct key management: Users don’t have to worry about securely storing private keys, as the provider handles key management on their behalf.

- Easy recovery process via support: Lost access can typically be restored through identity verification and customer service, making account recovery straightforward.

- Advanced services—integrated trading, automation, and staking: Many centralized wallets offer built-in access to trading platforms, cryptocurrency trading bots, and staking tools for passive income.

- Fast fiat and crypto transfers: Integration with fiat on-ramps and internal wallet systems ensures quick deposits, withdrawals, and crypto transfers.

Disadvantages

- Users lack full control over keys and funds: Since the provider controls private keys, users depend on them to access and secure their assets.

- Centralized vulnerabilities—providers can be hacked or suffer internal fraud: Due to their single points of failure, centralized systems are prime targets for cyberattacks and insider threats.

- Custody introduces privacy concerns: Personal data and transaction histories are often stored on provider servers, raising concerns over surveillance and data misuse.

- Regulatory oversight may lead to account freezing or restrictions: Governments and regulators can impose sanctions or request account freezes, limiting access without user consent.

How Businesses Build a Centralized Crypto Wallet

Building a centralized crypto wallet from scratch requires more than just integrating blockchain functionality—it demands a strategic blend of usability, compliance, security, and scalability. Businesses collaborating with a seasoned crypto wallet development company must consider several critical stages and technological components to ensure robust, user-ready infrastructure.

UI/UX and Fiat On-Ramps

A seamless user interface is the foundation of wallet adoption. Developers focus on clean, intuitive designs that guide users effortlessly through registration, wallet access, deposits, and withdrawals. Including Cryptocurrency Payment Gateway Development layers enables seamless fiat-to-crypto conversions—an essential feature for onboarding non-technical users and businesses operating in mixed currency ecosystems. Fast deposits and withdrawals through banking APIs, cards, or e-wallets increase accessibility and satisfaction.

Architecture & Security

Wallet architecture needs to address both functionality and protection. Businesses must choose between hot wallets for instant transactions and cold wallets for long-term storage. In addition, MPC wallets (Multi-Party Computation) are increasingly popular due to their ability to decentralize key management without compromising user convenience. Core security elements include private key encryption, SSL-secured data exchanges, biometric logins, and firewall-protected environments. Real-time fraud monitoring systems and transaction validation protocols also form part of the security stack.

Regulatory & Compliance Layers

To operate legally across jurisdictions, enterprises must embed KYC (Know Your Customer) and AML (Anti-Money Laundering) mechanisms into the wallet. This includes document verification, biometric authentication, risk profiling, and transaction history tracking. Centralized wallets must also support configurable onboarding flows for different user types (individuals, businesses, institutions) and generate compliance reports for auditors or regulators. These legal safeguards help build trust and protect against misuse.

Scalability & Token Support

The wallet’s backend must be built to handle growing user numbers, transactional loads, and evolving token standards. Developers should ensure compatibility with TRC20 wallets, XDC crypto, and asset-backed cryptocurrencies. As the digital asset landscape grows more diverse, wallets that support multi-token and multi-chain functionality will outperform limited ones. Cross-chain bridge integrations and swap engines also enable users to manage a wide variety of assets from a single interface.

Costs of Development

Understanding the crypto wallet development cost is vital before initiating a project. Expenses vary based on feature sets, the number of supported platforms (Web, Android, iOS), and backend complexity. A basic centralized wallet might range from $20,000 to $50,000, while enterprise-level builds with KYC, fiat gateways, and multi-chain support can exceed $100,000. Ongoing costs include maintenance, feature updates, compliance upgrades, and infrastructure scaling.

Integration and Testing

Flawless integration with blockchain nodes (Ethereum, Tron, XDC, etc.) ensures real-time access to transaction histories, balances, and on-chain confirmations. Testing must cover performance, security, load capacity, and cross-platform functionality. QA teams stress-test wallets under heavy transaction scenarios, simulate attacks, and validate recovery procedures. Final builds should be deployed across multiple platforms with synchronized updates and support for third-party API integrations like crypto trading bot development.

New Trends in Centralized Wallets

- Smart Wallet Partnerships: Combining AI-integrated smart crypto wallet tech for personalized suggestions and insights.

- Institutional Markets: MEC, Web3, and digital asset custody require secure, compliant solutions.

- Hybrid Wallets: Pairing centralized experiences with options for private key export or self-custody.

- Enterprise Wallets: Scaling to support large businesses needing treasury, payroll, or merchant functionality.

Centralized Wallet vs Exchange

While many exchanges incorporate wallets, wallet providers focus on simplified storage and payments. Exchanges offer richer trading tools, liquidity, and market features, but may be less convenient for everyday use or merchant payments.

Choosing the Right Wallet in the Market

Key decision factors include:

- Security protocols (cold storage, MPC): Evaluate whether the wallet uses cold storage or advanced security layers like MPC wallets to safeguard user assets from breaches.

- Supported assets—TRC20, asset-backed, XDC networks: Ensure the wallet supports a diverse range of tokens, such as TRC20 wallets, asset-backed cryptocurrencies, and networks like XDC crypto.

- Fiat gateway options and geographic availability: Check if the wallet provides seamless fiat on/off ramps and whether those services are accessible in your region.

- Recovery features, KYC requirements, and support: Look for wallets with clear recovery options, responsive support teams, and compliance with KYC/AML regulations.

- Business integrations and cost structures: Consider how well the wallet integrates with your business ecosystem, such as payment systems or APIs, and the overall cost of crypto wallet development.

Launch Your Own Centralized Crypto Wallet

Build secure, scalable, and regulation-ready crypto wallet solutions tailored for your business.

Conclusion

A centralized crypto wallet offers an accessible entry into digital finance, with streamlined custody, rich features, and strong security, though users trade some control for convenience. As digital economies evolve, these wallets play a vital role in mainstream adoption and enterprise use.

Partnering with a proven crypto wallet development company is essential for businesses and platforms to deliver secure, compliant, and scalable solutions. As you build your centralized wallet—whether for payments, trading, or custodial services—focus on security, usability, token support, and regulatory alignment to stay ahead in next-gen digital finance.

Want assistance building a multicurrency, asset-backed crypto wallet or integrating payment gateways with robust security? Debut Infotech can help—let’s design the next standard in centralized crypto wallets.

Frequently Asked Questions

A. A centralized wallet is a custodial cryptocurrency managed by a third party, such as an exchange or service provider. It stores and secures users’ private keys on their behalf, allowing easy access, recovery options, and integrated trading or payment services.

A. In a centralized crypto wallet, the platform controls your private keys, simplifying the user experience but reducing self-custody. In contrast, a decentralized wallet gives you full control over your keys, enhancing privacy and security, but comes with greater responsibility.

A. Yes, centralized wallets are generally safe if managed by reputable providers. They offer strong security layers like 2FA, KYC/AML, and MPC wallet protection. However, since a third party holds your funds, you must trust their infrastructure and compliance practices.

A. Absolutely. Most centralized wallets support multicurrency wallet functionality, enabling storage and transactions with popular coins like Bitcoin, Ethereum, TRC20 tokens, and even emerging assets like XDC crypto or asset-backed cryptocurrencies.

A. Most centralized wallets offer recovery processes via email or phone number verification, along with identity confirmation (KYC). This recovery method is one of the major advantages of using custodial wallet services.

A. Businesses—especially those using services like crypto wallet development services or Cryptocurrency Payment Gateway Development Company solutions—benefit from centralized wallets thanks to fiat integration, user management, and easier compliance.

A. Yes. Many centralized wallets are integrated with crypto trading bot development tools or offer direct access to Cryptocurrency Trading Bots, allowing users to automate trading strategies within the platform.

Leave a Comment