Table of Contents

Home / Blog / Tokenization

Top Real Estate Tokenization Companies Transforming Property Investment in 2026

November 4, 2025

November 4, 2025

Real estate tokenization, which involves converting property ownership into tradable digital assets, is reshaping how people invest in real estate. Custom Market Insights reports that the global real estate tokenization market was valued at USD 3.5 billion in 2024 and is projected to reach USD 19.4 billion by 2033, growing at a CAGR of 21%.

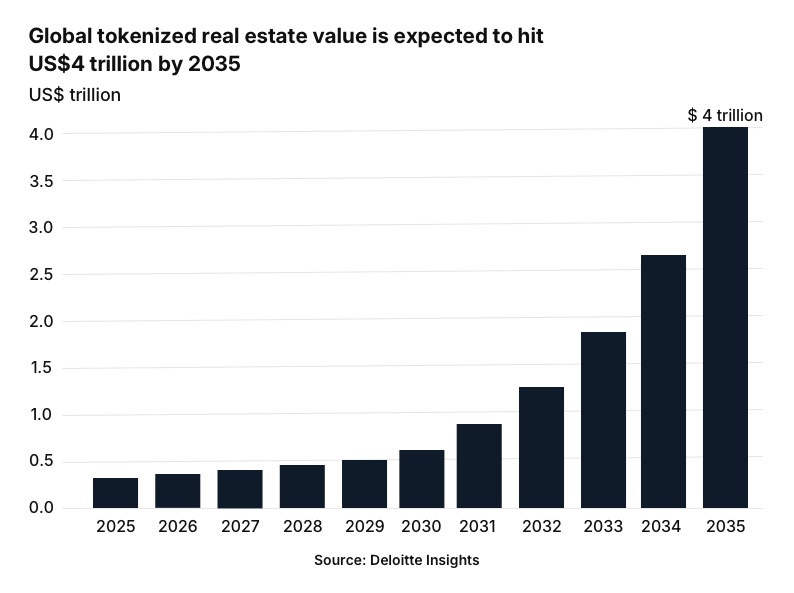

According to the Deloitte Center for Financial Services, the value of tokenized real estate is projected to surge from under $ 0.3 trillion in 2024 to approximately $ 4 trillion by 2035, reflecting a compound annual growth rate (CAGR) of 27%. In addition, tokenized private real estate funds are forecasted to grow to US$1 trillion by 2035, reaching an estimated 8.5% market penetration rate.

This growth rate is made possible by strong investor demand for fractional access, improved liquidity, and increased transparency.

In this article, we will explore what real estate tokenization is, its benefits, review leading companies that are tokenizing real estate, and offer a guide on how to choose the right one.

Launch Your Tokenized Property Platform

Transform your real estate assets into digital tokens with our blockchain-powered solutions. We build secure, compliant platforms that simplify property investment and ownership.

What is Real Estate Tokenization?

Real estate tokenization is the process of converting property ownership rights into digital tokens stored on a blockchain. Each token represents a share in the property, allowing multiple investors to hold fractional ownership. This model transforms traditional real estate investment by breaking large assets into smaller, tradable units.

It also enhances record-keeping and minimizes disputes since every transaction is transparent and traceable. By combining blockchain technology with property assets, tokenization introduces a more secure, efficient, and borderless investment method.

Benefits of Real Estate Tokenization

The appeal of real estate tokenization lies in its ability to open up a market that was previously restricted to wealthy investors. It changes the perception of property ownership from a privilege to an accessible investment.

Tokenized real estate eliminates intermediaries, reduces costs, and facilitates faster settlement, making property investment more inclusive and globally accessible.

1. Accessibility

Tokenization breaks down the barrier of large capital requirements. Investors can now buy fractional shares of high-value properties, spreading their portfolios across multiple assets. This flexibility creates new opportunities for small and mid-level investors while maintaining compliance with jurisdictional laws.

2. Transparency

Every transaction on a tokenized platform is recorded on the blockchain, offering clear and immutable audit trails. This eliminates the opacity often seen in traditional property deals. Buyers, sellers, and regulators can all verify ownership, ensuring fairness and accountability throughout the investment process.

3. Efficiency

Blockchain automates many of the manual steps involved in property transactions. Smart contracts manage everything from ownership transfers to profit distribution. The result is reduced paperwork, lower administrative costs, and faster deal execution — advantages that traditional real estate often struggles to match.

4. Liquidity

Traditionally, real estate investments are considered illiquid, locking up capital for extended periods. Tokenization changes that. Investors can sell their tokens on secondary markets, turning long-term assets into liquid, tradable instruments. This flexibility gives investors greater control over when and how they access their capital.

Related Read: Role of Smart Contracts in Real Estate Tokenization

Top 12 Real Estate Tokenization Development Companies

Choosing the right tokenization real estate tokenization development company can significantly impact the success of a project. Several tokenized real estate companies have distinguished themselves by delivering reliable blockchain solutions, regulatory alignment, and investor trust.

1. Debut Infotech

Debut Infotech is a blockchain development firm offering real estate tokenization solutions. It is headquartered in India (Gurgaon) and operates globally through client partnerships. The firm has worked with real estate groups in Dubai (AlFahim Group) and other markets, and built tokenization platforms for various property types (residential, commercial, industrial).

Services

They offer full-stack tokenization services: asset strategy consulting, smart contract engineering and audits, token design, compliance & legal support, blockchain integration, investor management tools, white-label platforms, and secondary market infrastructure.

Key Points

- Years of experience: 2011 (14 years)

- Number of employees: 50 – 149

- Number of projects completed: Multiple real estate tokenization platforms and assets across markets

- Hourly rate: $25 – $49/hr

- Ratings at Clutch: 4.9

- Reputed Patrons: AlFahim Group, BEC Group, Futurm One (among clients)

2. RealT

RealT is a U.S.-based platform that specializes in tokenized real estate investments. Founded in early 2019, the company is headquartered in Detroit, Michigan, and serves investors worldwide. RealT has tokenized over 400 properties in the U.S., valued at tens of millions of dollars, across single-family and multi-family homes.

Services

RealT issues ERC-20 “RealTokens” that represent fractional ownership, manages the distribution of rental income, supports secondary trading, and provides tools for token holders to view returns, transfer tokens, and engage in DeFi lending/borrowing.

Key Points

- Years of experience: 5+ years (since 2019)

- Number of projects completed: > 400 properties tokenized

- Reputed Patrons: Individual investors globally (65,000 registered), DeFi partners, and property management firms

3. Polymath

Polymath is a security token infrastructure company that focuses on issuing compliant tokenized securities, including real estate. Founded in 2017, the company is headquartered in Toronto, Canada, with a global approach to its markets.

Polymath has been applied to real world asset tokenization efforts in real estate, infrastructure, and other asset classes via partnerships and white-label issuance.

Services

Polymath provides a compliance-first issuance platform (Polymath Capital Platform), Token Studio for creating security tokens with embedded regulatory rules, node-as-a-service infrastructure, and subsidy programs for issuers to reduce compliance costs.

Key Points

- Years of experience: 8 years (since 2017)

- Number of projects completed: Multiple STOs across sectors (including real estate)

- Reputed Patrons: Asset managers, private issuers, and legal firms using Polymath tooling.

4. Propy

Propy is a proptech company based in Palo Alto, California, founded around 2015, that integrates blockchain into real estate transactions. It has facilitated global property sales by enabling blockchain-recorded deeds, with over USD 4 billion in transactions processed.

Services

Its services include a property marketplace, blockchain-based title registry and escrow, AI-assisted closing tools, utility token issuance, offer/transaction management, and a self-driving transaction platform.

Key Points:

- Years of experience: 9–10 years (since 2015)

- Number of projects completed: Numerous real estate transactions globally and token issuance (e.g., Propy token)

- Reputed Patrons: Real estate agents, title companies, global buyers, and sellers using Propy’s platform.

5. SolidBlock

SolidBlock is a real estate tokenization platform with roots in Israel and offices in New York. It gained attention in 2018 by tokenizing the St. Regis Aspen Resort via an $18 million security token offering. It has since expanded globally through partnerships (e.g., Latin America via Wconnect) and listings of assets in London, Phuket, and New Haven, among others.

Services

SolidBlock offers Tokenization as a Service (TaaS), structuring asset-backed security tokens for high-value real estate, ensuring legal/regulatory compliance, facilitating digital issuance, secondary trading, dividend (or rental income) automation, investor dashboards, and marketplace access. It also provides white-label solutions, cloud hosting, and post-issuance support.

Key Points

- Years of experience: 5-6 years (active since 2018)

- Number of projects completed: Several tokenized real estate deals, including luxury resorts and commercial properties

- Reputed Patrons: Investors and property owners involved in high-end real estate assets; partners for regional expansion, like Wconnect in LATAM; collaboration with INX for token listing.

Related Read: Legal and Regulatory Challenges in Real Estate Tokenization

6. RealFund

RealFund is a Spain-based real estate tokenization company (founded with roots in Madrid). It operates in Spain and collaborates internationally through partners in the blockchain, legal, and real estate sectors. Its portfolio includes tokenization of real estate projects (both debt/equity/revenue types) and development-type assets.

Services

RealFund provides end-to-end tokenization: feasibility analysis of property projects, legal and financial structuring, issuance of tokens on blockchain, investor onboarding, management of cap tables in real time, distribution of dividends/interests, and secondary market access.

Key Points

- Years of experience: A Few years — active in the recent tokenization wave.

- Number of projects completed: Multiple (span of real estate tokenization structures in Spain)

- Reputed Patrons: Partners in Spanish and international real estate & blockchain sectors; clients who have used RealFund to tokenize projects.

7. Metlabs

Metlabs (Metlabs Blockchain SL) is headquartered in A Coruña, Spain. They have delivered over 30 projects in web3 and blockchain, including real estate/ real-world asset (RWA) tokenization. Their team consists of approximately 15 in-house professionals. They serve clients across Europe and beyond. Their solutions are being adopted by customers looking for compliance, technical robustness, and traceability.

Services

Metlabs offers a white label tokenization platform, custom tokenization for RWAs, blockchain consulting, dApp development, deployment of private blockchains, UX/UI design, and back-end/front-end work. They support standard protocols (e.g., ERC-3643) for RWA token issuance, regulatory compliance, and secondary market readiness.

Key Points

- Years of experience: 3+ years in dedicated Web3 / RWA tokenization work.

- Number of employees: ~15 in-house team members.

- Number of projects completed: Over 30 blockchain/tokenization projects.

- Hourly rate: $50 – $99

- Ratings at Clutch: 5.0

8. Slice Global / Slice RE

Slice RE was founded in 2018 and is headquartered in San Francisco, California, United States. The company is active globally, offering cross-border access to institutional U.S. commercial real estate (CRE) through tokenization. One known project is Ann Street, a commercial property in Manhattan, which was tokenized via the Slice platform.

Services

Slice RE tokenizes limited partner (LP) interests in commercial real estate, enabling investors to obtain fractional ownership in large U.S. CRE assets. It offers a platform where tokens represent these LP shares; these tokens are compliant with regulatory requirements, allow income from rent or appreciation, and aim for liquidity via trading of such tokens. They also source and vet institutional real estate deals, providing due diligence and structuring to reduce barriers to entry, high costs, and illiquidity.

Key Points

- Years of experience: 5-7 years (since 2018)

- Number of projects completed: At least one high-profile tokenization (e.g., Ann Street); more in pipeline via institutional CRE deals.

- Reputed Patrons/Partners: Institutional investors and real estate owners backing tokenized CRE; the merger with StraightUp broadened its access to development opportunities in cities such as New York, Los Angeles, and San Francisco.

9. Harbor

Harbor was founded around 2017 and is headquartered in San Francisco, with additional presence in Chicago. It focuses on tokenizing private securities—especially real estate funds and commercial real estate. In 2019, Harbor tokenized $100 million in real estate funds via Ethereum. In 2020, digital asset custodian BitGo acquired Harbor to strengthen its security token offering capabilities.

Harbor has worked with property developers, broker-dealers, and institutional issuers to convert real estate share ownership into compliant tokens.

Services

Harbor offers an end-to-end platform, including onboarding (KYC/AML and accreditation checks), regulatory compliance protocols (its “R-Token” standard ensures that every transaction meets the rules), issuance and minting of tokens, token transfer validation, secondary market enabling, and custody integration (e.g., via BitGo).

Key Points

Years of experience: 6–8 years (active since 2017)

Number of projects completed: Multiple tokenized real estate funds and offerings

Reputed Patrons: Institutional issuers, broker-dealers, and real estate firms using Harbor’s compliance protocol

10. Tokeny Solutions

Tokeny Solutions is a Luxembourg-based fintech company launched in 2017. It has expanded its reach globally via partnerships. It acts as a tokenization infrastructure provider across Europe, the U.S., and beyond. It supports multiple jurisdictional deployments and collaborates with traditional financial institutions, asset managers, and token issuers.

Services

Tokeny provides a full lifecycle platform for tokenized securities. Its services include compliant issuance (with KYC/AML workflows), investor onboarding, issuance & distribution, token transfer (via its T-REX protocol), investor servicing (including corporate actions and reporting), and interoperability with marketplaces. It also offers white-label solutions and modular APIs to integrate with existing systems.

Key Points

- Years of experience: 7+ years (since 2017)

- Number of projects completed: Over 100 issuers; tens of security tokens issued (per Tokeny’s statements)

- Reputed Patrons: Traditional financial institutions, asset managers, blockchain projects, and Euronext among supporters and partners

11. BrickBlock

BrickBlock is a tokenization and digital asset platform that enables investment in tokenized real estate, funds, and other assets. It has operated in the tokenization space for several years and targets global markets. Its operations span across Europe and markets interested in tokenized fund structures.

Services

BrickBlock enables issuers to package properties into tokenized funds, manage distribution, issue tokens, and provide investors with dashboards. It also supports the automated management of portfolios. It offers brokerage-like services, as well as integration with exchanges or secondary markets.

Key Points

- Years of experience: Several years (exact start date not publicly confirmed)

- Number of projects completed: Multiple tokenized fund and real estate projects (as per sector listings)

- Reputed Patrons: Property developers, fund managers, and investors engaging with tokenized fund models

12. DigiShares

DigiShares is a Denmark-based company specialising in real estate tokenization infrastructure. They launched around 2017-2018 and have expanded across Europe, including markets such as the UK, Germany, and the Nordics. Their portfolio includes various tokenized property and fund-share projects, often collaborating with property developers, fund managers, and legal firms to ensure real-world asset (RWA) tokenization is compliant and scalable.

Services

They offer white-label tokenization solutions: issuance of tokens tied to real estate or funds, management of real-estate cap tables, investor onboarding (KYC/AML), secondary market support, and dashboards that allow real-time tracking of token transactions and asset performance. Their solutions are designed to be modular, allowing clients to select only what they need. Key Points

Years of experience: 5-7 years (operating since 2017-2018)

Number of projects completed: Multiple across Europe; details vary per country and partner

Reputed Patrons: European property developers and tokenization clients; firms needing compliant RWA token infrastructure are among their clients.

Also Read: Real Estate Tokenization Platform Cost: A Detailed Breakdown

Factors to Consider When Choosing a Real Estate Tokenization Company

Not every blockchain developer is suited for real estate tokenization. The process demands both technical and legal precision. Investors and developers should assess a company’s expertise, compliance measures, and infrastructure before committing.

1. Experience and Reputation

Tokenization companies with proven experience in tokenizing large-scale properties bring reliability and practical understanding. Their track record in handling complex assets helps avoid costly mistakes during token issuance or trading.

2. Regulation and Compliance

Compliance determines credibility in tokenized real estate. A company must follow KYC/AML policies, securities regulations, and property laws to ensure tokens meet both national and international standards.

3. Safety

Security remains a key factor. A dependable tokenization platform should use advanced encryption, multi-signature wallets, and risk monitoring systems to safeguard investor funds and property data.

4. Transparency

A transparent company ensures clients have access to real-time data on asset performance, investor distribution, and regulatory audits. This builds confidence and maintains fair dealings.

5. Technology

The foundation of any successful tokenization project lies in the technology stack. A reliable company uses scalable blockchains, smart contracts, and APIs that integrate seamlessly with investor platforms. The right tools make trading efficient and compliance effortless.

Partner With a Leading Tokenization Company

Collaborate with our blockchain development experts to design, launch, and manage your real estate tokenization platform from inception to completion.

Conclusion

Real estate tokenization companies USA are rapidly redefining property ownership by unlocking liquidity, improving transparency, and enabling fractional investments.

As the market scales and potentially reaches trillions in value, selecting a company with experience, strong compliance, robust technology, and clear transparency is vital.

With the right partner, tokenization can turn traditionally illiquid real assets into more accessible, efficient, and liquid investment vehicles.

FAQs

Ethereum is the most widely used blockchain for real estate tokenization, as it supports smart contracts and fractional ownership. Other platforms, such as Polygon, Solana, and Avalanche, are also gaining traction due to their lower fees and faster transactions. The choice depends on project size, security requirements, and the investor’s reach.

The cost usually ranges from $25,000 to over $150,000, depending on asset value, legal setup, and blockchain platform. Expenses include compliance, smart contract development, token issuance, and marketing. High-value properties or complex regulatory structures can further increase the total.

Yes, it’s legal in most countries, as long as it complies with securities and property laws. In the U.S., for instance, tokenized assets must comply with SEC regulations. Legal compliance ensures investor protection, prevents fraud, and ensures projects align with existing real estate regulations.

One well-known case is the St. Regis Aspen Resort in Colorado. It was tokenized on the Ethereum blockchain, allowing investors to buy shares as digital tokens. Each token represented a portion of the hotel’s equity, making real estate investing accessible to smaller investors.

First, pick a property and conduct legal due diligence. Next, create digital tokens representing ownership shares using blockchain technology. Partner with a tokenization platform, issue the tokens to investors, and ensure compliance with real estate and securities laws. Finally, list tokens on a compliant exchange.

Our Latest Insights

Leave a Comment