Table of Contents

Home / Blog / Cryptocurrency

Crypto Exchange Development for Institutional Investors: Key Features Needed

July 31, 2025

July 31, 2025

Every crypto exchange has a similar underlying architecture, which typically comprises a robust blockchain system and robust smart contracts.

However, when approaching crypto exchange development for institutional investors, you may need to take additional steps to meet the high-volume demands of institutional clients. Whether you’re building from scratch or exploring white label crypto exchange development for faster deployment, additional layers of security, a deep liquidity pool, and a customizable trading interface are crucial.

Because an institutional crypto trading platform handles large trading volumes, it must offer advanced risk management tools and a robust API integration to connect external trading systems and custodial services seamlessly. Additionally, they must adhere strictly to regulatory guidelines, including those related to privacy, data protection, and KYC/AML. Furthermore, unlike retail exchanges that are designed with ease of use in mind, these platforms are built for speed, precision, and uptime.

It’s a whole different ball-game entirely. But it’s not something you can’t handle. Especially with the help of Cryptocurrency Exchange Development Companies like Debut Infotech Pvt Ltd.

In this article, we examine the development of crypto exchanges for institutional entities. We will be focusing on use cases to give you a view of how it’s used to solve real-world problems today. In this, you will find specific ways that institutional exchange platforms can help your business reach its unique objectives. In doing so, we’ll highlight some key features that an institutional crypto trading platform should have.

What is an institutional crypto trading platform?

Put simply, an institutional crypto trading platform is built with institutions in mind, as opposed to individuals.

What does this mean?

It means these platforms are specifically designed to meet the unique needs of large players, such as hedge funds, asset managers, proprietary trading firms, and corporate treasuries.

Because of the calibre of those who use an institutional exchange and the volume of transactions, these platforms are built for speed, security, compliance, and deep liquidity. This is a clear variation from retail platforms, which are built to help small investors navigate the market with ease.

As a result, an institutional crypto trading platform must have the following features:

- Advanced risk management tools

- Customizable APIs

- Real-time analytics

- Regulatory grade compliance framework

- Audit logging.

Beyond this, an institutional exchange also grants investors access to large liquidity pools, over-the-counter (OTC) desks for block trades, and multi-asset support.

Finally, these platforms provide investors with access to premium services, including white-glove onboarding and a dedicated account manager. They also reduce latency by offering co-location options. They are more than trading tools—they help you manage portfolio execution and risk control.

We’re going to get a bit deeper into these things as we go on.

Launch a cutting-edge institutional exchange with future-ready infrastructures today.

Discuss your idea with crypto exchange experts to capitalize on the rapidly growing digital economy by investing in a cryptocurrency exchange.

Key features every institutional crypto trading platform must have

Here are some features that every cutting-edge institutional crypto trading platform must possess:

1. Institutional-Grade Security and Regulatory Compliance

While retail traders may tolerate minor glitches or downtime, institutions like hedge funds, asset managers, family offices, and corporate treasuries require foolproof security and legal protection. After all, they’re dealing with a lot of financial firepower, so there’s little room for inefficiencies.

As such, they insist on platforms that have enterprise-grade safeguards.

What does this look like for an institutional crypto trading platform?

This section examines some essential features that ensure protection, build trust and credibility, ultimately fostering long-term adoption.

A. Multi-Layered Security Architecture

For a platform to be institutionally secured, it needs a multi-layered security protocol that protects it against various threats—from phishing and wallet compromise to internal breaches.

The protocols that make up a proper Cryptocurrency Exchange Architecture include:

- Cold and Hot Wallet Segregation

Wallets store the private keys that allow you to access your cryptocurrency on a blockchain. Hot wallets are always connected to the internet, while cold wallets store private keys offline in a physical wallet.

Institutional exchanges should store the majority of assets in a cold wallet while using hot wallets for everyday transactions. This combination is known as wallet tiering or hybrid custody, and it helps keep your assets safe from hackers who are more likely to target your hot wallet.

- Multi-Signature Wallets

The safest institutional platforms require multiple trusted parties to approve a transaction before it can be fulfilled. This prevents single-point-of-failure scenarios and eliminates internal fraud. - Biometric and 2FA Authentication

Institutional exchange platforms must incorporate two-factor authentication (2FA) protocols to add an extra layer of security. If they have biometric logins, it is even better. - Regular Penetration Testing and Audits

The best institutional platforms adopt a proactive approach to security. These platforms conduct regular third-party penetration tests and bug bounties.

B. Compliance with Global and Regional Regulations

Non-compliant platforms can pose a range of threats to investors, including loss of assets, theft, and criminal exposure. As such, compliance is central to the development of a crypto exchange platform.

Here are some regulatory frameworks institutional platforms must adhere to:

- Built-in KYC/AML Modules

Exchanges must conduct Know Your Customer (KYC) and Anti-Money Laundering (AML) verifications when onboarding an institutional client. This process must be compulsory for each client and designed to accommodate clients worldwide.

- Data Protection and GDPR/CCPA Compliance

Platforms that cater to users in the EU or California must follow strict data governance rules. This includes privacy-by-design, right-to-access, and right-to-be-forgotten protocols. - Support for Licensing and Reporting Frameworks

Institutional platforms must support reporting obligations like transaction logs, suspicious activity reports, and tax data exports. This includes Bitlicense (New York): MiCA (EU), or VASP licensing (Asia). - Audit-Ready Infrastructure

Institutional exchanges need to integrate audit protocols to improve transparency for themselves and also for regulators. Built-in audit logs and immutable transaction records are necessary for due diligence and compliance checks.

C. Real-Time Threat Detection and Monitoring

In addition to static defense, these exchanges must include real-time monitoring systems to detect suspicious patterns and to prevent fraud.

Here are some ways they can do that

- AI-Powered Fraud Detection

Artificial intelligence agents can monitor users to detect abnormalities in trading behavior, login patterns, and fund movement and report suspicious activities in real-time.

- Whitelisting and Withdrawal Limits

Institutional exchanges must be able to whitelist wallets. They should also set transaction limits to prevent unauthorized large withdrawals. - Geo-Fencing and IP Blacklisting

Exchanges that can restrict access by geography or IP address can add another layer of defense against external threats and credential stuffing attacks.

So, that’s it when it comes to security.

2. Deep Liquidity and Multi-Asset Support

Liquidity is central to the functioning of an institutional exchange. This is because these investors move huge sums at a time, and any delays or basis point of slippage costs a lot of money.

Nobody wants that!

As such, a crypto platform designed for them must offer deep liquidity pools. It must also offer throughput and smooth access to a wide range of digital and fiat assets. Without these things, the platform is unattractive to investors.

In this section, we will examine some of the key features and structures essential for delivering real-time liquidity and multi-asset support.

A. Institutional-Grade Liquidity Pools

Deep liquidity enables a platform to execute large orders without disrupting the market. Here is how it can be achieved:

- Internal Matching Engine with High Throughput

The engine should be able to handle thousands of transactions per second (TPS) without delays. - Aggregated Liquidity from Multiple Sources

To offer the best prices to users, exchanges may have to gather buy/sell offers from other exchanges—and even decentralized platforms—in addition to their system. - Tight Bid-Ask Spreads

Wide spreads kill volume. Liquidity provisioning must maintain tight spreads across major trading pairs, even during periods of high volatility. - Support for Market Makers

To deepen liquidity across all pairs, institutional exchanges should offer market makers fee rebates and incentives. - Dark Pools for Block Trades

Big trades that don’t show up on the public order book until they are completed are called dark pool transactions. Some institutions prefer to trade this way because it protects sensitive trading strategies and avoids front-running. As such, top exchange platforms for institutions should offer this option.

B. Wide Asset Coverage: Crypto, Fiat, and Stablecoins

Institutional players often need to trade across various assets and would prefer to use a single platform for convenience. Therefore, the best exchanges must offer a unified interface that supports a wide range of assets.

These include:

- Major Crypto Assets

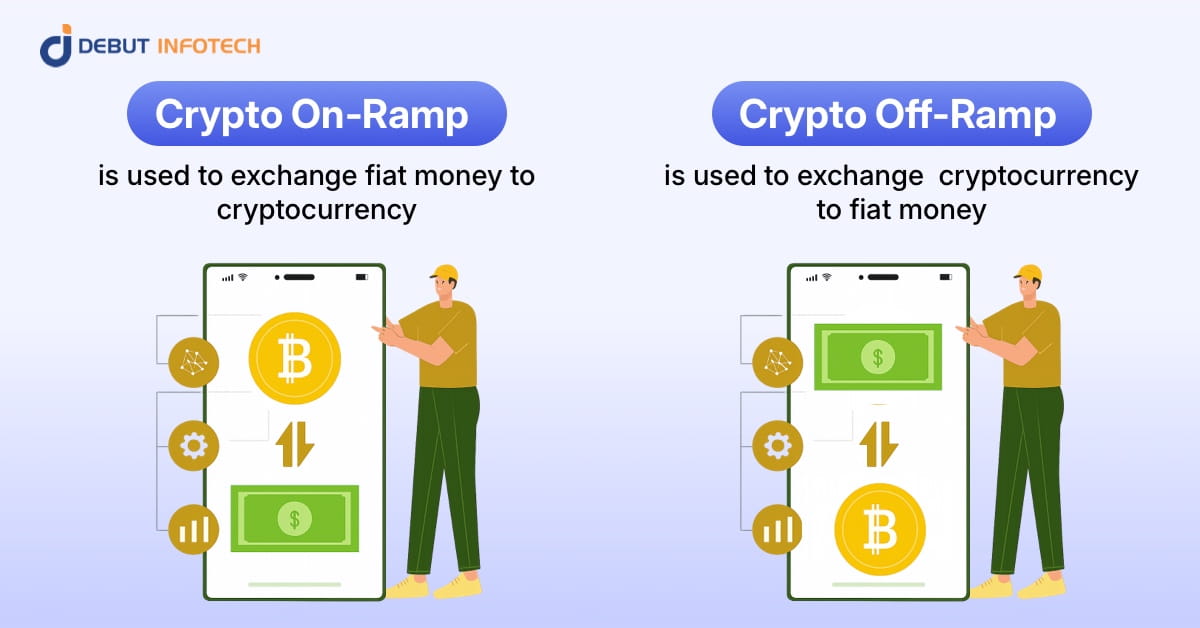

These are blue-chip cryptocurrencies such as BTC, ETH, SOL, XRP. Other high-cap names must also be supported with strong liquidity. - Stablecoins and Fiat On/Off-Ramps

To move money around with ease, Institutional traders need to convert native tokens to stablecoins (USDT, USDC). They also need fiat integration (USD, EUR, NGN, etc.). This can be achieved by setting up bridges that connect exchange platforms to stablecoins and using banking APIs or payment processors for easy access to fiat. - Emerging Tokens with Institutional Relevance

A great institutional exchange platform should support regulated tokenized assets—like real-world asset (RWA) tokens, asset-backed stablecoins, and regulated securities tokens.

C. Cross-Pair Swaps and Multi-Currency Trading

Since institutions typically trade across regions and assets, an institutional platform must provide access to:

- Cross-Currency Pairing

Investors should be able to trade between cryptocurrencies and also between crypto and fiat without having to convert to USD first. - Multi-Currency Wallets

Exchange platforms for major players enable investors to hold and manage balances in multiple currencies seamlessly. - Automated Currency Conversion APIs

A robust FX engine behind the scenes makes it easy for backend systems to handle conversions during settlement, invoicing, or trade execution.

3. High-Performance Trading Engine and Infrastructure

Institutional exchange platforms are not hobbyist platforms—they must be designed for precision, speed, scalability, fault tolerance, and infrastructure resilience.

The big players don’t tolerate order mismatches, execution delays, or system downtime during high-volatility periods, so a great platform must be built to the highest standard to guarantee a seamless experience.

As such, every institutional crypto exchange must implement the following critical trading engine and infrastructure features:

A. Ultra-Low Latency Matching Engine

At the core of any exchange is the matching engine. For institutional investors, this engine must deliver:

- Sub-Millisecond Order Execution

For arbitrage strategies and algorithmic trades to be effective, orders must be placed, matched, and confirmed within microseconds. Any delay—even by a few seconds—could result in significant losses. - High Throughput (100K+ TPS)

During market surges, the engine must be able to handle large volumes without delaying execution or bottlenecking. - Deterministic Matching Logic

When an exchange engine is inconsistent, it can lead to random matches, unfair trades, or slippage, rather than matching the best price first or the first to arrive.

- Load Balancing and Failover Systems

For the engine to perform optimally during spikes, it should be able to auto-distribute requests across servers and failover seamlessly if one component fails.

B. Infrastructure for High-Frequency Trading (HFT)

Many institutions use HFT strategies that require specialized infrastructure:

- Co-Location Capabilities

Network latency reduces when institutional clients deploy their servers—physically or virtually—close to the exchange’s matching engine. This increases execution speed.

- FIX and WebSocket APIs

Exchanges should enable low-latency FIX (Financial Information eXchange) protocol APIs and real-time WebSocket feeds for price data and execution. - Order Types Tailored for HFT

To enable complex execution strategies, exchanges must support IOC (Immediate-or-Cancel), FOK (Fill-or-Kill), iceberg orders, and post-only orders. - Tick-Level Market Data Feeds

To power quant models and execution bots, institutions need real-time order book snapshots and tick-level data.

4. Advanced Risk Management and Trade Execution Tools

Institutional investors want more than tools—they want absolute control over their risk exposure, trade timing and capital allocation. Unlike retail traders who can afford to set and forget, they have strict mandates to protect assets, optimize performance and comply with strict guidelines.

Therefore, an exchange targeting these type of investors need to provide a wide range of risk management mechanisms and execution tools that go far beyond market and limit orders

Here are some rudimentary features that every institutional exchange must have:

A. Tiered Account Controls and Sub-Accounts

Because institutions work with different teams, departments, and multiple strategies under one organization, your platform needs to include these features:

- Multi-Level Access Permissions

Exchanges should be built in such a way that parent accounts can have multiple accounts under them with different rights. For example, some may have rights to trade only, while others may trade and withdraw. To help with oversight and compliance, parent accounts should be able to check performance and exposure at the portfolio level. - Role-Based Authorization Controls

With Role based authorization control, you can assign specific roles to different personnels. This allows for granular control to prevent internal fraud. For example, CFOs, compliance officers and traders will have different permissions which limits what they can do. - IP and Device Whitelisting per Role

To reduce the risk of credential compromise, an institution may restrict sub-account access to specific IP addresses or devices. In essence, only these devices will be able to access the credentials.

B. Built-In Risk Management Systems

If your exchange platform lacks a real-time risk visibility system, institutions may be exposed to significant losses. Therefore, you must have the following embedded in your exchange platform:

- Real-Time P&L Monitoring

Your exchange should allow traders and managers to monitor profit and loss to the trade level. To make this possible, it needs to have dashboards that include unrealized and realized profit and loss (P&L), margin utilization, and risk-to-equity ratios. - Dynamic Margin Calculators

Margin requirements should be adjusted to mirror market volatility and portfolio composition. This prevents overleveraging. - Auto-Deleveraging Mechanisms

Your exchange should automate liquidation protocols if an account goes beyond risk thresholds. This helps to prevent further losses without disrupting broader market liquidity. - Circuit Breakers and Kill Switches

Institutions should be able to define trade halts or system pauses if certain loss thresholds or abnormal trading patterns are detected.

5. White-Glove Support, Custom APIs, and Integrations

Institutions need premium support and flexible integration in addition to a well-functioning exchange. This support must include deep onboarding, API access for their internal systems, and fast human assistance when issues arise.

As such, white-glove service isn’t a luxury—it gives you a competitive edge.

In this section, we will explore the support and integration capabilities that transform your exchange from a tool into a strategic partner for institutional clients.

A. Dedicated Account Management and Concierge Support

Institutions prefer to build long-term relationships, and so trust is central to their choice in platform. To build trust, your exchange must provide:

- Dedicated Account Managers (AMs)

You should assign an account manager to each institution—one who understands their business, trading behavior, and risk profile—to act as a direct human touchpoint for all operations. - 24/7 Human Support with Tiered Escalation

Real-time support is closely tied to real-time trading. As such, your exchange should include a multi-tiered support system that offers instant chat, emergency phone lines, and escalations to engineer-level support. - Onboarding Assistance and Training

The onboarding process on your exchange should include guided walkthroughs, system configuration, compliance review, and integration of back-office reporting tools. - SLAs and Service Guarantees

As mentioned earlier, trust is central to a long-term partnership with institutional investors. Therefore, you must provide a written service level agreement from the get-go. This should include formal uptime commitments, response times, and incident handling protocols.

B. Robust, Customizable API Infrastructure

Institutions don’t interact with platforms using systems. As such, your exchange must expose full-featured APIs designed for:

- FIX Protocol and REST/WebSocket APIs

FIX is the global standard in institutional finance. Offering low-latency FIX endpoints alongside REST and WebSocket ensures your exchange is compatible with any existing system. - Modular Endpoints with High Rate Limits

Institutions pull thousands of data points per second. Your APIs should have generous rate limits and modular endpoints for everything from order placement to audit logs. - Webhook and Callback Support

Institutions often run automated systems that require real-time notifications to act on execution data or margin alerts. This is done using webhook or push messages. - Developer Sandbox and Staging Environment

Your exchange should include real-time simulation. This allows clients to test integrations before pushing to live environments.

Attract premium institutional investors with a tailored cryptocurrency exchange.

Contact our crypto exchange experts to tailor your crypto trading platform for institutional investors.

Conclusion

Developing an institutional exchange platform is a complex process that requires a variety of features to guarantee institution-grade security, risk management, and performance. So, now, you know the features your exchange needs to be recognized as a quality institutional crypto trading platform. But that’s not enough.

You must also be able to assemble all these features correctly to venture into crypto exchange development for institutional investors successfully. This complexity necessitates partnership with a veteran crypto exchange development company. Debut infotech Pvt Ltd has worked with some of the biggest institutions in the world, building custom-made solutions that blend rich features with innovative technology. Reach out today for crypto exchange development for institutional investors.

Frequently Asked Questions

A. Institutional investors include banks, hedge funds, asset managers, proprietary trading firms, and corporate treasuries. These players typically trade high volume and so require more secure and high performing infrastructures.

A. The most common security feature for crypto exchanges is Two-factor authentication (2-FA). It adds an extra layer of protection from account hackers.

A. They look for platforms that are secure, flexible, and high performing. They also prioritize platforms with a deep liquidity pool, advanced risk management system and real-time support.

A. This refers to the strategies that major financial institutions like hedge funds, investment banks, and pension funds use to trade on behalf of their clients or themselves.

A. This involves large-scale cryptocurrency transactions by reputable organizations such as asset managers, banks, and hedge funds. It executes transactions effectively by utilizing sophisticated tools, extensive liquidity access, and regulatory compliance; it frequently has a major impact on market patterns and price movements.

Leave a Comment