Table of Contents

Home / Blog / Cryptocurrency

Why Choosing Microservices Architecture for Cryptocurrency Exchange Software Development

October 8, 2025

October 8, 2025

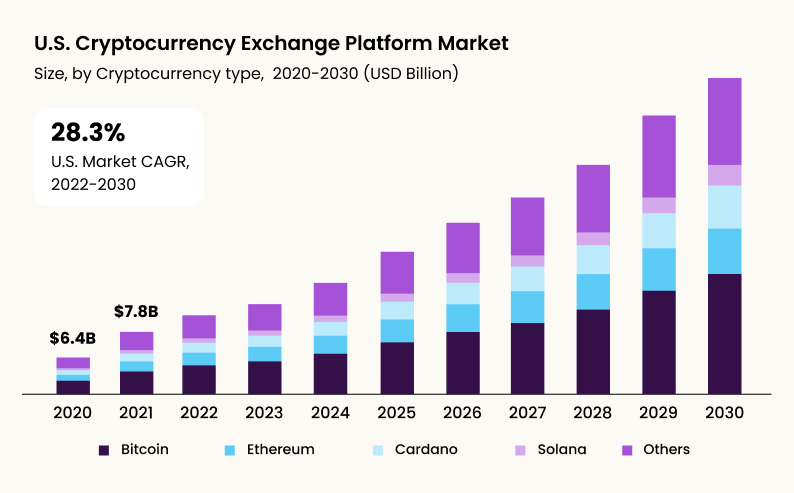

As the finance world grows, cryptocurrency exchange software development has become more crucial than ever. The global cryptocurrency exchange platform market was valued at USD $30.18 billion in 2021 and is projected to grow to USD $264.32 billion by 2030, at a CAGR of 27.8%, according to Grand View Research. Meanwhile, approximately 74% of organizations are already using microservices architecture, with many reporting improved deployment speed and operational efficiency, per Gartner survey.

Given these trends, adopting microservices for building crypto exchanges is strategically important. This architecture enables modular design, faster feature delivery, improved scalability, high privacy and security, compatibility with CI/CD, and robust monitoring.

In this article, you’ll learn why using microservices for cryptocurrency exchange software development delivers substantial benefits and what frameworks, features, challenges, and best practices to consider.

Build Your Exchange the Smarter Way

Launch a scalable, secure, and future-ready crypto exchange with a microservices architecture. Our team ensures smooth development tailored to your business needs.

What is Microservices Architecture?

Microservices architecture is a design approach in which a complex software application is broken down into smaller, independent services. Each service is designed to perform a single function and communicates with others through lightweight protocols such as APIs. This structure contrasts with monolithic systems, where all components are interconnected and dependent.

In the case of cryptocurrency exchange software, adopting microservices ensures that individual services—like trading, wallet management, or user authentication—operate independently yet cohesively. This significantly improves maintainability and resilience.

Read More – Cryptocurrency Exchange Development Revenue Models.

Benefits of Microservices Architecture for Building Cryptocurrency Exchange Software

Here are some microservices architecture benefits for building crypto exchange software:

1. Faster Deployments

With microservices, updates can be rolled out to specific services without affecting the entire system. This means your cryptocurrency exchange can adapt quickly to regulatory changes, new trading features, or security enhancements. Faster deployments keep your platform competitive and responsive, ensuring users always experience a fresh and functional environment.

2. Scalability

Scalability is one of the strongest arguments for using microservices in crypto exchanges. You can scale individual components like the trading engine or wallet module based on demand rather than scaling the entire system. This allows resources to be used more efficiently, reducing costs while still supporting high transaction volumes and user growth.

3. Higher Productivity

Since teams can work on independent services simultaneously, productivity rises. Developers no longer need to wait for one part of the system to be completed before beginning their work. This autonomy allows faster iteration cycles and reduces development bottlenecks, making it an optimal approach for time-sensitive projects such as cryptocurrency exchanges.

4. Technology Flexible

Microservices architecture design patterns let teams use the best technology for each specific function. For instance, one service may rely on Python for data analysis, while another uses Go for real-time transaction handling. This flexibility encourages innovation, allowing crypto exchanges to integrate new technologies without being constrained by a rigid architecture.

5. Security and Quality Monitoring

Security is crucial in cryptocurrency exchanges, and microservices strengthen it. By isolating services, vulnerabilities are contained, reducing the chance of a system-wide breach. Continuous quality checks can also be applied at the service level, enabling faster identification and correction of flaws. This layered approach enhances both trust and operational reliability.

6. Compatibility with CI/CD and Agile

Microservices architecture aligns naturally with CI/CD pipelines and agile methodologies. Development teams can continuously integrate new code, test it within isolated services, and deploy changes rapidly. This compatibility fosters an environment of iterative improvement, which is essential for platforms dealing with dynamic markets like cryptocurrency trading.

7. Higher Privacy

Because microservices distribute functions across multiple modules, sensitive information can be confined to specific services, reducing exposure. For cryptocurrency exchanges, this separation ensures higher privacy for financial transactions and user data. It also allows stronger encryption practices tailored to different services, offering users greater confidence in platform security.

Competent Features of Microservices Architecture

To maximize the advantages of microservices architecture, it integrates several essential features such as:

1. API Accuracy

Accurate APIs are the backbone of microservices. They ensure smooth communication between independent services without data loss or delays. In decentralized crypto exchange platforms, precise APIs allow the trading engine, wallet, and user services to interact seamlessly. This accuracy directly impacts reliability, transaction speed, and user satisfaction, preventing costly disruptions.

2. Traffic Management

Effective traffic management distributes user requests evenly across services, preventing overload on any single module. For cryptocurrency exchanges, this means consistent performance during peak trading hours when transaction volumes surge. By balancing loads intelligently, microservices reduce downtime risks and guarantee a stable, responsive platform capable of handling sudden market volatility.

3. Straightforward Codes

Microservices are designed with simpler, modular codebases. Each service has a focused purpose, making its code easier to develop, debug, and maintain. In cryptocurrency exchanges, straightforward coding ensures faster upgrades and reduced risk of errors. This modularity also empowers developers to test or enhance individual services without disturbing others.

4. Data Offloading

Data offloading reduces system pressure by transferring large or less critical data operations to secondary storage or services. In crypto exchanges, this ensures that trading and wallet operations remain swift while non-essential processes are handled elsewhere. It improves system efficiency and helps maintain consistent user experiences under high demand.

5. Monitoring

Monitoring is vital to ensure every microservice functions optimally. Advanced monitoring tools detect bottlenecks, latency, or failures in real time. In cryptocurrency exchanges, this capability allows operators to resolve issues before they impact users. Continuous monitoring supports stable operations, enhances security, and builds trust in the platform’s reliability.

The Main Framework of Microservices Architecture Solution

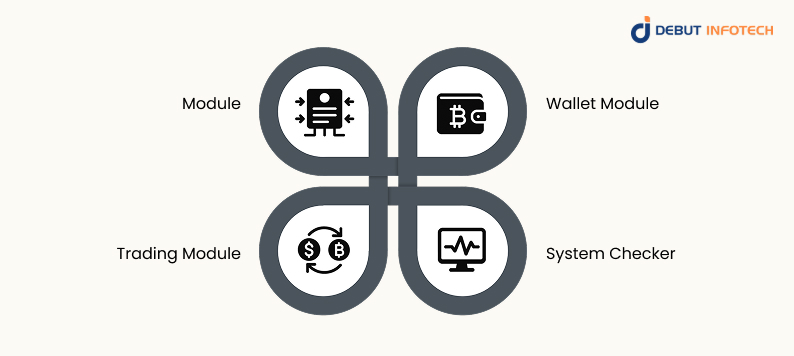

At its core, microservices architecture in cryptocurrency exchanges revolves around four central frameworks:

1. Module

The main module serves as the command center of the architecture. It coordinates communication between services, ensures requests are routed correctly, and oversees system integrity. In P2P crypto exchange development, this module guarantees harmony across the trading, wallet, and user services, enabling seamless workflows and uninterrupted transactions even during peak activity.

2. Wallet Module

The wallet module is responsible for securely managing deposits, withdrawals, balances, and transaction histories. It integrates with blockchain networks to ensure accurate processing and employs encryption to safeguard assets. In crypto exchanges, a dedicated wallet module ensures transparency, protects user funds, and allows instant updates to reflect trading activities.

3. Trading Module

The trading module powers order matching, execution, and management of buy and sell requests. It ensures trades are processed quickly, maintaining fair pricing and minimizing latency. This module is crucial for cryptocurrency exchanges to provide users with a smooth trading experience, supporting high volumes and real-time market responsiveness.

4. System Checker

The system checker constantly monitors the health of all microservices, ensuring uptime and stability. It identifies failures, triggers alerts, and initiates corrective actions automatically. For cryptocurrency exchanges, this module minimizes downtime, prevents transaction disruptions, and safeguards user trust by ensuring the entire system remains functional at all times.

Other Frameworks of Microservices Architecture

Beyond the main frameworks, a cryptocurrency exchange often relies on additional microservices for advanced functions. They are:

1. Trading Micro Service

The trading microservice handles order matching, price updates, and trade execution independently. By isolating these tasks, top decentralized exchanges can scale trading capacity efficiently, ensuring accurate, real-time processing even during market surges without affecting other services like wallets or user authentication.

2. User Micro Service

This service manages user registration, authentication, and profile details. It ensures account security, role-based permissions, and KYC/AML requirements compliance. Separating user functions enhances privacy, prevents overload, and allows exchanges to strengthen access controls without interrupting trading or wallet operations.

3. Wallet Micro Service

Dedicated to crypto transactions, the wallet microservice oversees deposits, withdrawals, and balance tracking. It interacts directly with blockchain networks, ensuring reliability. By isolating wallet services, exchanges strengthen fund security, minimize vulnerabilities, and support multiple cryptocurrencies simultaneously with seamless integration and high efficiency.

4. System Health Checker Micro Service

This microservice continuously evaluates the performance and stability of all components. It identifies service disruptions, latency issues, or crashes and provides alerts. For crypto exchanges, it guarantees reliability by ensuring every service functions optimally, minimizing downtime risks and transaction interruptions.

5. Service Per Trade Pair

Exchanges often dedicate individual services for specific trade pairs like BTC/ETH or USDT/XRP. This approach ensures faster trade execution and better scalability. Service per trade pair prevents bottlenecks, optimizes resource allocation, and maintains consistent performance as new assets are added.

6. Rabbit MQ

Rabbit MQ manages asynchronous communication between services using message queues. It ensures reliable data exchange without overwhelming services during high transaction loads. For crypto exchanges, Rabbit MQ improves resilience, balances workloads, and keeps the system responsive even under intense demand.

7. Service Components

Service components are smaller building blocks within each microservice that focus on specialized functions. In crypto exchanges, these components handle tasks such as order validation, fee calculation, or logging. Their modular nature makes upgrades and troubleshooting far more efficient.

8. Wallet Service Per Crypto

Instead of using a single wallet for all coins, each cryptocurrency gets its dedicated wallet service. This ensures better blockchain compatibility, quicker transaction processing, and enhanced security. It also simplifies upgrades when integrating new tokens into the exchange.

9. API Gateway

The API gateway acts as the central entry point for all client requests. It routes traffic efficiently, applies authentication, and manages rate limits. In cryptocurrency exchanges, it secures communication while streamlining access to trading, wallet, and user services.

10. Socket Service

Socket services enable real-time communication between clients and the exchange. They power live market feeds, instant trade confirmations, and updates on user balances. By maintaining continuous connections, socket services enhance user experience and support responsive trading environments.

Read also – The Impact of AI on Cryptocurrency Exchange Development.

How Big Companies Are Using Microservices Architecture

1. Netflix

Netflix leverages microservices to handle billions of daily viewing requests across the globe. Each feature, from video streaming to recommendations, runs independently, allowing fast updates and resilience. This model ensures uninterrupted service, even when demand spikes, a principle that cryptocurrency exchanges can adopt for reliability during heavy trading periods.

2. Amazon

Amazon’s e-commerce empire relies heavily on cloud based microservices. Services like product search, payments, and shipping operate as separate units but work seamlessly together. This separation enables rapid innovation, better fault tolerance, and enormous scalability. For cryptocurrency exchanges, applying a similar architecture helps support high-volume trading while keeping the user experience consistent.

3. Uber

Uber utilizes microservices to coordinate millions of rides in real time. In this microservices architecture example, each component, from ride-matching to payments, operates as its own service, ensuring speed and flexibility. This architecture enables global scalability and quick feature deployment. Exchanges can benefit from this model by improving efficiency and responsiveness during trading surges.

Challenges of Implementing Microservices

Despite its benefits, implementing microservices comes with challenges.

1. Complexity

Microservices introduce significant complexity compared to monolithic systems. Coordinating numerous independent services requires robust orchestration and monitoring tools. This complexity can result in integration difficulties and higher development costs for cryptocurrency exchanges if teams lack structured processes and advanced system management practices.

2. Lack of Unified Governance

Without transparent governance, development teams may adopt inconsistent coding standards, security protocols, or data policies across services. This inconsistency increases risk and makes long-term maintenance challenging. Exchanges implementing microservices must enforce strict governance models to ensure uniform practices, reduce fragmentation, and maintain overall system cohesion.

3. Expertise

Implementing microservices demands specialized knowledge in distributed systems, API management, and DevOps practices. Not all development teams possess this expertise. For cryptocurrency exchanges, insufficient skillsets can slow deployment, increase errors, and compromise security. Recruiting or training qualified professionals becomes essential for successful implementation.

4. Data Consistency

Maintaining consistent data across multiple independent services is a common challenge. In exchanges, where accuracy in balances and trades is non-negotiable, inconsistency can damage user trust. Implementing strategies like distributed databases, event sourcing, and synchronized data pipelines is crucial to avoiding mismatches and transactional errors.

5. Communication Overhead

Microservices rely heavily on inter-service communication, often through APIs or messaging queues. This dependency introduces latency and overhead if not optimized properly. For crypto exchanges, inefficient communication can slow trade execution and wallet operations, undermining performance. Careful planning of communication patterns is necessary to ensure efficiency.

Looking to Partner with Reliable Microservices Experts?

We specialize in building crypto exchanges with cutting-edge microservices architecture. Trust us to deliver speed, security, and scalability.

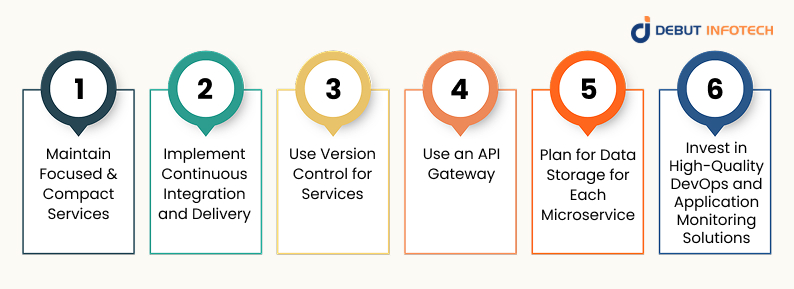

Best Practices for Implementing Microservices

To achieve the best results when using microservices architecture for centralized or decentralized crypto exchange development, developers need to follow established practices such as:

1. Maintain Focused and Compact Services

Each microservice should perform a single, well-defined task. Keeping services compact prevents unnecessary complexity and makes them easier to manage. In cryptocurrency exchanges, this practice ensures that critical components like wallet services or trading engines can evolve independently without affecting unrelated features, reducing development and maintenance risks.

2. Implement Continuous Integration and Delivery (CI/CD)

CI/CD pipelines automate testing, integration, and deployment. This enables rapid updates without service downtime. For crypto exchanges, CI/CD supports faster rollout of features like new tokens or security patches, maintaining system stability while allowing continuous improvement and minimizing disruptions for users during peak trading activity.

3. Use Version Control for Services

Version control allows tracking and managing different iterations of microservices. It ensures compatibility between older and newer versions during upgrades. For exchanges, version control prevents conflicts during updates, allowing gradual rollouts while maintaining stability across critical services such as trading, wallets, and user authentication modules.

4. Use an API Gateway

An API gateway centralizes client requests and routes them to the appropriate service. It also provides authentication, throttling, and monitoring features. For cryptocurrency exchanges, an API gateway ensures secure, efficient communication between services, improves scalability, and simplifies user access to multiple functionalities through a unified entry point.

5. Plan for Data Storage for Each Microservice

Each microservice should manage its own dedicated data storage to avoid dependencies and conflicts. In cryptocurrency exchanges, this prevents inconsistencies between trading records, user balances, and wallet transactions. Independent storage also improves scalability, as each service can handle its own growth without straining shared databases.

6. Invest in High-Quality DevOps and Application Monitoring Solutions

DevOps practices and strong monitoring tools are essential for managing distributed systems. They help track performance, detect issues early, and automate recovery processes. For exchanges, investing in reliable monitoring enhances security, reduces downtime risks, and ensures seamless operation, ultimately strengthening user trust in the platform.

Building Scalable Crypto Exchanges with Microservices Architecture: Debut Infotech’s Approach

For businesses exploring reliable partners, choosing a cryptocurrency exchange development company that combines blockchain expertise with microservices excellence is vital.

Debut Infotech is recognized as a dependable partner, offering advanced blockchain solutions built on a microservices architecture. Our approach ensures modular scalability, robust security, and faster deployment cycles. These are key requirements for high-performance exchanges.

Related Read: Cryptocurrency Exchange App Development – Startup Guide

With deep expertise in blockchain and modern frameworks, we help businesses design resilient platforms that can handle complex trading environments. By leveraging microservices, we empower clients with flexibility, continuous innovation, and long-term reliability, making them a go-to partner for blockchain development projects.

Conclusion

Cryptocurrency exchange software development leveraging microservices architecture offers clear advantages: rapid deployments, high scalability, flexible technology stacks, enhanced security and privacy, and strong alignment with Agile/CI-CD workflows.

Whilst challenges like complexity, governance, and data consistency exist, best practices, including compact service design, API gateways, versioning, and robust monitoring, mitigate risks. As market demand expands, adopting microservices will become a decisive factor for exchanges aiming to stay competitive, secure, and future-ready.

FAQs

A. Switching to microservices isn’t all smooth sailing. Businesses often face hurdles like higher infrastructure costs, complex service communication, and the need for skilled developers. Managing multiple independent services also requires solid monitoring tools. Without proper planning, these challenges can slow down deployment and affect overall performance.

A. Unlike a monolithic setup where everything’s bundled together, microservices split everything into smaller, manageable services. This makes scaling way easier, boosts performance, and prevents the entire platform from crashing if one service fails. For crypto exchanges that deal with heavy trading traffic, that flexibility is a major win.

A. Yes, and that’s one of the biggest perks. If one microservice goes down, the rest of the system keeps running. With monolithic systems, a single failure can freeze the entire platform. This design makes downtime less likely, which is critical in nonstop crypto trading.

A. It might cost more upfront because microservices require advanced setups and skilled teams, but long-term savings are significant. You avoid massive downtime losses, scale efficiently, and upgrade without rebuilding the entire system. For crypto exchanges, this cost-effectiveness adds up quickly as trading volumes grow.

A. Leading blockchain firms use microservices to build modular, flexible exchange platforms. They focus on separating functions like trading, payments, and security into independent services. This way, updates roll out faster, scaling is smoother, and security patches don’t disrupt the whole system—keeping the exchange agile and future-ready.

Leave a Comment