Table of Contents

Home / Blog / Cryptocurrency

A Guide to Integrating Liquidity APIs in Crypto Exchanges

June 28, 2024

June 28, 2024

In the realm of cryptocurrency trading, the use of cutting-edge technologies is crucial for guaranteeing smooth transactions, market stability, and improved user experiences. Application programming interfaces, or APIs, for liquidity have become revolutionary in the modern era due to their profound influence on the operation of cryptocurrency exchange development software.

In order to improve trading efficiency, deepen market liquidity, and create a strong cryptocurrency ecosystem, it is important to grasp the relevance of incorporating liquidity APIs into cryptocurrency exchange development software. This article will explore these areas.

What Is The Crypto Liquidity Provider API?

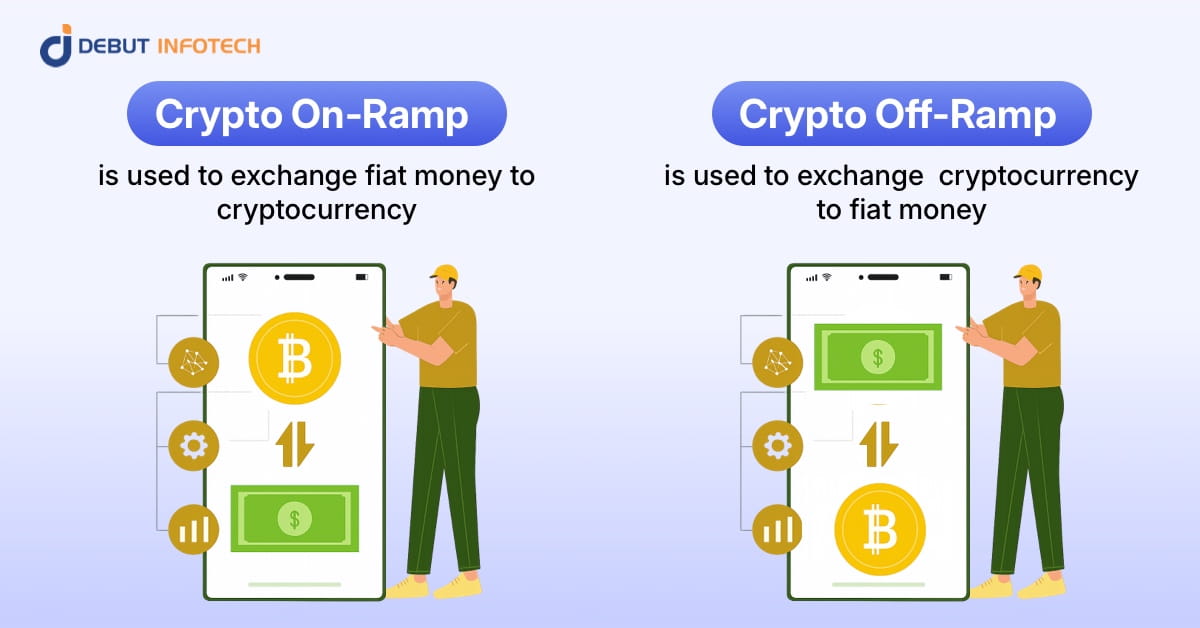

These days, liquidity APIs are essential to any successful cryptocurrency exchange development company. By using a solution like this, users can fulfill deals quickly and prevent slippage by ensuring that the portal receives assets with the best convertibility.

Put differently, liquidity APIs let online marketplaces communicate with order books and fund pools to give exchange applications access to the most liquidity possible. Trading pairs are readily accessed through an API connection, so once adopted, executing orders just takes a few seconds.

Prominent cryptocurrency exchanges usually offer the best liquidity because they have sizable individual pools. Nonetheless, cryptocurrency portals can also leverage secondary liquidity sources (market makers, or MMs) to expand the quantity of currency pairs available.

This is particularly true for new projects that wish to interact with several currency pairs, as huge portals sometimes engage solely with the most well-known online assets.

How to Integrate Liquidity API in Crypto Exchange

Liquidity APIs are essential to a dependable cryptocurrency exchange development company, as we already know, but implementing such a structure might take a lot of time or work. We’ll go over how to use one of these tools without encountering any unnecessary issues down below.

Research and search for potential liquidity providers (LPs)

You must first familiarize yourself with the records that already exist. The most widely used solutions are liquidity providers, MMs, and additional cryptocurrency platforms. Examine the applicants’ backgrounds and reputations; also consider the costs they demand. Make sure the provider has the necessary licenses to work in the industry you are interested in. You can find out more by visiting the supplier’s website or getting in touch with the appropriate authorities.

Make connections

This could entail establishing the API implementation while maintaining a watch on the connection to make sure everything is operating as it should. To enable your platform to access the partner’s API, the team needs to be proficient in writing code and comprehend the system documentation that the LP has provided.

API integration

This process unifies the API of the chosen LP with your system. It gives access to other LP data as well as the trade book of the liquidity provider. To enable your gateway to access the system, generate character sets and API keys. Liquidity keys can be generated by you or sent by the LP at your request.

Connection control

The connection has to be tested after the API integration is finished to make sure everything is working properly. Run unique tests that mimic actual trading scenarios, such as purchasing and selling virtual currency in any volume and at any price. This will enable you to find mistakes and inconsistencies that need to be fixed before usage.

Tracking and improvement

To get the intended outcomes, an API needs to be assessed and optimized after it is put into use. It can entail keeping an eye on business activity and adjusting the instrument’s parameters to guarantee optimal performance. The quantity of API calls per second can be changed to prevent overtaxing the liquidity provider’s API. To ensure that consumers receive accurate insights from the platform, you may additionally customize how often order book information is updated.

Control of commercial activity

You can find out how many transactions have been made on the exchange by keeping an eye on cryptocurrency trading activity. This will assist you in recognizing and effectively resolving important issues, such as poor commercial activity or a protracted order execution period.

Setting API parameters

To reach the highest possible degree of profitability for your service, you can modify the API settings. Decide how many API calls to make in a second to lighten the burden on the LP tools. You can also decide how frequently your order book data is updated, giving clients the ability to follow current trends.

For your digital virtual asset solution to establish the best trading practice for your clients, you must incorporate liquidity APIs. It creates reliability, successful order processing, and liquidity, all of which provide your gateway a competitive edge in the cryptocurrency industry.

To maintain continuous and successful commercial operations, it is crucial to approach the deployment of AI responsibly and comprehend the security concerns, potential reliability issues, and speed constraints. Adding such tools to the trading toolset can make it easier for anyone to operate in a virtual money environment, regardless of experience level in the cryptocurrency market or desire to learn the ins and outs of liquidity APIs as a developer.

The Significance Of Integrating Liquidity API In Crypto Exchanges

- Enhancing Market Liquidity

In the cryptocurrency market, liquidity refers to the ease with which digital assets can be purchased and sold without producing substantial price swings. It might be difficult for traders who want to execute big orders when there is not enough liquidity since it can cause erratic price movements. An organization that develops software for cryptocurrency exchanges can incorporate liquidity APIs into your platform, facilitating the establishment of relationships with various liquidity providers and aggregators. Because of this, traders can purchase or sell assets at current market levels without experiencing significant price fluctuations.

- Enhancing Trading Efficiency

Liquidity APIs simplify trading by automating the matching of buy and sell orders. The liquidity API effectively matches an order made by a user through the cryptocurrency exchange software with the best available counterpart order in the order book. Because it’s automated, it speeds up trade execution and guarantees that transactions are completed quickly and effectively.

- Improving Market Depth

Market depth can be defined as the volume of buy and sell orders in the order book at various price levels. A deep market will have a significant number of orders with different price structures, which enables the traders to have multiple trading options. Choosing the right cryptocurrency exchange development company will help integrate the best liquidity APIs, increasing market depth. These APIs play an active role in connecting the exchanges to a network of liquidity providers. The more the liquidity providers are integrated, the more the order book deepens and offers a broader range of price levels for the traders to choose from. It allows the traders to enter or exit positions with minimal slippage and have a great trading experience.

- Reducing Trading time

Liquidity APIs facilitate faster trading on white label cryptocurrency exchange development platforms. It is now simpler to match buy and sell orders quickly thanks to these APIs, which link exchanges to numerous liquidity providers. Transactions also happen in real-time. This automation simplifies the trading process, reduces delays, and enables traders to take advantage of market opportunities quickly and efficiently.

- Minimizing Price Volatility

One of the hardest parts of trading cryptocurrencies is dealing with price volatility. Reducing price volatility can be achieved by integrating liquidity APIs. Large buy or sell orders are absorbed by the market without causing sharp price swings when there is enough liquidity. It provides steadiness, which readily draws traders and investors.

- Encouraging Institutional Participation

Liquidity APIs are essential for creating a stable and liquid trading environment that draws institutional traders and boosts the overall trading volumes of cryptocurrency exchanges. Institutions like hedge funds, asset managers, and proprietary trading firms are looking for deep market liquidity and efficient order execution to support their trading volumes, and the integration of these features into p2p cryptocurrency exchange software is essential for encouraging these institutions to enter the market and execute large trades on behalf of their clients.

- Facilitating Arbitrage Trading

Arbitrage trading involves traders capitalizing on price discrepancies for a specific asset across various exchanges. They purchase the asset at a lower price on one exchange and sell it at a higher price on another to generate profits. Crypto exchange software integrated with liquidity APIs enhances arbitrage trading opportunities by offering real-time access to order books from multiple exchanges. This enables traders to quickly spot price differences and execute profitable trades.

Benefits of Choosing the Right Cryptocurrency Exchange Software Development Company

A critical step that directly affects the liquidity and performance of your crypto exchange is choosing the correct exchange developer. Here is how this decision greatly improves liquidity:

- Strong Matching Engine: An experienced developer for cryptocurrency exchanges creates and deploys a sturdy matching engine, which is essential for matching buy and sell orders. Orders are filled quickly and precisely thanks to a matching engine that has been fine-tuned. It does this by reducing order book disparities, which increases liquidity.

- Liquidity Provider Integration: Skilled developers are able to build connections with liquidity providers and successfully include them into the exchange architecture. By adding depth to the order book, these liquidity providers—such as market makers and liquidity pools—improve liquidity.

- Order Execution Efficiency: A knowledgeable software engineer for crypto exchanges makes sure that huge orders do not cause significant price slippage by optimizing order execution algorithms. It draws in traders and institutions with ease, increasing liquidity and bringing significant trading volumes.

- Trust and Security: To protect user funds and promote trust among traders, a respectable developer implements a number of security measures. More traders are drawn to a secure exchange, which boosts total liquidity.

- Scalability: You need to make sure your exchange can grow as it gets bigger. Software for cryptocurrency exchanges is created by skilled developers to withstand rising trading volumes without compromising functionality. Scalability guarantees that when your exchange becomes more well-known, it can handle increased liquidity demands.

- User-Friendly Interface: Great trading experiences will draw more traders to your exchange, and a well-designed user interface will contribute to this. Users are more likely to join and contribute to increasing liquidity if it is simple for them to navigate and execute deals.

- Regulations and Compliance: A skilled developer makes sure that your trade conforms to all applicable laws. Increasing reputation and drawing in institutional traders who need a compliant trading environment are two benefits of regulatory compliance that increase liquidity.

Advantages and Disadvantages of Integrating Crypto Liquidity API

Utilizing the liquidity API gives new crypto exchanges a lot of benefits and enables them to enter the market faster. Since businesses no longer need to raise money on their own, these tools have allowed obstacles to new ventures to be greatly reduced. Listed below are some more advantages of using this API for trading

- Optimize business efficiency: These interfaces for decentralized finance (DeFi) match buy and sell orders and accelerate business processes. The API ensures quick and efficient operations by quickly comparing an order placed through the digital assets portal with the best possibilities available in the order book.

- Ability to complete procedures quickly: API solutions shorten the time it takes for transactions made through cryptocurrency applications to execute. These trading systems match buy and sell orders easily since they are synced with several LPs, and everything is done in real time.

- Reducing price volatility: One of the primary issues with digital currency is cost volatility. Cost volatility is positively impacted by the use of liquidity API. The region handles large transactions with minimal cost changes when there is optimal liquidity.

- Encouraging institutional participants: Institutional players are encouraged to enter the market by using liquidity APIs in cryptocurrency applications, which draw in hedge funds and other private businesses to complete transactions on behalf of clients. These players have rigorous standards for order execution and industry liquidity in order to reach their commercial scales.

Downsides of Crypto Liquidity API

Even though the crypto API tool has a large list of benefits, it is not without certain drawbacks:

- Security: To prevent unauthorized access to users’ trading accounts, it is essential to maintain secure key management and storage.

- Reliability: Delays or outages in some liquidity APIs might have a detrimental impact on trading strategies. Ensure that you have a backup plan ready.

- Limited speed: In order to guard against exploitation, several markets limit the pace at which API queries can be made. Developers and market players should keep this in mind and make appropriate plans for their activities.

You should test your liquidity API before launching to make sure it functions properly. To test the exchange process, the majority of developers provide staging areas. It will guarantee that everything functions properly prior to the construction being put into place.

Conclusion

A thriving, effective, and stable cryptocurrency market is greatly influenced by the integration of liquidity APIs into crypto exchange software. These APIs promote institutional participation, simplify arbitrage trading, deepen market liquidity, improve trading efficiency, boost market depth, and lessen price volatility. They also enhance user experience. It makes sense that liquidity APIs are essential to the development of the crypto trading ecosystem.

Selecting the best custom software development company for your cryptocurrency wallet development services is essentially a calculated risk that will have an immediate impact on the liquidity of your exchange. Debut Infotech, a blockchain guru who assists you in being the proud owner of a skillfully designed and competently run exchange that draws in traders, liquidity providers, and institutions, is the best option available. Together, we can quickly develop an effective crypto exchange program by talking through your needs.

Ready to enhance your crypto exchange with seamless liquidity?

Partner with Debut Infotech to integrate advanced Liquidity APIs, ensuring optimal trading conditions and increased market depth.

Frequently Asked Questions: Crypto Liquidity API

A Liquidity API is a tool that allows crypto exchanges to access and integrate liquidity from various sources. It is crucial to ensure that there are enough buy and sell orders in the market, which helps maintain price stability, reduce volatility, and enhance the overall trading experience for users.

Better price discovery, lower slippage, higher trading volume, and happier users are just a few advantages of integrating a liquidity API. Your exchange can draw in more traders and fight more successfully in the market by providing deeper liquidity.

Look for characteristics like strong security measures, low latency, high uptime, compatibility with your current infrastructure, and access to a variety of liquidity sources when choosing a liquidity API. Think of APIs that provide sophisticated analytics tools and real-time data as well.

The current architecture of your exchange as well as the documentation and assistance offered by the API provider will determine how challenging it is to integrate a Liquidity API. Reputable API providers typically simplify the integration process for most development teams by providing thorough instructions, SDKs, and technical assistance.

When implementing a Liquidity API, security is crucial. To safeguard your data and transactions, make sure the API provider use encryption protocols, authentication techniques, and frequent security audits. Establish appropriate monitoring and access controls as well in order to identify and eliminate any such dangers.

It is feasible to integrate various Liquidity APIs, and doing so can be advantageous. It improves the overall depth and durability of the market by enabling your exchange to receive liquidity from many sources. Nonetheless, cautious management is also necessary to guarantee smooth functioning and prevent disputes.

Metrics including response time, order execution speed, uptime, and the effect on trading volume and price stability on your exchange should all be tracked in order to assess the success of a liquidity API. Additionally, get user input to evaluate how well the API facilitates a seamless trading experience.

Leave a Comment