Table of Contents

Home / Blog / Blockchain

Top 10 DeFi Platforms for 2025: A Comprehensive Guide

August 21, 2024

August 21, 2024

Decentralized finance (DeFi) is shaking things up in the finance world by providing all of us with the opportunity to explore alternatives to the traditional banking system that are open, transparent, and safe. As a result of the proliferation of decentralized finance platforms, consumers now have access to leading DeFi networks that provide them with one-of-a-kind financial prospects.

As more businesses become interested in decentralized finance, selecting the appropriate platform becomes an increasingly important consideration. This is especially true if you are looking to maximize returns, ensure the safety of your assets, and dive headfirst into the decentralized economy. Regardless of whether you are searching for the best DeFi trading platform for particular services such as loans or trading, finding the appropriate pick can have a major impact on your investments.

This post will provide you with an overview of the top 10 DeFi platforms. We will discuss the most important aspects of each one, including its advantages and characteristics that set it apart from the others. These platforms, which are frequently considered the best decentralized finance platforms, offer a broad range of financial services, which will assist you in making better decisions in this expanding sector.

What is a DeFi Platform?

A DeFi (Decentralized Finance) platform is a blockchain-based application that provides financial services without relying on traditional intermediaries such as banks or financial institutions. These platforms, also known as DeFi crypto platforms, operate on decentralized networks, primarily using smart contracts to execute and enforce transactions automatically. Whether you’re engaging in defi investment through lending, borrowing, or trading, the best DeFi platforms offer a robust and transparent way to manage your assets.

Ready to transform your business with cutting-edge DeFi solutions?

Discover how we can help you stay ahead of the competition.

How Decentralized Finance (DeFi) Works

DeFi runs on blockchain technology, with most platforms being built on Ethereum. But other blockchains like Binance Smart Chain (BSC) and Solana are also catching up. The heart of DeFi is smart contracts—basically, self-executing agreements where everything’s coded in. These contracts automatically handle transactions once certain conditions are met, cutting out the middleman entirely.

Here’s a quick rundown of how these platforms work:

1. Smart Contracts

Think of these as the brains behind a DeFi platform. They automate transactions without needing a third party. This is particularly crucial for defi lending platforms, which rely on smart contracts to manage loans and interest payments securely and efficiently.

2. Liquidity Pools

Users pool their assets together to create liquidity, which is then used for trading, lending, and borrowing. If you contribute, you can earn rewards like transaction fees or tokens, a key feature provided by Defi development services.

3. Decentralized Exchanges (DEXs)

Unlike traditional exchanges, decentralized platforms like DEXs let you trade directly from your wallet. No need for a central authority, which means more privacy and control over your assets. For those seeking the top DeFi platforms for trading, these DEXs are often the best DeFi trading platforms available.

4. Lending and Borrowing

You can lend your assets to others and earn interest, or you can borrow by putting up collateral. Interest rates are usually decided by how much supply and demand there is on the platform, a dynamic that makes defi lending platforms like Aave a good choice.

5. Yield Farming and Staking

Yield farming is about earning rewards by depositing assets into crypto DeFi platforms, while staking is locking up your assets to help run the platform in exchange for rewards. Both are popular ways to earn some passive income in the DeFi world, especially on the best DeFi platforms.

Advantages of DeFi for Investors

Decentralized platforms present unique advantages and opportunities for investors, making them an appealing option compared to traditional financial institutions. Here are some of the benefits:

1. Yield Farming and Staking

DeFi platforms often offer higher returns compared to savings accounts. Investors can earn interest by lending their cryptocurrencies, participating in yield farming, or defi staking tokens to receive rewards for locking up their assets.

2. Tokenization

Decentralized finance platforms enable the tokenization of real-world assets, such as real estate or stocks, allowing easier access to these investments.

3. Diversification

Investors can diversify their portfolios by accessing various assets like cryptocurrencies, stablecoins, and tokenized assets within the DeFi ecosystem. Top DeFi development companies often provide these opportunities for diversification, making them attractive to both retail and institutional investors.

4. Self Custody

In DeFi, investors have control over their assets through wallets without relying on third-party custodians like banks or brokers, reducing the risk of asset loss due to third-party failure. Best DeFi networks emphasize this self-custody model.

5. Transparency

DeFi crypto platforms operate on blockchains offering transparency of transactions and smart contract operations. Investors can verify how their investments are managed and ensure that the system functions as expected.

6. Lower Transaction Costs

DeFi platforms eliminate intermediaries like banks or brokers, which significantly reduces transaction fees. This is particularly advantageous for cross-border transactions where traditional fees can be high.

7. Efficiency

Smart contracts that are automated help make processes like lending, borrowing, and trading more efficient, cutting down on the costs and time typically involved in these activities. A top blockchain app development company will continuously innovate to enhance these efficiencies.

8. Global Accessibility

Decentralized finance platforms are open to anyone with an internet connection, regardless of location. This widens the scope of investment possibilities to a global audience, including those who may not have access to traditional financial services.

9. 24/7 Markets

DeFi markets operate 24/7, unlike traditional financial markets that adhere to specific trading hours. This flexibility allows investors to respond to market fluctuations and conduct trades at any time.

10. Decentralized Structure

The decentralized nature of DeFi makes it less susceptible to risks linked with financial institutions, such as bank collapses or government interventions.

11. Community-led Governance

Numerous DeFi platforms are overseen by their communities through decentralized organizations (DAOs), granting investors a say in decision-making processes and the project’s trajectory. For those looking to influence the direction of the best decentralized finance platforms, participating in these DAOs is a significant advantage.

You may also like to Read: What is DeFi Lending

Demand from Institutional Investors for DeFi Platforms

The DeFi sector, once dominated by individual enthusiasts and retail investors, is now drawing significant interest from institutional investors. This shift is driven by several factors:

1. Attractive Yields

Institutional investors are increasingly attracted to the high yields available through DeFi platforms, particularly in an environment of low-interest rates in traditional markets. Yield farming, staking, and liquidity provision on top DeFi platforms offer opportunities for significant returns.

2. Portfolio Diversification

DeFi platforms provide a new asset class that allows institutional investors to diversify their portfolios. This diversification can reduce overall portfolio risk and provide exposure to the rapidly growing digital asset market. Investing in top DeFi networks offers unique opportunities for portfolio expansion.

3. Transparency and Security

The transparency provided by blockchain technology is appealing to institutional investors, as it allows for real-time auditing and verification of transactions. The security features inherent in blockchain technology also offer protection against fraud and hacking, making top DeFi platforms a secure choice for large-scale investments.

4. Innovation and Customization

Institutional investors are interested in the innovative financial products offered by DeFi platforms. These include the ability to create customized financial instruments, such as synthetic assets, that can track the value of virtually any asset, providing new ways to hedge risk or gain exposure to different markets.

5. Regulatory Clarity

As governments and regulators begin to provide clearer guidelines on digital assets and DeFi platforms, institutional investors are more comfortable entering the market. Regulatory clarity reduces uncertainty and the perceived risk of investing in DeFi crypto platforms.

6. Strategic Partnerships

Many DeFi platforms are forming partnerships with traditional financial institutions, further integrating DeFi into the broader financial ecosystem. These partnerships can lead to greater adoption and more sophisticated financial products, which are appealing to institutional investors looking for the best DeFi trading platforms.

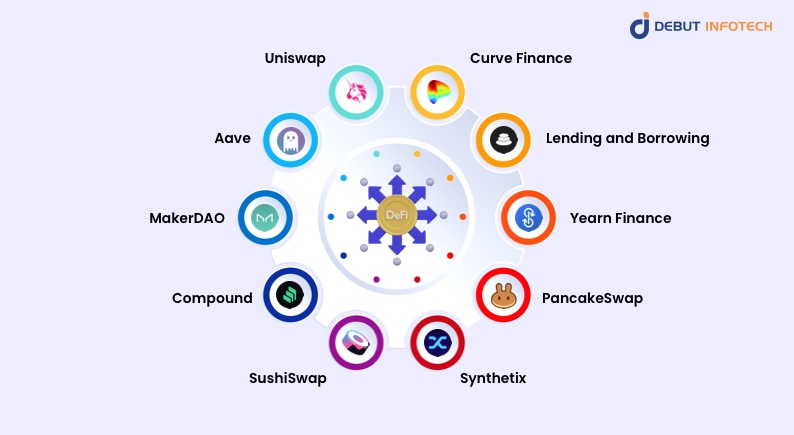

10 Best DeFi Platforms to Watch Out

Here is an analysis of the top 10 best DeFi platforms, highlighting their key features, benefits, and unique selling points.

1. Uniswap

Uniswap is a leading decentralized exchange (DEX) built on the Ethereum blockchain. It allows users to trade ERC-20 tokens directly from their wallets without intermediaries. Uniswap’s automated market-making (AMM) model, which uses liquidity pools instead of order books, ensures continuous liquidity. This model has been widely adopted across the DeFi space.

Key Features:

- Simple and intuitive interface.

- Wide range of supported tokens.

- High liquidity and low slippage.

Benefits:

- Decentralization and trustlessness.

- Incentives for liquidity providers through fees and token rewards.

- Accessibility for new projects to list tokens without a centralized authority.

2. Aave

Aave is a leading lending and borrowing platform in the DeFi space. It allows users to earn interest on their crypto holdings or borrow assets using collateral. Aave introduced the concept of “flash loans,” allowing users to borrow instantly and without collateral, provided the loan is repaid within the same transaction.

Key Features:

- Variety of supported assets for lending and borrowing.

- Flash loans and rate-switching between stable and variable rates.

- Decentralized governance through AAVE token holders.

Benefits:

- Competitive interest rates.

- Advanced risk management features.

- Strong security measures and regular audits.

3. MakerDAO

MakerDAO is the protocol behind DAI, a stablecoin pegged to the US dollar. Unlike traditional stablecoins, DAI is fully decentralized and collateralized by various assets deposited into the Maker Vaults. Users can generate DAI by locking up assets like ETH as collateral.

Key Features:

- Stable and decentralized currency (DAI).

- Collateralized debt positions (CDPs) for asset-backed loans.

- Decentralized governance through MKR token holders.

Benefits:

- Stability and decentralization of DAI.

- Flexibility in collateral types.

- Strong community governance and transparency.

4. Compound

Compound is a popular DeFi platform for lending and borrowing cryptocurrencies. It allows users to supply assets to liquidity pools and earn interest, while borrowers can access these assets by providing collateral. The platform’s algorithm adjusts interest rates based on supply and demand.

Key Features:

- Automated interest rate adjustment.

- Support for multiple cryptocurrencies.

- Governance through COMP token holders.

Benefits:

- High liquidity and efficient market rates.

- Transparent and decentralized governance.

- Easy integration with other DeFi protocols.

5. SushiSwap

SushiSwap is a decentralized exchange and AMM that originated as a fork of Uniswap but has since evolved with its unique features. It offers yield farming, staking, and various liquidity mining opportunities, making it a popular choice for DeFi users seeking to maximize their returns.

Key Features:

- Yield farming and staking rewards.

- Integration with multiple blockchains.

- SushiBar for staking SUSHI tokens.

Benefits:

- Competitive rewards for liquidity providers.

- Active community and ongoing development.

- Versatility in supported blockchains and assets.

6. Curve Finance

Curve Finance is a decentralized exchange optimized for stablecoin trading. It provides low slippage and low fees for trading between stablecoins, making it a go-to platform for stablecoin swaps. Curve also offers liquidity pools for users to earn fees and rewards.

Key Features:

- Optimized for stablecoin trading with low fees.

- High liquidity for stablecoin pools.

- Governance through CRV token holders.

Benefits:

- Minimal slippage and transaction costs.

- High returns for liquidity providers.

- Integration with other DeFi platforms for composability.

7. Balancer

Balancer is a decentralized automated portfolio manager and liquidity provider. It allows users to create custom liquidity pools with up to eight different tokens. Balancer’s unique model allows for more flexible asset allocations compared to traditional AMMs.

Key Features:

- Multi-token liquidity pools with custom weightings.

- Automated portfolio rebalancing.

- Governance through BAL token holders.

Benefits:

- Flexibility in pool creation and asset allocation.

- High potential returns for liquidity providers.

- Efficient trading and rebalancing mechanisms.

8. Yearn Finance

Yearn Finance is an aggregator for DeFi yield farming, where users can deposit their assets and earn optimized yields across various DeFi protocols. Yearn’s automated strategies help users maximize returns without constantly monitoring the market.

Key Features:

- Automated yield optimization.

- Vaults for different risk/reward strategies.

- Governance through YFI token holders.

Benefits:

- Passive income generation with minimal effort.

- Diversified strategies for risk management.

- Strong community and active governance.

9. PancakeSwap

PancakeSwap is a decentralized exchange on the Binance Smart Chain (BSC), offering similar services to Uniswap but with lower fees and faster transaction times. It has become one of the most popular DEXs on BSC, thanks to its user-friendly interface and extensive farming and staking options.

Key Features:

- Low fees and fast transactions on BSC.

- Yield farming and staking rewards.

- Lottery and NFT marketplace.

Benefits:

- Cost-effective trading experience.

- High yields for liquidity providers.

- Diverse earning opportunities through staking and lotteries.

10. Synthetix

Synthetix is a decentralized platform for creating synthetic assets, which are tokens that represent real-world assets like stocks, commodities, and fiat currencies. Users can mint these synthetic assets by staking SNX tokens as collateral.

Key Features:

- Creation of synthetic assets (Synths).

- Decentralized exchange for trading Synths.

- Governance through SNX token holders.

Benefits:

- Exposure to a wide range of assets without leaving the blockchain.

- High liquidity and low slippage for trading Synths.

- Innovative platform with ongoing development.

Related Read: Top 15 DeFi Protocols

DeFi Trends for 2025 and Future Predictions

As DeFi continues to evolve, several trends are expected to shape the industry in 2025 and beyond. They are:

1. Increased Institutional Adoption

The trend of institutional adoption of DeFi is expected to accelerate in 2025. As more traditional financial institutions recognize the benefits of DeFi, they will likely increase their participation in the sector. This could lead to more significant investments in DeFi projects and the development of institutional-grade DeFi platforms tailored to meet the needs of large investors.

2. Regulatory Clarity

Regulatory developments will play a crucial role in the growth of DeFi. In 2025, we can expect more jurisdictions to provide clear guidelines on how DeFi platforms should operate. This regulatory clarity will reduce uncertainty and encourage more institutional investors to invest in smart contract development in the DeFi space. Additionally, compliance with regulations will likely lead to the creation of more secure and transparent DeFi platforms.

3. Interoperability Between Blockchains

Interoperability, or the ability for different blockchains to communicate and interact with each other, will be a key focus in 2025. As DeFi expands across various blockchain networks, the need for seamless cross-chain transactions will become more critical. Interoperability solutions will enable users to move assets and data between different DeFi platforms easily, enhancing the overall user experience and unlocking new opportunities for growth.

4. Development of Decentralized Derivatives

Decentralized derivatives markets are expected to gain traction in 2025. These markets will allow users to trade derivative contracts such as options and futures in a decentralized manner, without the need for traditional exchanges. The growth of decentralized derivatives will attract institutional investors seeking more sophisticated financial instruments within the DeFi ecosystem.

5. Integration of Traditional Finance with DeFi

The integration of traditional finance (TradFi) with DeFi is likely to become more prominent in 2025. Financial institutions will increasingly explore hybrid models that combine the benefits of DeFi with the stability and trust of traditional finance. This integration will lead to the development of new financial products and services that bridge the gap between DeFi and TradFi, making DeFi more accessible to a broader audience.

6. Sustainable Yield Farming

The sustainability of yield farming, a popular DeFi activity, will come under scrutiny in 2025. As the market matures, there will be a shift towards more sustainable yield farming practices that focus on long-term value creation rather than short-term gains. This trend will likely result in the development of yield farming strategies that are less reliant on high inflationary token rewards and more focused on providing consistent, stable returns.

Have a project in mind?

Contact Us today to discuss your requirements and see how our experts can bring your vision to life!

Conclusion

These top 10 DeFi platforms each bring something unique to the table, catering to different needs and preferences. Whether you’re a trader, lender, borrower, or someone looking to earn passive income, there’s a DeFi platform out there that can help you achieve your financial goals in the decentralized world.

When selecting a DeFi development company, prioritize experience in blockchain technology, a proven track record with successful DeFi projects, and expertise in smart contract development. Assess their security protocols, client reviews, and transparency in communication. Opt for a firm that offers end-to-end solutions, ensuring a seamless and secure development process. Contact us today to discuss your DeFi project and take the first step toward success.

FAQs

Q. What sets DeFi platforms apart from traditional financial services?

A. DeFi platforms fundamentally differ from traditional financial services by operating on decentralized networks that leverage blockchain technology. This approach eliminates the need for intermediaries such as banks, resulting in enhanced transparency, reduced transaction fees, and broader access to financial services for individuals worldwide. This decentralized model represents a significant advancement in how financial transactions are conducted and accessed.

Q. How do I select the best DeFi platform for my needs?

A. When choosing a DeFi platform, consider key factors such as the platform’s security features, the range of services offered (such as lending, borrowing, or trading), the user experience, and the underlying blockchain network. Additionally, examining user reviews and the platform’s reputation within the crypto community can provide valuable insights. A well-researched decision will ensure that you select a platform that aligns with your specific needs and preferences.

Q. Are DeFi platforms safe for investment purposes?

A. DeFi platforms offer innovative financial opportunities but come with specific risks, including smart contract vulnerabilities, market volatility, and a lack of regulatory oversight. To mitigate these risks, it is crucial to conduct thorough research, choose well-established platforms, and diversify your investments. By taking these precautions, you can confidently navigate the DeFi space and capitalize on its potential benefits.

Talk With Our Expert

Our Latest Insights

USA

Debut Infotech Global Services LLC

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment