Table of Contents

Home / Blog / Cryptocurrency

What it Takes to Launch Your White Label Crypto Exchange Software

October 16, 2025

October 16, 2025

Launching your white label crypto exchange software isn’t just about acquiring the technology. It’s more about building a business that can scale and compete.

Success depends on more than functionality; it requires structured planning, compliance with complex regulatory frameworks, and the right partnerships for payments and banking.

According to Grand View Research, the global cryptocurrency market, valued at USD 5.70 billion in 2024, is projected to hit USD 11.71 billion by 2030. At the same time, in 2024, over 560 million people use cryptocurrencies worldwide, per a data from Triple A. These stats show massive growth potential and user adoption of cryptocurrencies.

To launch successfully, you need a specialized team, robust architecture, advanced security, liquidity strategies, and customer retention frameworks that allow you to compete effectively in a crowded marketplace.

In this guide, we’ll discuss what is required to launch a white label crypto exchange software. But, before that, let’s cover the reasons for choosing white-label crypto exchange software.

Ready To Kickstart Your Exchange?

Get a ready-to-deploy white label crypto exchange tailored to your brand. Our team sets everything up so you can hit the market fast without the usual headaches.

Top Reasons to Choose White Label Crypto Exchange Software

1. Faster Market Entry

White label crypto exchange software accelerates time-to-market by removing the complexity of building a platform from the ground up. Entrepreneurs gain access to a pre-built, fully functional solution that is scalable, secure, and ready for immediate customization and deployment.

2. Cost Efficiency

Instead of investing heavily in long decentralized crypto exchange development cycles and infrastructure, businesses save significant expenses by adopting white label solutions. These savings can then be redirected toward liquidity management, regulatory compliance, and user acquisition strategies, making the business model more sustainable.

3. Built-in Security Measures

Reputable white label providers integrate advanced security features such as cold storage wallets, DDoS protection, encryption protocols, and two-factor authentication. These safeguards protect user assets and data, strengthening customer trust—an essential factor in attracting and retaining a loyal trading community.

4. Flexibility and Customization

White label solutions are designed for adaptability, allowing businesses to align the platform with their brand identity. Features, interface, and trading tools can be tailored to meet target audience preferences, helping new exchanges stand out in a competitive crypto trading environment.

What Is Involved in Launching Your White Label Crypto Exchange Software?

1. Market Research & Planning

Launching begins with thorough research. Careful planning ensures your exchange enters the market strategically, with clear goals and a realistic understanding of opportunities and risks.

a) Analyze the cryptocurrency market

Understanding overall crypto market performance, trading volumes, adoption rates, and volatility trends is critical. A detailed analysis helps identify opportunities and risks, ensuring your exchange enters the market with a strong strategy rather than guesswork.

b) Identify and segment your target audience

Different groups—retail traders, institutional investors, or high-frequency traders—have unique needs. Defining your audience allows you to tailor features, liquidity, and compliance frameworks, ensuring the platform aligns with their expectations and drives meaningful adoption from launch.

c) Conduct a competitor analysis

Studying competitors provides clarity on what works and where gaps exist. Assessing their features, security models, and user experience helps shape a unique value proposition, enabling your platform to stand out instead of replicating established exchanges.

d) Assess the regulatory environment

Each jurisdiction enforces its own compliance rules, including KYC, AML, and taxation. Mapping these regulations early prevents legal risks, supports seamless licensing, and positions your exchange for long-term growth within compliant, high-potential regions.

e) Evaluate potential white-label providers

When selecting a white label provider or cryptocurrency exchange development company, review their reputation, compare features, and assess scalability. Inquire about liquidity, customization capabilities, and ongoing support. Requesting a demo ensures functionality and user experience meet expectations before committing to a solution.

2. A Specialized Team of Experts

Success depends on assembling a capable team. Having dedicated professionals for compliance, operations, and growth ensures your platform functions smoothly from day one.

a) Legal Officer

A legal officer ensures your exchange complies with licensing laws, contracts, and jurisdictional requirements. They guide policy-making, mitigate risks, and handle disputes, making them essential for navigating the complex regulatory landscape of cryptocurrency markets.

b) Chief Compliance Officer

The compliance officer designs and enforces KYC and AML procedures, aligning operations with regulatory standards. Their role is vital in preventing fraud, meeting international obligations, and safeguarding the exchange’s reputation in competitive financial markets.

c) Head of Customer Acquisition

This specialist develops strategies to attract traders, build partnerships, and boost visibility through marketing. They ensure the platform grows its user base steadily, balancing aggressive outreach with sustainable, long-term customer acquisition methods.

d) Head of Customer Support

Customer support leadership guarantees efficient handling of user issues, from technical queries to transaction disputes. A responsive support framework strengthens trust, improves satisfaction, and builds loyalty—crucial elements in retaining long-term exchange users.

e) Multiple Administrators

Having skilled administrators allows smooth daily operations, including monitoring liquidity, managing system performance, and ensuring compliance updates. Their oversight creates operational stability, reducing the risks of downtime or errors in high-volume trading environments.

Related Read: OTC Crypto Exchange Development Cost: Complete Breakdown for 2025

3. Adhering to Regulatory Framework

Compliance is central to operating a legal and sustainable exchange. Understanding jurisdictional rules and aligning with regulations helps maintain trust and long-term credibility.

a) Jurisdiction Compliance

Selecting the right jurisdiction is critical. Different regions enforce unique cryptocurrency regulations, licensing requirements, and tax obligations. Ensuring your exchange complies with the laws of your chosen jurisdiction minimizes legal risks and enhances credibility with regulators and users.

b) KYC Requirements Alignment

Your platform must implement robust KYC processes that align with regional and international requirements. Verifying user identities prevents fraud, supports anti-money laundering measures, and fosters trust, making compliance a central part of exchange security and transparency.

c) Orientation and Due Diligence With KYC Provider

Partnering with a reliable KYC provider involves careful due diligence. Reviewing their verification methods, data security practices, and compliance track record ensures seamless integration, safeguarding both user information and the exchange’s standing with regulators.

d) Verification Levels & Limits Setup

Defining multiple verification levels creates flexibility for users while maintaining compliance. Establishing transaction and withdrawal limits for different account tiers balances user convenience with security, ensuring proper monitoring of trading activity across various customer segments.

e) Budget Allocation for Team Setup

Compliance comes at a cost. Allocating sufficient budget for hiring legal experts, compliance officers, and ongoing training ensures adherence to evolving laws. This financial preparation protects your exchange from penalties while securing operational continuity.

4. Building Relationships with Banks and Payment Processors

Strong financial partnerships are essential for smooth operations. Collaborations with banks and payment providers support reliable deposits, withdrawals, and liquidity management for your users.

a) Custodian/Treasury Setup

Establishing a reliable custodian or treasury system guarantees safe management of customer funds. It ensures segregation of client assets, improves transparency, and reinforces user confidence in the financial responsibility of your exchange operations.

b) Set Up of Bank Accounts for Customer Deposit

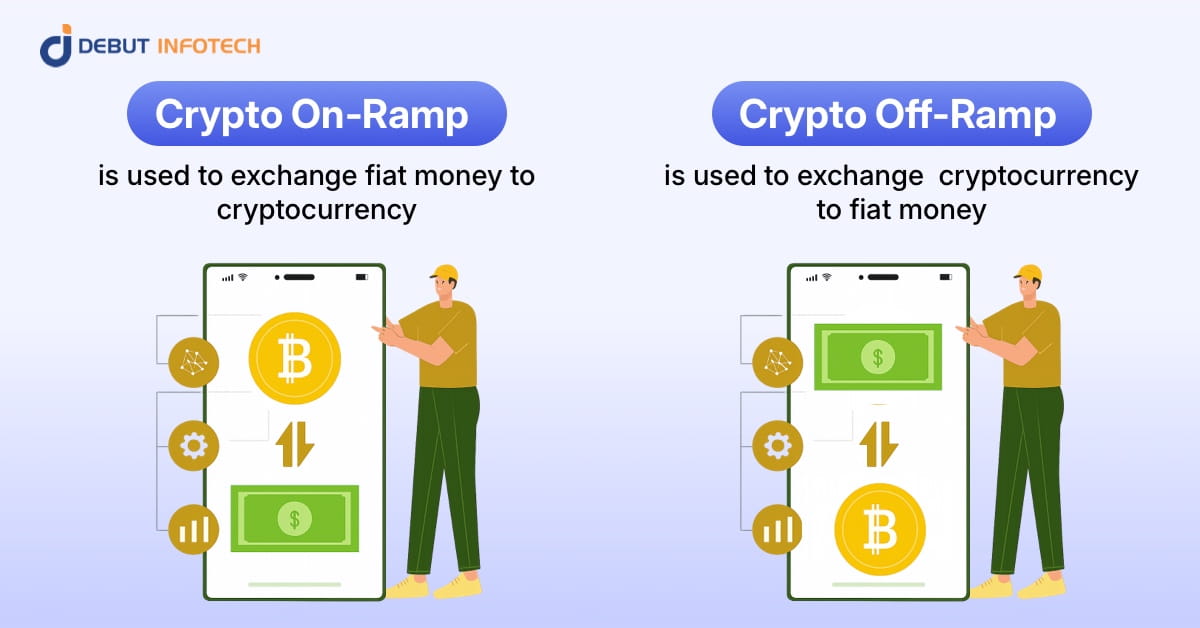

Dedicated bank accounts are necessary for customer deposits. Establishing these accounts through reputable financial institutions provides a transparent channel for fiat-to-crypto conversions, improving transaction efficiency and customer trust in your exchange.

c) Planning of Deposit & Withdrawal Procedures

Well-structured deposit and withdrawal procedures prevent transaction delays and reduce user frustration. A clear system ensures smooth fund flows, supports liquidity management, and strengthens the overall customer experience within your trading platform.

d) Building Relationships with Payment Providers

Reliable payment provider partnerships expand transaction options for users, from bank transfers to digital wallets. Strengthening these relationships increases platform accessibility, reduces downtime, and ensures your exchange can meet customer demands across multiple payment methods.

e) Maintaining Effective Client Communication

Transparent communication with clients regarding deposit times, withdrawal limits, or payment updates builds trust. Proactive updates and clear instructions reduce misunderstandings, helping customers feel secure and supported while using your platform.

Partner with Experts Who Deliver

Don’t risk delays or half-baked setups. Work with a provider that has launched successful crypto exchanges worldwide and knows exactly what it takes.

5. Architect Your Crypto Exchange Using White Label Software

Designing the structure of your white label crypto exchange requires careful planning. With white label software, businesses can build scalable, customizable, and secure platforms tailored to specific needs.

a) Determine Product Features & Trading Guidelines

Carefully define the features that will shape your exchange, such as supported cryptocurrencies, trading pairs, order types, and liquidity models. Establishing clear trading guidelines ensures smooth operations, reduces disputes, and sets professional standards for traders.

b) Cold Storage Wallet Integration

Integrating cold storage wallets protects digital assets from hacking attempts by keeping them offline. This security measure enhances trust, minimizes exposure to breaches, and demonstrates your commitment to safeguarding customer funds from evolving cyber threats.

c) Fee Structure Setup

Designing a fair and transparent fee structure is crucial for user satisfaction. Fees should balance profitability and competitiveness, covering trading, withdrawals, and other services while maintaining affordability to encourage higher trading volumes.

d) Website Optimization for Mobile

Mobile optimization ensures users can trade seamlessly on smartphones or tablets. Responsive design, intuitive navigation, and fast loading speeds enhance accessibility, making your platform more attractive to modern traders who prefer trading on the go.

e) Customization with White-Label Provider

Collaboration with your contracted white label crypto exchange development company helps tailor the exchange to your brand’s vision. Customizable features, design flexibility, and provider assistance ensure the platform feels unique, user-friendly, and capable of competing in a crowded crypto exchange market.

f) Creation and Integration of Specific Feature List for Front End

Work with your provider to build white label crypto exchange with a user-focused front end. Integrating features like trading dashboards, analytics tools, and personalized alerts enhances usability, creating a polished interface that attracts and retains users.

g) Ensure Robust Security Implementation

Strong security should underpin every aspect of your exchange. Employ multi-signature wallets, advanced encryption, and DDoS protection to shield both the platform and customer data, preserving trust and operational stability.

6. Test Running Your White Label Crypto Exchange Platform

Testing ensures your platform performs reliably under real conditions. Comprehensive checks reduce errors, confirm security, and prepare the exchange for a successful public launch.

a) Functional & Performance Testing

Rigorous functional testing verifies that trading, deposits, withdrawals, and order matching work without errors. Performance testing ensures the platform can handle peak trading volumes smoothly, avoiding downtime and ensuring reliable user experiences.

b) Security & Compliance Testing

Testing security protocols ensures vulnerabilities are eliminated before launch. Compliance testing validates adherence to KYC, AML, and jurisdictional laws, reducing risks of legal penalties and maintaining operational legitimacy.

c) User Experience (UX) & User Interface (UI) Testing

Testing the UX and UI ensures the exchange is easy to navigate, visually appealing, and responsive. Smooth user journeys reduce abandonment rates and encourage traders to remain active on the platform.

d) Disaster Recovery & Backup Testing

Backup and recovery simulations prepare the platform for unexpected outages or data loss. A tested disaster recovery plan guarantees operational continuity, safeguarding customer assets and confidence in your exchange during unforeseen events.

e) Customer Support Process Testing

Testing customer support processes ensures your team can handle technical issues, complaints, and disputes effectively. Reliable support reduces frustration, improves loyalty, and positions your exchange as trustworthy in the eyes of traders.

Also Read – Cryptocurrency Exchange Software Development.

7. Generating Liquidity as a Top Concern

Liquidity is the backbone of any exchange. Without strong liquidity, trades fail, user trust decreases, and growth becomes difficult to sustain.

a) Deciding Which Exchange to Set Up an Account

Liquidity partnerships start with selecting reliable exchanges where accounts will be established. Choosing well-regulated, high-volume exchanges ensures steady order flow, minimizes slippage, and strengthens the credibility of your trading platform in competitive markets.

b) KYC with Partner Exchange

Partner exchanges typically require strict KYC verification for access to liquidity pools. Completing this process thoroughly helps maintain compliance, ensures smooth fund transfers, and provides legitimacy to your liquidity arrangements, enhancing both security and operational stability.

c) Funding Maintenance with Partner Exchange

Maintaining sufficient balances with liquidity partners is essential for uninterrupted trading activity. Regular funding checks and adjustments prevent order mismatches or execution delays, ensuring your platform consistently delivers seamless trading experiences for users.

d) Setup Strategies and Maintenance of Credential with Your Partners

Securely managing exchange credentials safeguards access to liquidity accounts. Establishing clear strategies for credential storage, updates, and monitoring ensures smooth operations, while preventing unauthorized access that could compromise your exchange’s trading ecosystem.

8. Strategize for Customer Retention and Growth

Retention strategies turn first-time users into loyal traders. Building brand trust, increasing visibility, and delivering value ensure sustainable, long-term exchange growth.

a) Design a Brand-Aligned Website

A well-designed website reflects your brand identity, building credibility and trust. Consistent branding, user-friendly layouts, and intuitive navigation encourage users to engage confidently, making the exchange feel professional and reliable.

b) Run PPC Campaigns to Enhance Online Visibility

Targeted pay-per-click campaigns drive immediate visibility, bringing qualified leads directly to your platform. Effective PPC strategies increase brand exposure, attract potential traders, and provide measurable results contributing to customer acquisition goals.

c) Media & Press Outreach to Crypto Channels and Others

Consistent media and PR outreach builds authority in the crypto community. Securing mentions in crypto publications and wider financial outlets boosts awareness, validates credibility, and positions your exchange as a serious industry contender.

d) Develop a Lead Acquisition Framework

A structured lead acquisition system helps capture, manage, and convert prospects. By leveraging CRM tools, data analytics, and targeted campaigns, your decentralized crypto exchange ensures continuous user growth and long-term revenue opportunities.

e) Manage Blog Content for SEO Activities

Publishing regular, optimized blog content improves search visibility and builds trust. High-quality articles addressing market trends and trading insights enhance domain authority, attracting organic traffic and strengthening user engagement.

f) Participate in Conferences to Boost Online Visibility

Industry conferences provide opportunities to network, build partnerships, and showcase your platform. Active participation enhances brand reputation, connects your team with potential users, and positions your exchange at the forefront of industry innovation.

Launch Your White Label Crypto Exchange with a Trusted Provider

Selecting the right white label crypto exchange software development partner is just as crucial as the features of your exchange, since it determines long-term reliability, scalability, and compliance readiness.

Debut Infotech is among the top 10 white label crypto exchange software providers and crypto exchange development companies. They deliver customizable, secure, and scalable solutions tailored to business needs.

With expertise in blockchain development and advanced trading features, we empower startups and enterprises to launch exchanges quickly while ensuring regulatory alignment, user trust, and long-term growth potential. Our white label crypto exchange solution includes multi-coin support, robust architecture, and integrated liquidity features. This makes us a strong choice for businesses aiming to compete effectively in the crypto market.

Conclusion

Launching your white label crypto exchange software is an opportunity to tap into one of the fastest-growing industries, but it requires diligence at every step.

From conducting detailed research and securing regulatory approvals to integrating strong banking relationships, building resilient infrastructure, and generating liquidity, every part matters. Pairing these essentials with customer-centric growth strategies ensures long-term sustainability.

By focusing on security, compliance, and user trust, your exchange can stand out, attract traders, and establish itself as a credible platform in a competitive global crypto market.

FAQs

A. The best white label crypto exchange software is one that’s secure, scalable, and customizable. It should support multiple cryptocurrencies, have strong compliance tools, and offer liquidity options. Platforms like Binance Cloud, AlphaPoint, and Debut Infotech’s white label solutions are often considered reliable choices.

A. To start, pick a trusted white label provider, decide on your exchange model, and get the necessary licenses. Customize the platform with your branding, set up payment gateways, integrate liquidity, and run security audits. Once done, launch with a marketing plan to attract traders.

A. The white label crypto exchange cost depends on features, security, and provider. A basic exchange may start around $30,000–$50,000, while advanced setups with liquidity, compliance, and extra tools can run over $100,000. Ongoing costs include licensing, server hosting, maintenance, and marketing to keep the exchange running smoothly.

A. Depending on customization and regulatory approvals, a white label exchange usually takes 2–6 weeks to launch. If you stick with the provider’s default features, it’s faster. More add-ons, security layers, and third-party integrations can stretch the timeline closer to a few months.

A. Scaling a crypto exchange requires adding liquidity providers, expanding to new markets, and upgrading infrastructure for higher traffic. Offering mobile apps, margin trading, or staking can boost growth. Strong marketing campaigns, partnerships, and regulatory compliance also help attract more users and build long-term trust.

Leave a Comment