Table of Contents

Home / Blog / Blockchain

Blockchain Infrastructure: Real-Estate Use Cases and Benefits

January 12, 2026

January 12, 2026

Blockchain Infrastructure is the backbone of all decentralized systems. It determines how networks communicate, how data is stored, how consensus is reached, and how applications function reliably over time.

Adoption keeps accelerating. As of 2025, over 560 million people worldwide engage with blockchain technology, showing how deeply blockchain-based systems are entering everyday use.

Market investment follows the same direction. The global blockchain market is projected to grow from $31.18 billion in 2025 to $393.42 billion by 2032, reflecting strong enterprise demand, according to Fortune Business Insights. Furthermore, in 2024, the blockchain in infrastructure market was estimated at $21.72 billion, and it’s projected to expand to roughly $278.75 billion by 2035, growing at around 26.11 % annually from 2025 to 2035.

In this guide, we will break down Blockchain Infrastructure clearly, covering its core layers, architectures, benefits, challenges, and the future shaping large-scale adoption.

Ready to Launch High-Performance Networks?

Implement blockchain infrastructure that supports complex applications and heavy workloads.

What Is Blockchain Infrastructure?

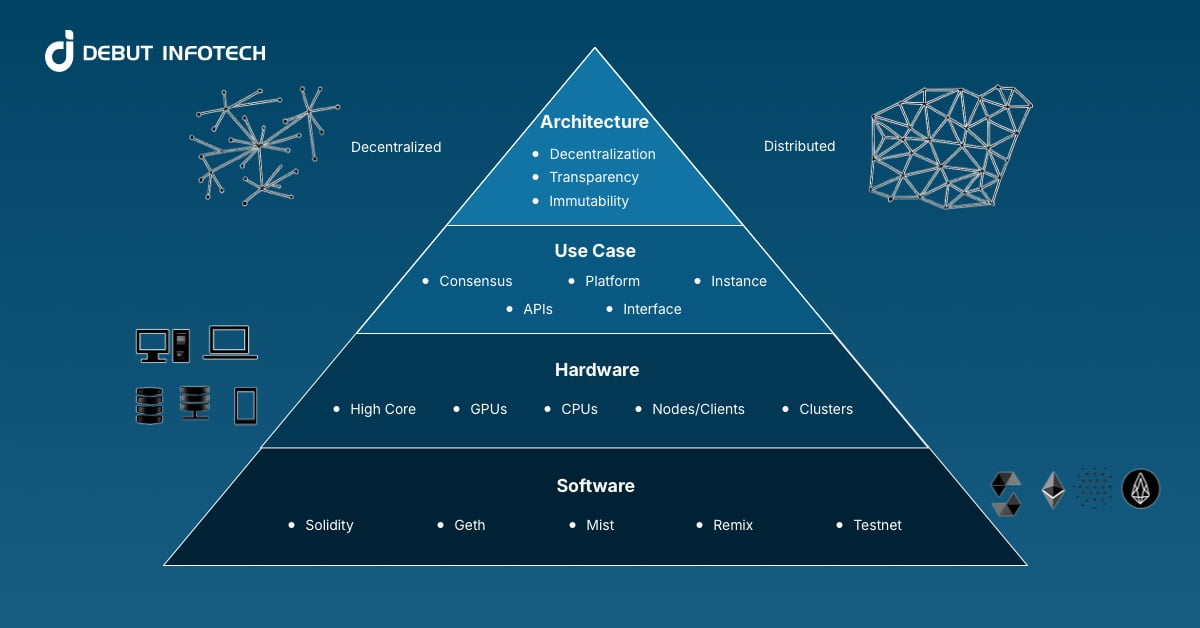

Blockchain infrastructure refers to the foundational technical layers that enable blockchain networks to operate reliably at scale. It includes the systems, blockchain ecosystem protocols, hardware, and software components responsible for data storage, consensus, security, and application execution.

Rather than focusing on a single blockchain or use case, crypto infrastructure provides the base environment that supports transactions, smart contracts, and decentralized applications across industries.

Key Components of Blockchain Infrastructure

1. Network Layer

The network layer handles peer-to-peer discovery, messaging, and data propagation between nodes across the infrastructure blockchain. It ensures blocks and transactions spread reliably, resists censorship, and tolerates node failure. Efficient networking directly affects latency, decentralization, and the network’s ability to remain synchronized under heavy load.

2. Hardware Layer

The hardware layer covers the physical and virtual infrastructure running blockchain nodes, including servers, cloud instances, storage, and networking resources. The hardware infrastructure determines performance, fault tolerance, and availability.

Proper hardware planning supports validator uptime, secure key management, redundancy, and predictable costs as networks scale across production-grade environments worldwide today.

3. Consensus Layer

The consensus layer defines the rules and algorithms nodes use to agree on transaction validity and block order. It replaces centralized trust with cryptographic and economic incentives. Consensus design influences security, throughput, finality speed, and resistance to attacks such as double-spending or network manipulation.

4. Data Layer

The data layer governs how blockchain information is structured, stored, and cryptographically linked. It includes blocks, transactions, state data, hashes, and Merkle trees. This component of infrastructure for blockchain ensures integrity, traceability, and tamper resistance, enabling anyone with permission to independently verify historical records over long-term network operation cycles globally.

5. Application Layer

The application layer delivers blockchain functionality to users and businesses through smart contracts, decentralized applications, APIs, and wallets. It abstracts complex infrastructure into usable interfaces. This layer defines user experience, business logic, integration with existing systems, and real-world adoption outcomes across diverse industries and regulated markets.

Key Functions and Benefits of Blockchain Infrastructure

1. Efficiency and Automation

Blockchain technology infrastructure enables automated execution of predefined rules through smart contracts, reducing manual intervention and operational delays. Workflows such as reconciliation, settlement, and reporting can run continuously with minimal oversight. This improves speed, lowers administrative costs, reduces human error, and allows organizations to scale complex processes without proportional increases in staff or intermediaries across distributed operating environments.

2. Transparency and Immutability

Blockchain infrastructure creates shared, append-only records that participants can independently verify. Once data is confirmed, it cannot be altered without consensus, strengthening accountability. This transparency supports auditing, compliance, and dispute resolution. At the same time, immutability preserves historical truth, reduces fraud, and builds confidence among parties that do not fully trust one another across multi-organization and cross-border ecosystems globally.

3. Security

Security is embedded into blockchain infrastructure through cryptography, decentralization, and consensus enforcement. Transactions are digitally signed, data is hashed, and control is distributed across many nodes. This design limits single points of failure, strengthens resistance to tampering and attacks, and improves system resilience even when some participants behave maliciously under real-world operational stress and adversarial conditions.

How to Set Up Blockchain Infrastructure

1. Define Objectives and Use Case

Start by identifying the business goals and specific blockchain applications. Clarify whether the network will support payments, asset tokenization, identity management, or supply chain tracking, as this determines architecture, consensus mechanism, and infrastructure requirements. Carefully evaluate the blockchain infrastructure requirements before proceeding with your project.

2. Choose Blockchain Architecture

Select between public, private, hybrid, or consortium blockchain based on control, transparency, and scalability needs. Each type affects security, performance, and compliance, so align the decentralized architecture with operational goals and regulatory obligations to ensure a sustainable deployment.

3. Set Up Network and Nodes

Deploy network nodes across physical or cloud infrastructure to ensure decentralization and fault tolerance. Configure peer-to-peer communication, peer-to-peer networking protocols, and synchronization mechanisms to maintain reliable block propagation and consensus across all participating nodes.

4. Implement Consensus and Data Layers

Integrate an appropriate consensus mechanism, such as Proof of Stake or Practical Byzantine Fault Tolerance, and configure the data layer for secure, immutable storage. Ensure cryptographic hashing, Merkle trees, and validation logic are robust and compatible with the intended workload.

5. Develop Applications and Smart Contracts

Build application interfaces, APIs, and smart contracts to interact with the blockchain. Conduct thorough testing, auditing, and deployment in a controlled environment to ensure functional reliability, security, and smooth integration with existing systems before going live.

Challenges of Blockchain Infrastructure

1. Scalability Trade-offs

Blockchain networks often struggle to balance Decentralization, cryptographic security, and performance. Increasing transaction throughput can raise hardware requirements or reduce validator participation.

Congestion, higher fees, and delayed finality emerge during peak usage, limiting suitability for high-volume applications and enterprise workloads that demand consistent performance.

Recommendation / Solution

Layered scalability approaches offer a practical path forward. Rollups, sidechains, and sharding reduce base-layer load while preserving security guarantees. Separating execution from settlement allows networks to scale incrementally, supporting higher throughput without centralizing control or compromising trust assumptions embedded in core blockchain design.

2. Governance Challenges

Blockchain governance is difficult due to distributed stakeholders with competing incentives. Protocol upgrades, parameter changes, and dispute resolution can become slow or contentious. Lack of clear authority may delay critical improvements, create forks, or weaken coordination, especially in public and consortium networks spanning multiple jurisdictions.

Recommendation / Solution

Clear governance frameworks should be defined early, combining on-chain voting with off-chain coordination processes. Transparent decision rules, upgrade paths, and accountability mechanisms help align participants. For enterprise blockchain and consortium chains, formal governance charters and legal agreements can reduce uncertainty and support long-term operational stability.

3. Complex Development Stack

Blockchain infrastructure development requires expertise in cryptography, distributed ledger technology, smart contracts, and security engineering. Tooling remains fragmented, increasing integration risk and development time. Errors at any layer can introduce vulnerabilities, making production deployment costly and slowing adoption among traditional enterprises with limited blockchain expertise.

Recommendation / Solution

Improved developer tooling and modular infrastructure can reduce complexity. Standardized frameworks, audited libraries, and managed blockchain development services lower entry barriers. Clear documentation and best-practice architectures help teams focus on business logic while minimizing security risks and accelerating deployment across regulated and large-scale environments.

4. Energy Considerations

Energy consumption remains a concern, particularly for networks using resource-intensive consensus mechanisms. High electricity usage raises operational costs and environmental scrutiny. This can limit institutional adoption, attract regulatory pressure, and create negative public perception, even when blockchain systems deliver strong security and transparency benefits.

Recommendation / Solution

Transitioning to energy-efficient consensus models significantly reduces environmental impact. Proof-of-Stake systems, optimized validator hardware, and greener hosting options improve sustainability. Infrastructure planning that prioritizes efficiency alongside security enables blockchain networks to meet performance goals while aligning with corporate and regulatory sustainability expectations.

Real-World Use Cases (and Why They Matter)

1. Stablecoin Issuance and Treasury Operations

Traditional stablecoin operations often rely on opaque reserve management, delayed reporting, and manual reconciliation across banks, custodians, and issuers. This lack of real-time visibility creates trust gaps, operational inefficiencies, and regulatory concerns, especially when reserves span multiple jurisdictions and financial institutions with differing reporting standards.

Blockchain Impact

Blockchain infrastructure enables on-chain issuance, programmable controls, and real-time reserve attestations. Treasury movements become traceable, balances verifiable, and supply changes auditable. Smart contracts automate issuance and redemption logic, reducing operational friction while improving confidence among regulators, partners, and users interacting with stablecoin ecosystems.

Why They Matter

Stablecoins function as critical financial infrastructure for payments, trading, and cross-border value transfer. Transparent and efficient issuance strengthens market trust and systemic stability. Reliable blockchain-based treasury operations reduce risk at scale, making stablecoins viable tools for institutions rather than experimental instruments with unclear backing.

2. Payments and Settlement

Conventional payment systems rely on multiple intermediaries, batch processing, and legacy messaging networks. Cross-border transfers are slow, costly, and prone to reconciliation errors. Settlement delays increase counterparty risk and tie up capital, particularly for businesses operating across time zones and fragmented banking infrastructures.

Blockchain Impact

Blockchain infrastructure enables near-instant settlement with shared transaction records across participants. Funds move directly between parties without layered intermediaries. Smart contracts automate clearing and reconciliation, lowering fees and reducing settlement risk while enabling continuous, always-on payment flows across borders and financial systems.

Why They Matter

Efficient settlement underpins modern commerce and financial stability. Faster payments improve liquidity management, reduce operational costs, and support real-time economic activity. Blockchain-based settlement systems lay the foundation for scalable digital finance, especially in global markets where legacy rails struggle to meet speed and transparency requirements.

3. Digital Identity and Credentials

Digital identity systems are fragmented, centralized, and vulnerable to breaches. Users repeatedly share sensitive data across platforms, increasing the risk of misuse and fraud. Organizations struggle to verify credentials reliably while complying with data protection regulations and managing identity across multiple systems and jurisdictions.

Blockchain Impact

Blockchain infrastructure supports decentralized identity models where credentials are cryptographically verifiable and user-controlled. Identity data can be selectively disclosed without centralized storage. This reduces breach risk, simplifies verification, and allows trusted credential exchange across blockchain platforms without duplicating sensitive personal information.

Why They Matter

Trusted digital identity is foundational for secure online interaction, finance, healthcare, and governance. Blockchain-based credentials restore user control while improving verification reliability. This balance between privacy and trust enables scalable digital services without expanding centralized data silos that expose individuals and institutions to growing security risks.

4. Tokenization of Real-World Assets (RWAs)

Real-world assets such as real estate, commodities, and private securities suffer from illiquidity, high entry barriers, and slow settlement processes. Ownership records are fragmented across custodians and registries, limiting transparency and making fractional ownership complex, expensive, or impractical for many investors.

Blockchain Impact

Blockchain infrastructure enables assets to be represented as programmable tokens with clear ownership rules. Transfers, compliance checks, and settlements occur on-chain. Fractionalization becomes native, liquidity improves, and asset management processes become more efficient, transparent, and accessible across global investor bases.

Why They Matter

Tokenization expands market access while modernizing asset infrastructure. It lowers capital thresholds, improves liquidity, and supports more inclusive participation. For institutions, it reduces operational overhead. For markets, it unlocks dormant value by transforming traditionally static assets into digitally native financial instruments.

5. Supply Chain and Provenance Tracking

Supply chains rely on siloed systems, manual documentation, and limited visibility across participants. This creates inefficiencies, delays, and opportunities for fraud or counterfeiting. Verifying origin, handling disputes, and ensuring compliance become difficult when data is fragmented and inconsistently recorded across organizations.

Blockchain Impact

Blockchain infrastructure provides a shared, immutable record of supply chain events. Each transaction is timestamped and verifiable, improving traceability and accountability. Smart contracts automate compliance checks and data sharing, reducing reconciliation efforts while strengthening trust among manufacturers, suppliers, regulators, and end consumers.

Why They Matter

Reliable provenance supports safety, sustainability, and regulatory compliance. Transparent supply chains reduce fraud, protect brand integrity, and improve consumer confidence. Blockchain-based tracking systems enable global coordination at scale, making complex supply networks more resilient and trustworthy in increasingly regulated and competitive markets.

The Future of Blockchain Infrastructure

1. Scalability Solutions

Future blockchain infrastructure will increasingly rely on layered architectures, including rollups, sidechains, and sharding models. These approaches separate execution, settlement, and data availability to improve throughput without weakening security. As tooling matures, scalable designs will support enterprise-grade workloads, real-time applications, and high-volume financial systems previously limited by on-chain constraints.

2. Energy Efficiency

Energy efficiency will remain a core focus as blockchain infrastructure evolves. Consensus mechanisms are shifting toward low-energy models, supported by optimized hardware and smarter network design. Infrastructure providers are also adopting greener hosting strategies, aligning blockchain operations with sustainability goals while maintaining economic security and long-term network resilience as adoption grows.

3. Interoperability

Interoperability will define the next phase of blockchain infrastructure growth. Cross-chain messaging, shared security models, and standardized protocols will allow assets and data to move seamlessly between networks. This reduces fragmentation, improves capital efficiency, and enables developers to build applications that span multiple blockchains without locking users into isolated ecosystems.

Building Infrastructure That Actually Holds Up

Debut Infotech is a reliable enterprise blockchain development company focused on building infrastructure that performs beyond pilots and proof-of-concepts. We apply real-world engineering discipline to ensure blockchain systems are secure, scalable, and ready for long-term operation.

How We Build Production-Ready Blockchain Systems

- Design and development of secure blockchain networks and protocol layers

- Smart contract architecture built for reliability, performance, and upgradeability

- Integration frameworks connecting blockchain with enterprise and legacy systems

- Compliance-aware development aligned with regulatory and operational realities

- Proven delivery across finance, tokenization, and enterprise-grade platforms

For organizations that require dedicated expertise and long-term ownership, we also enable teams to hire blockchain developers who have hands-on experience delivering production-grade blockchain solutions.

Looking for A Partner for Reliable Blockchain Infrastructure

Collaborate with a team dedicated to building secure, high-performance blockchain foundations for your business.

Conclusion

Blockchain Infrastructure serves as the foundation for secure, scalable, and efficient decentralized systems. Understanding its layers, architectures, benefits, and challenges is essential for leveraging blockchain effectively.

From payments and digital identity to tokenization and supply chain tracking, robust infrastructure enables real-world applications to thrive.

As scalability, interoperability, and energy-efficient solutions continue to advance, Blockchain Infrastructure will remain central to innovation, driving adoption and unlocking new possibilities across industries worldwide.

FAQs

Q. Which is the best blockchain infrastructure?

A. There’s no one-size-fits-all answer. Ethereum is popular for smart contracts, while Solana and Avalanche are praised for speed and low fees. The “best” depends on what you want—DeFi, NFTs, enterprise solutions, or general transactions. Pick the one that matches your project’s needs and community support.

Q. What is the infrastructure layer of the blockchain?

A. It’s basically the foundation that makes blockchain run. This layer includes the network of nodes, consensus mechanisms, and the hardware and protocols that handle transactions. Without it, nothing on the blockchain—smart contracts, tokens, or apps—would work. Think of it as the engine under the hood.

Q. How to set up blockchain infrastructure?

A. Start by picking a blockchain platform and setting up nodes, either on your own servers or via cloud providers. Next, configure your network, security protocols, and consensus method. Finally, test the setup with transactions before going live. It’s a mix of tech, hardware, and careful planning.

Q. How much does blockchain infrastructure cost?

A. On average, running blockchain infrastructure costs $5,000–$15,000 per month for a mid-sized setup. Costs depend on hardware, cloud servers, development, and maintenance. Bigger networks with faster speeds or enterprise-grade security can push that number much higher.

Q. How is modern blockchain infrastructure used in the real world?

A. It’s everywhere. Banks use it for secure payments, companies track products, and developers build decentralized apps. The infrastructure supports transparency, speed, and security, making it useful wherever trust and data integrity matter.

Talk With Our Expert

Our Latest Insights

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment