Table of Contents

Home / Blog / AI/ML

Generative AI in Banking and Finance: A Complete Guide

March 27, 2024

March 27, 2024

The world of banking and finance is extremely fast-paced. Traditional approaches struggle to keep up with evolving customer needs, regulatory necessities, and sheer amounts of financial data. This is where artificial intelligence (or generative AI) comes into play.

Traditional AI/ML technologies analyze previous data and make predictions based on it. But generative AI takes a step further by producing new and unique data. That is why generative AI in finance and banking is best suited for generating synthetic financial data, improving customer interaction, and enhancing risk management processes.

So the question arises: is generative AI being used in the finance and banking sector right now? And what does the future look like? Will we be more productive, efficient, OR jobless and dependent on generative AI? This article aims to give you an in-depth analysis of its current applications and future possibilities in the finance and banking industry.

Understanding the Current State of Generative AI in Finance and Banking

In 2022, the market size of generative AI in finance and banking industry was approximately 0.85 billion US dollars. With a forecasted compound annual growth rate or CAGR of 28.1 percent from 2022 to 2023, the market size is projected to experience significant growth. By 2032, it is expected to exceed 9.4 billion US dollars.

These stats suggest that it’s just the beginning of a new era. But if we put numbers aside, a big question arises. What exactly is generative AI, and how is it being used in finance currently? Generative AI is a subset of artificial intelligence. It can generate new data by leveraging different machine learning models. Interestingly, this new data resembles (but is not the same as) the input data it was trained on.

AI in finance and banking is being utilized in various innovative ways. It is being used to detect and prevent fraud by analyzing patterns in data. It’s also being used to enhance customer experience by generating personalized content based on customer behavior. Furthermore, generative AI is being used for risk assessment and credit scoring.

Read also this blog: Generative AI in SaaS: Key Trends, Benefits, and Future Holds.

So, the opportunities to utilize the power of generative AI are endless. Through the stats, we saw that it is not only transforming the way banking finance sectors operate but also showing promising growth figures.

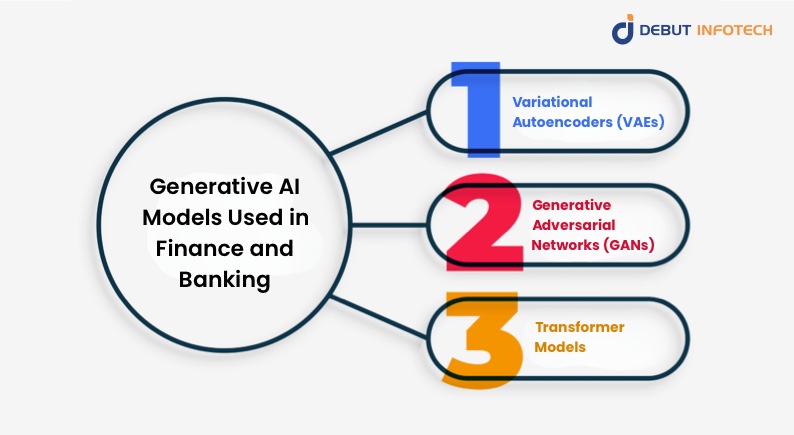

Generative AI Models Used in Finance and Banking

Numerous generative AI models are currently being used in finance and banking, but VAEs, GANs, and transformer models are the most prominent options.

1. Variational Autoencoders (VAEs)

VAEs can generate new data that resembles the input data. Because of this, VAEs can analyze data and identify patterns that can be used to generate synthetic financial data. It can also be used in fraud detection. Since it can identify patterns, it will be able to detect anomalies that may indicate fraud.

2. Generative Adversarial Networks (GANs)

GANs also generate new data but have a different training approach than VAEs. Generative Adversarial Networks consist of two neural networks, a generator and a discriminator, that compete against each other to generate new data. Like VAEs, it can also be used for synthetic data generation, fraud detection, and forecasting of financial market trends.

3. Transformer Models

Transformer models were introduced in 2017, and since then, they have excelled in tasks that involve computer vision and NLP. Transformer-based models like BERT and GPT were initially developed to process NLP but are now used in industries like fintech. They can classify transactions and represent them by vectors as fraud or non-fraud. They can help in data processing, analysis, and forecasting.

9 Use Cases of Generative AI in Finance and Banking

Now that we have covered the basics of AI in finance and banking, let’s try to understand how it’s used.

1. Market Simulation

Finance geeks use a method called market simulation to analyze and predict the behavior of financial markets. This means a virtual representation of the market is created. Then, historical data, market trends, and various other variables are used to suggest possible future scenarios. This helps traders and investors make informed decisions.

And where data is involved, generative AI can play its role by making the process more effective. AI in finance and banking can create synthetic market data that closely resembles real-world data. This allows organizations to test different scenarios and make informed decisions based on the simulated results.

2. Examine Market Trends

In the world of finance, it is important to be aware of the current market trends. This includes price movements, trade volumes, etc. The numbers in financial markets change daily. So, one day, there will be an upward trend; the other day, it will be sideways or downward. So it becomes difficult to catch up with these changing trends.

So, finance companies can save a lot of time by using generative AI. Many generative AI models can analyze large amounts of existing and real-time data and identify patterns and trends. Most generative AIs can generate text, images, code, audio, and video content. Therefore, it can produce concise summaries of complex financial reports in digestible formats, like visual charts.

3. Portfolio Optimization

Generative AI in finance can be a powerful tool for portfolio optimization. It can help investors understand potential risks and returns, thus enabling them to make more informed decisions. It can generate various potential portfolio allocations and investment strategies and evaluate their performance under different market conditions.

4. Algorithmic Trading

Algorithmic trading is a method of automated trading, and it’s one of the best ways to use AI in finance and banking. It’s done through programmed trading instructions that account for time, price, and volume variables. This type of trading allows computers to imitate the roles of human traders.

The advantages of algorithmic trading include the best execution of trades, reduced transaction costs, and fewer chances of manual errors, which is a win-win situation. Because of these benefits, algorithmic trading makes up approximately 60-73% of all stock trading activity in the United States. This means that a significant majority of the buying and selling of stocks is done automatically by algorithms rather than by human traders.

5. Fraud Prevention and Detection

In 2023, the Reserve Bank of India recorded over 13,000 bank frauds across India. Therefore, fraud is a major part of the banking and finance industry and should be prevented at all costs. Traditionally, fraud detection relies on rule-based systems and detection techniques, which may not always be effective in identifying complicated and new fraud patterns.

That’s why many banking and finance companies are using generative AI. It helps them to analyze large volumes of transactional data to identify irregularities and suspicious patterns that may indicate fraudulent activities. The most beneficial part is that it saves a lot of time. Imagine going through hundreds of pieces of data to detect fraudulent patterns – that would cost a lot of time. But generative AI can do it within minutes and then give you a full report.

6. Credit Risk Assessment

In finance and banking, credit risk assessment is used to evaluate the creditworthiness of a person, business, or other entities. These entities are mostly the ones seeking financial services, such as loans. The purpose is simple – to check the risks borrowers might possess.

Typically, banks or other financial institutions have to check the borrower’s credit history, incomes, assets, liabilities, and overall financial health. Banks use statistical models for this. But now, many banks are trusting generative AI to conduct this evaluation.

7. Customer Personalized Experience

With the help of fintech, banks and financial institutions are serving their customers better. However, they can enhance this experience by integrating generative AI in this process. These institutions can train and use generative AI to offer personalized recommendations and insights to each customer.

8. Customer Service Chatbots

To enhance their customer’s experience, banks and finance structures must provide good customer service. There are two ways of doing it: either hire customer service representatives or use generative AI.

AI chatbots can understand and respond to customers’ queries in real-time. Moreover, they can offer financial advice such as budgeting tips or investment suggestions based on the preferences of the customer.

9. Automated Documentation

Last but not least, generative AI can automate the tedious process of documentation in the banking and finance sector. It can generate text that mimics human-like language patterns. Therefore, it can be used to streamline the process of making financial documents like reports, contracts, etc. This way, more time is saved, there is less chance of manual error, and overall efficiency increases.

Future Implications of Generative AI in Finance and Banking

With the current success of generative AI in finance and banking, it is expected to continue to grow in these sectors. Research suggests that banks will spend $85.7 billion of dollars on generative AI by 2030.

Therefore, we can assume that generative AI will streamline processes by automating routine tasks such as customer service inquiries and fraud detection. This will free up human employees to focus on complex issues.

Related Read: How Generative AI for Software Development Is Accelerating Innovation.

However, it also means that many people will lose their jobs. Nonetheless, if implemented thoughtfully, generative AI in finance and banking has the potential to greatly improve efficiency, accuracy, and decision-making in these sectors.

Challenges of Using Generative AI in Finance and Banking

So far, we have mostly discussed the benefits of using AI in finance and banking. But let’s not forget that there is always another side to the coin. And that generative AI also poses some serious threats.

1. Ethical and Security Challenges

One major ethical concern of using generative AI is the potential for biased or unfair outcomes in the decision-making process. If AI models are trained on data showing societal biases or other discriminations, they may adopt it as well.

Additionally, the use of generative AI in fraud detection and prevention can raise concerns about privacy and data security. Since a computer program is involved, there are more chances of vulnerabilities that may lead to breaches of customer privacy.

And even though generative AI in finance and banking can prevent fraud– it can also be used for financial manipulation. AI Technology can be easily exploited to create convincing counterfeit documents or manipulate market data. This can cause market distortions or, even worse, fraudulent transactions.

2. Regulatory Challenges

Other than ethical and security challenges, there are some regulatory challenges to using generative AI. There are concerns about data privacy, security, and compliance. Therefore, regulators will have to ensure that generated data meets the regulatory standards and doesn’t compromise sensitive information. Regulators must also develop frameworks to detect and put an end to fraudulent activities that may arise due to the use of AI in finance and banking.

Conclusion

Generative AI in finance and banking deserves all of the hype due to its ability to generate new data that can mimic the patterns of previous (existing) data. This not only helps banks and other financial institutes identify fraudulent activities but also helps investors make informed decisions. AI also helps these institutions improve their relations with customers by providing them with personalized recommendations and chatbots.

Stats and figures show a promising growth of generative AI in the future, which will make the financial markets more productive. If you want to prevent your company from fraud, make data-driven investment decisions, or want to improve customer relations, we recommend using generative AI development. At Debut Infotech, we provide several AI-related services in finance and banking.

If you feel stuck about the type of services you need, we are here to assist you. You can have a consultation call with our team at any team, or you can get more information by reading our guides related to AI and its role in different industries.

Frequently Asked Questions: Generative AI in Finance and Banking

Here are some FAQs you might have in mind about generative AI in finance and banking.

A. Generative AI is a type of artificial intelligence that is capable of generating new data by analyzing existing data. In finance and banking, it can be used to make synthetic financial data, examine market trends, automate trading, and create personalized chatbots.

A. Yes, AI in finance and banking can be used to create synthetic data that helps in preventing and detecting fraud. It can also identify vulnerabilities in the system that can alert banks and financial institutions to take more cybersecurity measures.

A. Yes, AI in finance and banking can be used to create synthetic data that helps in preventing and detecting fraud. It can also identify vulnerabilities in the system that can alert banks and financial institutions to take more cybersecurity measures.

A. Generative AI is not all sunshine and roses. There are multiple cons that finance and banking institutions must be aware of. One major drawback is the security risk. Generative AI algorithms may expose vulnerabilities in the system, especially if it is not secure enough. There are other issues, like data privacy, regulatory challenges, and ethical concerns.

A. Not yet, but does it need to be? Yes. Recently, the European Union introduced its AI act, but it has yet to reach the finish line. In finance and the banking sector, there is a great need to regulate generative AI before it is used in fraudulent activities.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment