Table of Contents

Home / Blog / Cryptocurrency

Spot Trading in Crypto: A Comprehensive Guide

January 14, 2026

January 14, 2026

Spot Trading in cryptocurrency involves buying and selling digital assets for immediate settlement at live market prices, offering direct ownership and transparent pricing.

InDecember 2024, global crypto Spot Trading volume surpassed $2.1 trillion, up 142% year-over-year, reflecting strong market engagement amid rising asset adoption.

Across the top centralized exchanges, quarterly Spot Trading volumes exceeded $6 trillion, marking a substantial quarterly surge and deepening liquidity in crypto markets.

Whether you’re a new entrant or seasoned trader, understanding Spot Trading fundamentals is essential for navigating today’s dynamic crypto ecosystem.

This guide explains how Spot Trading works, where it takes place, its advantages and limitations, and actionable steps to trade effectively.

Launch Your Spot Trading Exchange

Build a fast, secure spot trading platform that users trust from day one. We design exchanges with clean interfaces, deep liquidity, and smooth trade execution that keep traders active.

What Is Spot Trading in Crypto?

Spot trading refers to the buying or selling of cryptocurrencies for immediate settlement at the prevailing market price. Once a trade is executed, the asset is delivered directly to the buyer’s wallet, and payment is settled without delay. This model contrasts with derivative trading, where contracts track price movements without transferring ownership.

Spot trading emphasizes real asset exchange, clear pricing, and direct custody, making it widely used across global crypto markets.

How Does Spot Trading Work?

Spot trading follows a clear flow where orders are matched, prices adjust through supply and demand, and assets change hands instantly. Market participants, execution venues, and pricing mechanisms all shape how trades are completed.

1. The Transaction Process

In spot trading, a trader places a buy or sell order on an exchange. The order is matched with a counterparty offering the opposite side at an agreed price. Once matched, the transaction settles immediately. The buyer receives the cryptocurrency, while the seller receives payment, typically in fiat currency or another digital asset.

2. Participants

Spot markets attract a broad range of participants. Retail traders use spot trading crypto to build portfolios or make short-term trades. Institutional investors rely on it for liquidity and price stability. Market makers support trading activity by continuously providing buy and sell orders, helping markets function smoothly and efficiently.

3. Price Discovery

Price discovery in spot-trading occurs through open market interaction between buyers and sellers. Prices adjust in real time based on supply, demand, and trading volume. This process ensures that asset values reflect current market sentiment, news, and liquidity conditions without artificial pricing mechanisms.

4. Leverage and Margin

Spot trading generally does not rely on leverage or borrowed funds. Traders use their available capital to purchase assets outright. This structure reduces exposure to forced liquidations and margin calls. It also encourages disciplined capital management, which supports long-term market participation.

5. Execution Venues

Spot trades are executed on platforms designed to match orders efficiently. These venues prioritize speed, transparency, and settlement accuracy. Execution quality depends on liquidity, order book depth, and platform reliability, all of which influence trading outcomes.

Where Spot Trading Occurs

Crypto spot trading takes place across multiple environments, each with distinct structures for custody, liquidity, and execution.

1. Centralized Exchanges

Centralized exchanges operate as custodial platforms that manage order matching, asset storage, and settlement on behalf of users. They provide deep liquidity, advanced trading interfaces, and customer support. Most centralized exchanges require identity verification and compliance checks, which enhances regulatory oversight and user protection but places trust responsibility on the platform during active trading periods worldwide.

Related Read: What is a Centralized Crypto Exchange? A Complete Guide

2. Decentralized Exchanges (DEXs)

Decentralized crypto exchange platforms enable spot algorithmic trading via blockchain-based smart contracts, without intermediaries. Users trade directly from their wallets while retaining full control of their assets. DEXs emphasize transparency and censorship resistance, with prices determined algorithmically or through liquidity pools. This structure supports innovation but may involve lower liquidity and higher transaction costs.

3. Over-the-Counter (OTC)

Over-the-counter spot trading enables direct transactions between parties outside public exchanges. It is commonly used for large-volume trades to reduce market impact and price slippage. OTC desks provide customized settlement, negotiated pricing, and discretion. This channel suits institutional participants and high-net-worth traders seeking efficient execution without affecting open-market prices.

Pros of Spot Trading

Spot trading offers straightforward access to crypto markets with transparent pricing and direct asset control. Its structure appeals to traders seeking clarity, predictable costs, and exposure without relying on leverage or complex contracts. Here are its pros:

1. Easy Accessibility

Spot trading is widely accessible through numerous platforms that support intuitive interfaces and multiple payment options. Traders can enter markets quickly with relatively low capital requirements. This accessibility encourages broader participation, allowing beginners and experienced investors to engage without complex onboarding processes or advanced technical knowledge, while maintaining straightforward trading mechanics across platforms.

2. Lower Trading Costs

Spot trading generally involves lower fees compared to leveraged or derivative products. Traders avoid interest charges, funding rates, and liquidation penalties associated with margin trading. Fee structures are transparent and predictable on top decentralized exchanges, which supports cost control. Over time, reduced transaction expenses can significantly improve overall trading efficiency and net returns.

3. Simplicity

Spot trading follows a straightforward buy-and-sell model where assets are exchanged at current market prices. There are no contract expirations, rollover conditions, or complex pricing formulas. This simplicity reduces operational errors and decision fatigue, making it easier for traders to focus on market analysis, timing, and disciplined execution strategies.

4. Lower Risk

Because spot algo trading does not rely on borrowed funds, risk exposure is limited to the amount invested. Traders are not subject to margin calls or forced liquidations triggered by sudden price swings. This structure supports measured risk management, capital preservation, and steady participation, particularly for those prioritizing long-term market engagement over short-term speculation.

5. Transparency

Spot markets operate with visible order books and real-time pricing, allowing traders to see available bids, asks, and trade volumes. This transparency supports fair price discovery and informed decision-making. Participants can assess liquidity conditions directly, which builds trust and reduces uncertainty around execution quality and prevailing market sentiment.

6. No Expiry Date

Spot trading positions have no predefined expiration, giving traders full control over holding periods. Assets can be retained, transferred, or sold at any time based on personal objectives or market conditions. This flexibility supports long-term investment strategies, portfolio rebalancing, and adaptive decision-making without pressure from contract settlement deadlines.

Cons of Spot Trading

Despite its simplicity, spot trading carries limitations tied to price volatility, capital requirements, and asset security. These factors influence profitability, risk exposure, and the level of responsibility traders must actively manage.

1. Limited Profit Potential

Spot trading relies entirely on actual price movement since leverage is typically not used. This limits the scale of potential returns, particularly during low-volatility periods. Traders seeking rapid gains may find spot markets less attractive compared to derivatives. Profits often require more extended holding periods, careful timing, and greater capital allocation to achieve meaningful growth.

2. Market Volatility

Cryptocurrency spot markets are known for sharp and sometimes unpredictable price swings. Sudden shifts in sentiment, regulatory news, or macroeconomic factors can move prices quickly. Without protective strategies, traders may face drawdowns during volatile periods. Managing exposure through diversification and planned exits is vital for maintaining stability amid changing market conditions.

3. Security Risks

Spot trading involves direct ownership of digital assets, which places security responsibility on traders, platforms, and crypto exchange development companies. Centralized exchanges can face operational failures or cyberattacks, while self-custody requires careful key management. Errors such as poor password practices or wallet mismanagement can result in permanent asset loss, underscoring the need for strong security discipline for spot algorithmic trading software.

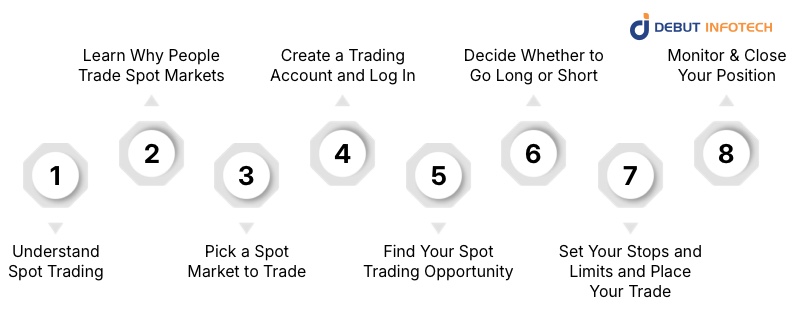

Steps to Trading Spot Markets

Spot trading follows a structured path that begins with market understanding and platform selection, then moves through opportunity analysis, execution, and position management, all guided by clear objectives and risk controls.

1. Understand Spot Trading

Before trading, it is crucial to understand how spot markets function, including order types, settlement timing, and custody models. Traders should be familiar with how prices are quoted and how trades are executed. This foundational knowledge reduces errors and supports informed decision-making when entering and exiting positions in active market conditions.

2. Learn Why People Trade Spot Markets

Traders participate in spot markets for various reasons, including long-term investing, portfolio diversification, and asset conversion. Some focus on price appreciation, while others use spot trading to hold cryptocurrencies for future use. Understanding these motivations helps traders define clear objectives and align strategies with realistic expectations and personal risk tolerance.

3. Pick a Spot Market to Trade

Choosing the right spot market involves evaluating trading pairs, liquidity levels, and historical price behavior. High-liquidity pairs often provide tighter spreads and smoother execution. Traders should also consider market volatility and personal familiarity with the asset. Selecting suitable markets supports consistent execution and reduces exposure to unnecessary price inefficiencies.

4. Create a Trading Account and Log In

Setting up a trading account requires selecting a reputable platform, completing registration, and enabling security features. A few white label crypto exchange platforms come with in-built verification features.

Some exchanges require identity verification before trading. Once logged in, traders should review account settings, deposit funds securely, and confirm withdrawal options. Proper account setup establishes a secure and reliable foundation for spot trading.

5. Find Your Spot Trading Opportunity

Identifying a trading opportunity involves analyzing price trends, trading volume, and market structure. Traders may use technical indicators or monitor news events that influence demand. Timing entries carefully helps improve execution quality. Consistent analysis supports disciplined decision-making and reduces emotional responses to short-term market fluctuations.

6. Decide Whether to Go Long or Short

In spot trading, going long involves purchasing an asset with the expectation of price appreciation. Short-selling options are limited and platform-specific. Traders must assess market direction, risk tolerance, and time horizon before committing funds. Clear directional decisions help manage exposure and align positions with broader market expectations.

7. Set Your Stops and Limits and Place Your Trade

Risk management is addressed by setting limit orders and stop-loss levels before executing a trade. These tools help control entry prices and restrict downside exposure. Defining exit points in advance promotes disciplined execution. Proper order placement ensures trades align with strategy rather than reacting impulsively to market movements.

8. Monitor and Close Your Position

After entering a trade on a spot algo trading software, ongoing monitoring helps track performance and changing market conditions. Traders should reassess positions as prices move or new information emerges. Closing a position at predefined targets or when conditions shift supports consistent results. Timely exits help protect gains and limit losses in volatile spot markets.

Partner With Experts in Spot Trading Development

Building a crypto exchange is complex. Working with our experienced development team gives you clarity, stability, and a spot trading platform built for long-term success.

Spot Trading Strategies

Successful spot trading relies on structured approaches that account for market conditions, liquidity, and time horizons. Different strategies support long-term positioning, short-term execution, and disciplined portfolio management across cycles.

1. Buy-and-Hold Investing

Buy-and-hold investing involves purchasing cryptocurrencies with the intention of holding them for an extended period. Traders rely on long-term market growth rather than short-term price movements. This strategy reduces trading frequency and costs while supporting portfolio stability. It suits participants who prefer gradual value appreciation and can tolerate interim price fluctuations.

2. Range Trading

Range trading involves identifying price levels where an asset repeatedly trades between support and resistance. Traders buy near support zones and sell near resistance levels, capitalizing on predictable price movement. This strategy works best in sideways markets with stable volatility. Accurate level identification and disciplined execution are essential for consistent performance.

3. Trend-Following Strategy

Trend-following focuses on trading in the direction of sustained price movement. Traders enter positions after confirming an upward or downward trend using price action or indicators. Positions are held as long as the trend remains intact. This approach aims to capture extended market moves and benefit from strong momentum and consistent market direction.

4. Breakout Trading

Breakout trading targets moments when the price moves beyond established support or resistance levels. Increased volume often confirms these moves, signaling potential continuation. Traders enter positions early in the breakout to capture momentum-driven gains. Proper risk controls are necessary, as false breakouts can occur during periods of low liquidity or during periods of uncertain market sentiment.

5. Dollar-Cost Averaging

Dollar-cost averaging involves investing fixed amounts at regular intervals regardless of price. This approach reduces the impact of short-term volatility and removes the need for precise market timing. Over time, it creates a balanced entry price. The strategy suits traders seeking steady exposure while managing emotional responses to market fluctuations.

6. Portfolio Rebalancing

Portfolio rebalancing adjusts asset allocations periodically to maintain predefined targets. Traders sell assets that have grown disproportionately, thereby increasing exposure to underweighted positions. This strategy manages risk and preserves portfolio structure over time. Regular rebalancing supports disciplined decision-making and helps align holdings with long-term investment objectives.

7. Liquidity-Based Trading

Liquidity-based trading focuses on assets with high trading volume and tight spreads. High liquidity supports efficient order execution and reduces slippage. Traders prioritize popular trading pairs where price action reflects broad market participation. This approach improves reliability, especially for larger orders, and supports consistent execution in active spot markets.

Read more – Understanding the Role of Tokens in the Crypto Exchange Ecosystem

Building the Infrastructure Behind Reliable Spot Trading

Debut Infotech supports the technical backbone that makes secure and efficient spot trading possible. The company designs and develops crypto exchanges, trading engines, wallets, and blockchain systems built for performance, transparency, and compliance.

With deep experience in market architecture, asset custody models, and crypto exchange development services, we help businesses launch and scale spot trading platforms that prioritize execution accuracy, security controls, and long-term operational stability in competitive crypto markets.

Conclusion

Spot Trading remains a fundamental entry point into cryptocurrency markets, offering direct asset ownership, transparent pricing, and straightforward execution. By understanding how Spot Trading works, where it takes place, and the strategies that support disciplined participation, traders can approach the market with greater confidence.

While price volatility and security responsibilities exist, structured planning and risk awareness help manage exposure. A clear grasp of Spot Trading principles supports informed decisions and sustainable engagement in crypto markets.

FAQs

A. People earn from spot trading by buying assets at lower prices and selling them after prices rise. Profits also come from holding strong coins long term, using limit orders, and managing risk. Fees, timing, and patience matter more than constant trading. Small gains add up over time.

A. Spot trading works well for beginners because it is transparent and straightforward. You buy an asset, you own it, and you can sell anytime. There is no leverage pressure, no liquidation risk, and losses are limited to what you invest. That makes learning calmer and more controlled.

A. Spot trading carries risk because prices move up and down without warning. You can lose money if you buy at the wrong time or panic sell. Still, risks are easier to manage since you are not borrowing funds. Proper research and discipline reduce mistakes significantly.

A. Neither is universally better. Spot trading suits people who want ownership and lower stress. Futures trading fits experienced traders who understand leverage and short selling. Futures can amplify gains, but they can also amplify losses quickly, wiping out accounts. Beginners usually start safer with spot markets.

A. Many scholars view spot trading as halal when it involves real ownership, immediate exchange, and no interest. It becomes problematic if it includes gambling behavior, excessive speculation, or prohibited assets. Final judgment depends on personal interpretation and guidance from a trusted scholar within Islamic finance principles.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment