Table of Contents

Home / Blog / Cryptocurrency

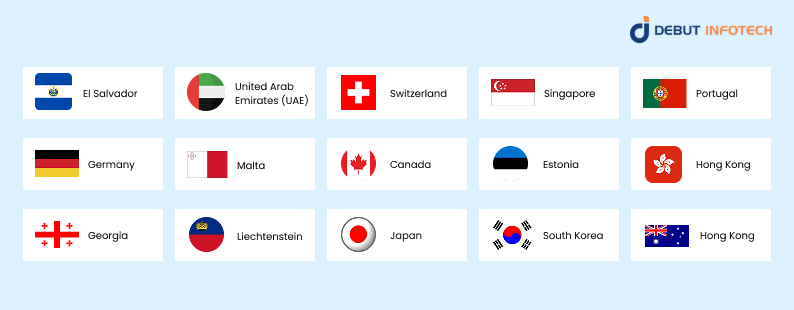

15 Crypto Friendly Countries Every Investor Should Know in 2025

May 7, 2025

May 7, 2025

The digital currency industry has shown fast-paced growth in 2025 as particular crypto friendly countries evolve into regulatory centers that drive blockchain acceptance and governance. These jurisdictions actively create an environment that allows investors, businesses, and developers to prosper. These crypto havens advance digital finance through various measures, including tax havens, organized blockchain solutions, and regulatory protocols shaping the upcoming digital finance period.

Crypto wallet development companies, crypto exchange development firms, and digital asset investors must consider environments that balance innovation and compliance when choosing operational bases or investment locations. The research examines 15 countries that are crypto friendly in 2025 by featuring their characteristics for crypto traders and businesses alongside blockchain supporters. The adoption of Web3 technology receives substantial attention from these countries through their deployment of flash loan arbitrage bots, the best crypto wallets, multicurrency wallets, and cryptocurrency payment gateway infrastructure.

What Makes a Country Crypto-Friendly?

Before exploring the list, it’s essential to understand the criteria that define a crypto-friendly nation:

- Regulatory Clarity: Clear and supportive laws governing cryptocurrency usage, trading, and investment reduce uncertainty for individuals and businesses. Countries with well-defined policies foster trust and accelerate crypto adoption.

- Tax Benefits: Favorable tax structures, such as exemptions on capital gains or lower income tax rates on crypto earnings, make a country attractive for crypto traders and long-term investors alike.

- Infrastructure: A robust ecosystem that includes licensed crypto exchanges, Bitcoin ATMS, blockchain startups, and financial institutions accepting digital currencies is critical to usability and growth.

- Government Support: National programs or sandbox environments that encourage innovation in blockchain and cryptocurrency play a pivotal role in legitimizing the industry and drawing in foreign investors.

- Financial Inclusion: Integrating cryptocurrencies into the mainstream financial system helps widen access to banking, especially in underbanked regions, and supports the broader vision of decentralized finance (DeFi).

- Tech Integration: Advanced countries also embrace innovations like AI-integrated smart crypto wallets, multicurrency wallet solutions, and support for asset-backed cryptocurrencies to future-proof their digital economies.

Top 15 Crypto-Friendly Countries in 2025

Now that we know what makes a country crypto-friendly, let’s go over the main purpose of this article: to help you pick the best country for crypto traders.

1. El Salvador

El Salvador is the pioneer nation in adopting Bitcoin as an official currency. The landmark decision established an economic basis that granted Bitcoin capital gains exemptions and blockchain educational initiatives for the country. The Chivo Wallet represents El Salvador’s key adoption of digital assets as the primary component for its digital economy implementation, enabling users to manage all Bitcoin wallet functions. The upcoming Bitcoin City initiative intends to draw international investors through an all-fee, tax-exempt policy that uses Bitcoin-backed bonds as its sole funding source. Crypto investors consider El Salvador more than just a pioneering nation because its improvements demonstrate how digital assets propel national economic modernization.

2. United Arab Emirates (UAE)

The cities of Dubai and Abu Dhabi within the UAE have progressively become the center for global crypto innovation development. The Virtual Assets Regulatory Authority (VARA), together with the Abu Dhabi Global Market (ADGM) regulations, provide crypto businesses with standardised operational frameworks through which they can obtain licenses. Dubai welcomes blockchain startup enterprises and crypto exchange companies through its tax-free policies and Dubai Multi Commodities Centre (DMCC) crypto-friendly economic area. The country is an ideal location for crypto entrepreneurs and high-net-worth investors because of its leading digital infrastructure, acceptance of AI applications, and dedicated AI strategy.

3. Switzerland

Switzerland’s Crypto Valley in Zug has become synonymous with blockchain innovation. The Swiss Financial Market Supervisory Authority (FINMA) was one of the first regulators to issue ICOs and token classification guidelines, giving projects legal certainty. In Switzerland, individuals benefit from favorable tax treatment, including no capital gains tax on cryptocurrencies held as personal investments. Additionally, Swiss banks and financial institutions have begun integrating crypto services, and the country is investing in cutting-edge crypto wallet development, custody solutions, and blockchain finance initiatives. It remains one of the best countries for crypto traders who value privacy, security, and regulatory clarity.

4. Singapore

Singapore has carved out a leading position in Asia’s blockchain sector. Governed by the Monetary Authority of Singapore (MAS), the city-state offers one of the most balanced crypto regulatory environments globally. Startups can register under clear licensing regimes while enjoying low corporate taxes and investor-friendly policies. Singapore is also home to a large number of AI-powered fintech companies working on innovations such as MPC wallets, flash loan arbitrage bots, and multicurrency wallet integrations. Its strategic location, financial ecosystem, and technology-driven culture continue to attract both investors and blockchain development firms.

5. Portugal

Portugal has emerged as a European crypto haven, largely due to its zero-tax policy on personal crypto gains. Investors and traders in Portugal do not pay VAT or capital gains tax on crypto transactions, provided they are not engaging in professional or business-like trading activities. In addition to its progressive tax policies, Portugal supports a growing network of blockchain companies, e-wallet app development startups, and crypto payment gateway solutions. The country has also become a hotspot for digital nomads and crypto freelancers, further enhancing its position as one of the countries that are crypto-friendly in 2025.

6. Germany

Germany offers one of the most structured regulatory approaches to cryptocurrencies in the EU. The government classifies Bitcoin and other cryptocurrencies as private money, which means individual crypto holdings are tax-free if kept for over a year. Germany’s financial institutions have increasingly embraced crypto, with banks now offering custody services and integrated trading platforms. Its supportive regulatory approach, robust financial infrastructure, and rising demand for AI tools in digital finance position Germany as an ideal destination for crypto entrepreneurs and long-term investors.

7. Malta

Often referred to as the “Blockchain Island,” Malta has implemented comprehensive frameworks to regulate blockchain and cryptocurrency businesses. The Malta Digital Innovation Authority (MDIA) and Virtual Financial Assets Act (VFAA) provide legal clarity and encourage innovation. The government has fostered partnerships between academic institutions and blockchain firms, promoting workforce development in crypto exchange development and crypto wallet security. Malta remains highly attractive to crypto projects looking for a transparent, innovation-friendly jurisdiction within the EU.

8. Canada

Canada’s mature financial market and technological advancements have made it a popular choice for blockchain startups and investors. Crypto is considered a commodity, and its trading is subject to capital gains tax. However, provinces like British Columbia and Ontario are leading innovation hubs, supporting blockchain applications and AI-driven financial solutions. The Canadian Securities Administrators (CSA) offer regulatory guidance on crypto investments, and the country has seen substantial growth in the development of cryptocurrency trading bots, asset-backed cryptocurrencies, and TRC20 wallets.

9. Estonia

Estonia’s digital-first approach makes it one of the most advanced countries in Europe in terms of blockchain adoption. With its e-residency program, Estonia allows global entrepreneurs to establish and manage crypto businesses remotely. The country also offers crypto service provider licenses under a transparent legal framework. Estonia has seen rapid growth in crypto wallet development companies and startups offering AI Copilot development for blockchain-based applications. For digital-first crypto investors, Estonia offers ease of business and innovative infrastructure.

10. Hong Kong

Despite facing political and regulatory pressures, Hong Kong remains a major financial hub with an active crypto scene. In 2023, the city introduced new licensing frameworks for Virtual Asset Service Providers (VASPs), aiming to balance consumer protection and innovation. Its proximity to mainland China, while maintaining a distinct regulatory regime, allows it to attract both Western and Asian crypto investors. With the increasing demand for flash loan arbitrage bots, AI models in DeFi, and crypto wallet innovations, Hong Kong continues to evolve as a pivotal location for the digital asset economy.

11. Georgia

Georgia offers one of the most competitive tax regimes for crypto investors—there are no capital gains taxes on cryptocurrency holdings, and mining operations enjoy favorable conditions due to low electricity costs. Over the years, Georgia has also built strong connections with foreign crypto investors and miners. It’s considered one of the best countries for crypto traders interested in mining or setting up businesses in emerging markets. With rising interest in integrating crypto with AI models for automated finance, Georgia is becoming more tech-savvy and investor-focused.

12. Liechtenstein

Liechtenstein’s Blockchain Act (Token and TT Service Provider Act) has established the nation as a leader in blockchain regulation. It offers comprehensive legal certainty for token-based business models, which include everything from asset-backed cryptocurrencies to tokenized securities. The country’s financial system is well-integrated with crypto, and banks are generally receptive to working with blockchain firms. Its low-tax policies and structured framework make it a top destination for institutional investors and crypto projects looking for long-term stability.

13. Japan

Japan has been a pioneer in regulating cryptocurrencies, recognizing Bitcoin as legal tender since 2017. The Financial Services Agency (FSA) enforces strict but clear regulations, offering consumer protection and encouraging innovation. Major financial institutions in Japan have embraced blockchain, with ongoing developments in crypto trading bot development and AI algorithms for decentralized finance. Japan’s cultural and technological affinity with innovation ensures it remains at the forefront of global crypto adoption.

14. South Korea

South Korea’s government has actively supported blockchain R&D while also cracking down on fraud and speculative trading. With strong public interest and a thriving fintech scene, the country has introduced taxation on crypto gains and regulations for exchanges. Local companies are heavily investing in ewallet app development, LLM models for financial prediction, and AI agents for digital asset management. South Korea is one of the few countries actively exploring crypto wallet vs exchange hybrid models, bridging CeFi and DeFi platforms.

15. Australia

Australia’s clear regulations have encouraged many crypto startups to flourish, particularly in cities like Sydney and Melbourne. The Australian Transaction Reports and Analysis Centre (AUSTRAC) oversees anti-money laundering compliance, while the country’s taxation office provides clear guidelines for individual and business crypto activity. Australia is also a leader in crypto wallet development cost transparency, offering robust services for businesses aiming to launch digital wallet solutions. Its integration of AI development services in crypto tools further solidifies its position in the global market.

Now, if you’re thinking about what is the most crypto friendly country? That answer will hang on how the points discussed above align with your needs.

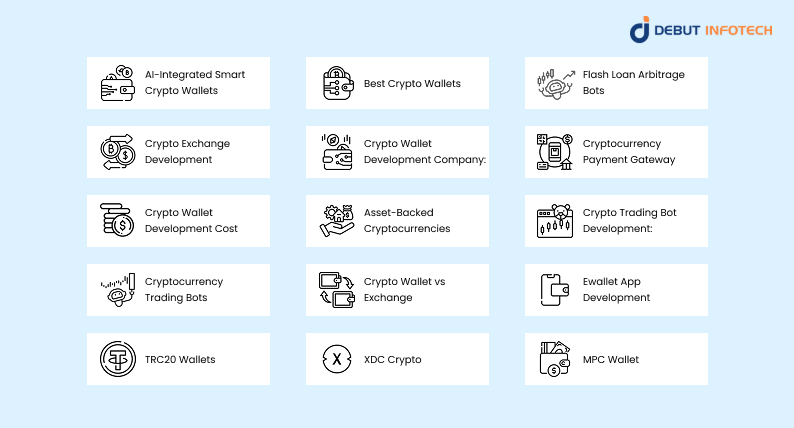

Integrating Advanced Crypto Tools and Services

The demand for sophisticated tools and services grows as the crypto ecosystem matures. Investors and businesses are increasingly seeking:

- AI-Integrated Smart Crypto Wallets: These wallets leverage artificial intelligence to enhance security, manage assets, and provide insights into market trends.

- Best Crypto Wallets: Security and user experience are paramount. Leading wallets offer multi-signature support, biometric authentication, and integration with decentralized applications.

- Flash Loan Arbitrage Bots exploit price discrepancies across platforms, executing rapid trades to generate profits without initial capital.

- Crypto Exchange Development: Building robust and secure exchanges is crucial for facilitating seamless trading experiences. Features like high liquidity, user-friendly interfaces, and regulation compliance are essential.

- Crypto Wallet Development Company: Working with a crypto wallet development company or partnering with experienced developers ensures the creation of secure and scalable wallets tailored to specific needs.

- Cryptocurrency Payment Gateway: Integrating crypto payment solutions enables businesses to accept digital currencies, expand their customer base, and reduce transaction fees.

- Crypto Wallet Development Cost: Costs vary based on features, security measures, and platform compatibility. Investing in quality development ensures long-term reliability.

- Asset-Backed Cryptocurrencies: These digital assets are pegged to tangible assets like gold or real estate, offering stability in volatile markets.

- Crypto Trading Bot Development: Automated trading bots execute strategies based on predefined algorithms, enhancing trading efficiency and reducing emotional decision-making.

- Cryptocurrency Trading Bots: These bots operate 24/7, analyzing market data to execute trades, providing users with a competitive edge.

- Crypto Wallet vs Exchange: While wallets store digital assets securely, exchanges facilitate buying and selling. Understanding their differences is vital for effective asset management.

- Ewallet App Development: Developing user-friendly e-wallets with features like QR code payments and transaction history enhances user engagement.

- TRC20 Wallets: These wallets support tokens on the TRON blockchain, known for low transaction fees and high throughput.

- XDC Crypto: XDC crypto Network focuses on global trade and finance, offering hybrid blockchain solutions for enterprises.

- MPC Wallet: Multi-Party Computation (MPC) wallets enhance security by distributing private key control among multiple parties, reducing single points of failure.

Conclusion

As we move deeper into 2025, the global landscape for cryptocurrency continues to mature. Governments worldwide are adapting their legal and financial infrastructures to embrace this technological evolution. The 15 countries that are crypto-friendly discussed above are not just regulatory safe havens—they are becoming global hubs of innovation, investment, and development. Whether it’s El Salvador’s Bitcoin-forward economy, Switzerland’s transparent financial ecosystem, or Singapore’s balanced regulatory structure, each jurisdiction offers unique opportunities for crypto traders, businesses, and investors.

For anyone looking to diversify their crypto portfolio, relocate for tax benefits, or launch a blockchain startup, understanding the advantages of each country is crucial. Additionally, with emerging trends like AI integrated smart crypto wallets, multicurrency wallet support, and decentralized finance (DeFi) solutions, countries that provide supportive environments will continue to attract forward-thinking investors. As regulatory clarity improves and technologies such as Cryptocurrency Trading Bots, flash loan arbitrage bots, and crypto exchange development gain traction, these nations stand out as pivotal players in the future of digital finance.

Frequently Asked Questions (FAQs)

A. El Salvador is often cited as the most crypto-friendly country due to its adoption of Bitcoin as legal tender and zero capital gains tax on Bitcoin transactions. However, countries like the UAE, Portugal, and Switzerland also offer very competitive environments for crypto investors.

A. Portugal and Germany stand out. Portugal offers zero tax on individual crypto gains, while Germany allows tax-free crypto sales if the assets are held for more than one year.

A. A crypto-friendly country typically offers regulatory clarity, low or no crypto taxation, easy licensing for crypto businesses, supportive infrastructure, and openness to blockchain innovation, including AI tools and smart wallets.

A. Yes, several countries like the UAE, Estonia, Malta, and Switzerland provide streamlined licensing and operational frameworks for crypto exchange development. You can also work with a crypto wallet development company for tailored services.

A. AI plays a growing role in crypto through tools like AI-driven trading bots, AI Copilot development, crypto wallet optimization, and data security. Investors are increasingly adopting AI models to gain insights and improve decision-making.

A. A crypto wallet is used to store digital assets securely, while a crypto exchange facilitates buying, selling, and trading of cryptocurrencies. Some advanced solutions now offer hybrid features that combine both.

A. Yes, all 15 countries have legal frameworks supporting the use of cryptocurrency. However, the specifics—like tax rates, usage limits, and business licensing—vary from one country to another.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

info@debutinfotech.com

Leave a Comment