Table of Contents

Home / Blog / Blockchain

Real Estate Tokenization- Enabling Limitless Investment Possibilities

July 23, 2024

July 23, 2024

The advent of blockchain technology has been regarded as the most advanced technological advancement for a variety of industries. Among these, one of the most talked-about topics is real estate tokenization, which has been gaining traction due to its exceptional benefits, including fractional property ownership, opening up a larger investor pool, and enabling unconstrained access.

With that said, It is anticipated that the worldwide real estate tokenization market size and share will rise at a compound annual growth rate (CAGR) of 2.90% between 2024 and 2034 reported by ProphecyMarketInsights. Furthermore, income from the sector is expected to rise from US$3.8 billion in 2024 to US$26 billion in 2034.

Given this technological breakthrough turned into a significant industry,

Many companies are already hoping on this growing path and are testing the waters of real estate tokenization. Nevertheless, there are still numerous intricacies that require further investigation in this rapidly expanding sector.

To help you navigate this frontier, we have created this blog to provide an all-encompassing overview of Real Estate Tokenization. We’ll delve into the fundamentals of the process, explore the exciting advantages for businesses & investors, and many more things.

What is Real Estate Tokenization

To put it simply, real estate tokenization is the process of converting ownership of a physical property into digital tokens that can be bought, sold, or traded on a blockchain-powered real estate tokenization platform. Each token represents a fractional share of the property, allowing multiple investors to own a piece of the property without needing to purchase the entire asset. This makes it easier for people to invest in real estate, as they can buy smaller, more affordable shares rather than an entire property.

Let’s Take An Example-

Imagine a $10 million apartment building tokenized into 10,000 digital tokens worth $1,000 each. An investor can buy 10 tokens for $10,000, owning 0.1% of the building. They can sell these tokens anytime on a digital marketplace, providing liquidity that traditional real estate investments lack.

How Does Real Estate Tokenization Work?

The process of converting the value of real estate into digital tokens that can be sold on a blockchain is known as “tokenization.” Here are the steps to help you understand how the process works:

- Selection and valuation of assets

Find a piece of real estate (such as a commercial building, a house, or a plot of land) and determine its market value.

- Legal and Regulatory Compliance

Ensure that the tokenization procedure complies with all applicable laws and regulations. Usually, this entails engaging with lawyers to ensure that the token deal is properly structured.

- Token Creation

Use blockchain technology to create digital tokens representing property shares. One token represents a small portion of ownership in the real estate asset.

Put smart contracts on the blockchain to regulate token generation, distribution, and trading. Smart contracts automate processes such as dividend payments and control changes.

- Offering tokens

To sell the tokens to buyers, launch an Initial Coin Offering (ICO) or a Security Token Offering (STO). In this step, you’ll tell people about the token sale and invite them to participate.

- Trading and Getting Tokens

Tokens can be purchased and sold on secondary markets or coin exchanges once they are issued. This increases liquidity, making it easier for purchasers to purchase and sell tokens.

- Ownership and Income

People who own tokens have ownership rights, such as rental revenue or profits from selling the property, based on the number of tokens they own. The blockchain records and controls these events.

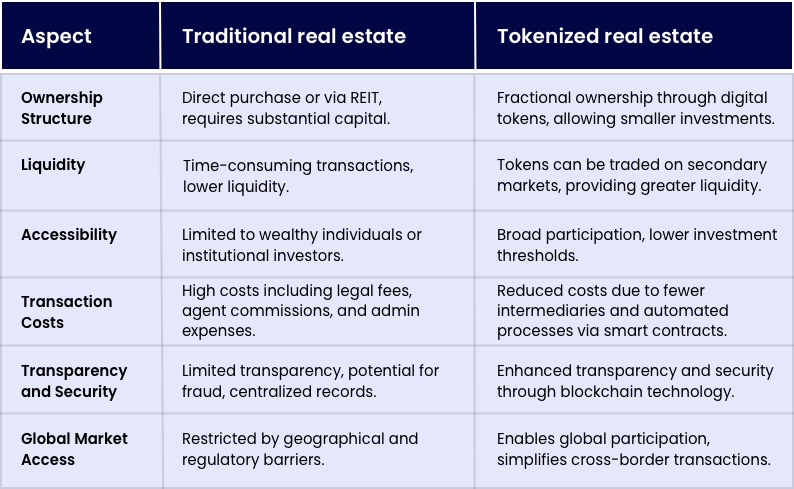

Difference between Traditional Real Estate Vs. Tokenized Real Estate

Different Types of Real Estate Tokenization

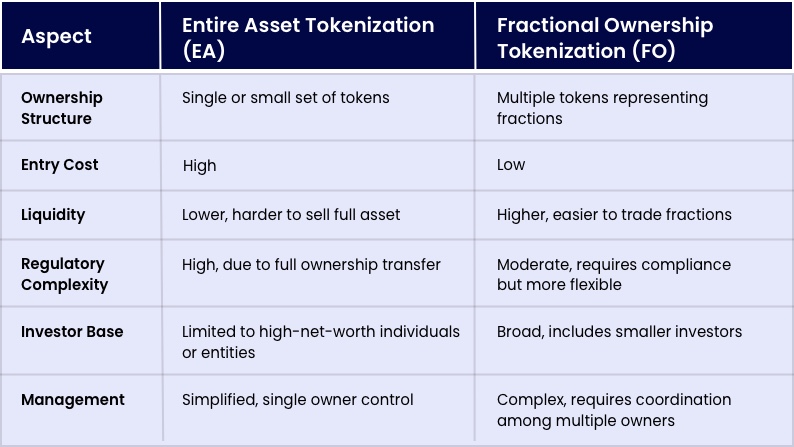

In the real estate industry, there are two primary types of tokenization: entire asset tokenization (EA Tokenization) and fractional ownership tokenization (FO Tokenization). Each type has its unique characteristics, benefits, and challenges.

Entire Asset Tokenization (EA Tokenization)

- Definition: This involves tokenizing the full value of a real estate asset into a single token or a set of tokens. The owner of these tokens holds complete ownership of the property.

- Implementation Difficulty: EA Tokenization is extremely difficult to put in place due to regulatory, legal, and logistical challenges. It requires comprehensive compliance with property laws and significant coordination between various stakeholders.

- Example: Tokenizing a $10 million office building into one digital token. The buyer of this token would own the entire property outright.

- Benefits: Simplifies ownership, as the entire asset is represented by a single token. Suitable for investors or entities seeking complete control over a property.

- Challenges: High entry cost, less liquidity, and complex regulatory requirements.

Fractional Ownership Tokenization (FO Tokenization)

- Definition: This involves dividing the ownership of a real estate asset into multiple tokens, each representing a fraction of the property’s value. Investors can purchase these tokens to own a portion of the asset.

- Current Usage: FO Tokenization is already in use and gaining popularity due to its accessibility and flexibility.

- Example: A $10 million residential building is divided into 10,000 tokens, each worth $1,000. Investors can buy any number of tokens according to their budget, owning a fraction of the property.

- Benefits: Lowers the barrier to entry for investors, enhances liquidity, and democratizes real estate investment by allowing more people to participate.

- Challenges: Requires effective management of multiple owners, potential for disputes among token holders, and adherence to complex regulatory frameworks.

Comparison of EA Tokenization and FO Tokenization

Key Benefits of Real Estate Asset Tokenization for Investor & Owners

Tokenization of real estate assets provides several benefits to investors as well as property owners, thereby altering the landscape of traditional real estate investing. Here is a detailed explanation of the most important advantages:

For Investors

- Diversification Opportunities

Tokenization allows investors to spread their investments across multiple properties rather than concentrating their capital in a single asset. This diversification reduces risk and allows investors to gain exposure to various property types and locations. By owning tokens in different properties, investors can hedge against market fluctuations and capitalize on the performance of different real estate markets globally.

- Increased Transparency and Security

Tokenized real estate leverages blockchain technology to ensure transactions are both secure and transparent. The blockchain ledger allows investors to access detailed ownership records and transaction histories. This visibility minimizes the risk of fraud and builds trust within the investment community.

- Ownership Flexibility

Unlike traditional methods, tokenization offers extensive fractional ownership options. Investors can customize their investments to fit their budget and risk preferences. For example, one can purchase a small token representing a fraction of a commercial building or acquire multiple tokens for a larger stake in a residential development project, offering unparalleled flexibility.

For Property Owners

- Liquidity of Tokenized Assets

Traditionally, the process of selling property can be both lengthy and frustrating. Tokenization addresses this issue by establishing a secondary market for these assets. Digital tokens, representing the property, can be traded on specialized platforms akin to stock exchanges. This capability allows property owners to exit their investments swiftly and efficiently. Enhanced liquidity introduces a broader spectrum of potential buyers, which can result in quicker sales and possibly higher property valuations.

- Reduction in Operational Costs

Property management often involves significant time and expenses. Tokenization optimizes this process through the implementation of smart contracts, which are self-executing agreements stored on the blockchain. These smart contracts can automate various tasks such as rent collection and distribution, thereby reducing the administrative load and associated costs for property owners.

- Global Investment Market Access

Tokenizing real estate eliminates geographical barriers, enabling owners to reach a global investor base. Imagine attracting investors from Europe for a beachfront property in Thailand or drawing interest from North American investors for an office building in Tokyo—all managed through a secure and transparent online platform. This wider reach can increase demand and potentially boost property valuations.

Real-World Success Stories of Real Estate Tokenization

It’s intriguing to consider, and even more so to put into practice. Success stories of tokenized high-end apartments in bustling city centers or massive commercial areas where investors may get a stake for a few hundred dollars are worth looking at.

- Resort at St. Regis Aspen

A luxury hotel and condominium complex in Colorado, USA, was tokenized in 2018 using blockchain technology, enabling investors to buy security tokens representing a portion of the property.

- Salt Lake City Townhome Community

In Ogden, Utah, a multifamily townhome complex has undergone tokenization, with a minimum investment threshold set at $1,000. This project is targeting an internal rate of return (IRR) of 16.8%.

- Hotel in Sapporo City

Kenedix, a leading Japanese real estate company, has launched its fifth digital security token, backed by a hotel located in Sapporo City. To date, the firm has successfully raised Yen 33 billion ($240 million) across these five properties. Kenedix anticipates that the real estate security token market will grow to Yen 2.5 trillion ($18 billion) by 2030.

- Apartment Complex in Dallas

A multifamily apartment building in Dallas with 250 units has provided investors with tokenized options. For this $47 million project, the development enterprise secured $6.5 million in investment from investors.

These aren’t isolated incidents; rather, they are contributing factors in a larger pattern that is paving the way for a continuous growth trajectory in the real estate asset tokenization market.

So, What are the Bottlenecks?

As more and more enterprises are venturing into this market, real estate tokenization presents several obstacles and constraints. The process’s bottlenecks are as follows:

Technical Challenges

Despite the promise of blockchain technology, it presents technical hurdles such as scalability, interoperability, and secure asset custody. Blockchain platforms need to handle large volumes of transactions efficiently and integrate seamlessly with existing financial systems. Moreover, securing digital tokens against theft or hacking is paramount, and solutions for custody and security are still being refined.

Regulatory Challenges

As of yet, there isn’t a single, broadly recognized legal framework for real estate tokenization. At the moment, the strategy is fragmented, with various regulatory agencies concentrating on particular areas:

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

Regulators are understandably worried about the possibility of money laundering and other illegal activity occurring in the cryptocurrency market. By forcing platforms to monitor transactions and verify user identities, AML/KYC rules seek to reduce these risks.

- Taxes

Global tax authorities are still figuring out how to tax the profits from tokenized real estate investments. This includes inquiries about potential exclusions for particular kinds of tokens as well as capital gains tax and rental income tax.

- Securities Law Compliance

Tokenized real estate often falls under securities regulations, depending on the jurisdiction. This requires issuers to navigate complex securities laws, including registration requirements and exemptions. Ensuring compliance with these laws is crucial to avoid legal repercussions and to protect investors.

- Privacy and Data Protection

Tokenized real estate transactions involve significant data collection and sharing. Ensuring compliance with privacy laws such as the General Data Protection Regulation (GDPR) in Europe and other local privacy regulations is essential to protect investor information and build trust.

Given the current legislative frameworks that need to be updated, the potential of this growing industry is too great to ignore.

This appeals to both property owners, who can sell a portion of their property for higher liquidity, and investors, who can now invest in high-value properties that were previously unavailable.

Ready to plunge into the ocean of real estate tokenization?

Step in with Debut Infotech to Embrace the Potential of Thriving Sector

Without a doubt, the entire world is watching the growth of real estate tokenization platforms and is astounded by the advantages of high security and flexibility when interacting with tokenized real estate assets digitally.

If you require an asset tokenization platform, contact a top real estate tokenization business to help you join this creative trend and reap the rewards.

Debut Infotech, a top-tier blockchain development company, can help you navigate the complexities of tokenization. Our expert developers have extensive experience with blockchain technology, having successfully completed various projects that have altered the real estate industry. From developing secure and scalable tokenization systems to integrating smart contracts, our team ensures that all projects satisfy the highest quality and security standards.

Our blockchain advisors can assist you in identifying appropriate investment possibilities and making informed decisions in this dynamic world. Drop us a line right away to discuss your real estate investment project requirements!

Talk With Our Expert

USA

2102 Linden LN, Palatine, IL 60067

+1-708-515-4004

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-708-515-4004

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

Sector 101-A, Plot No: I-42, IT City Rd, JLPL Industrial Area, Mohali, PB 140306

9888402396

info@debutinfotech.com

Leave a Comment