Table of Contents

Home / Blog / Blockchain

List of 10 Best DeFi Lending Platforms in 2025

May 15, 2025

May 15, 2025

Decentralized Finance (DeFi) lending platforms have reshaped the traditional financial landscape by enabling permissionless access to loans, interest-bearing accounts, and asset lending, without relying on banks or intermediaries. As of early 2025, the total value locked (TVL) in DeFi protocols stands at approximately $128.6 billion, reflecting a significant presence in the financial ecosystem.

Leading platforms like Aave have achieved remarkable growth, with Aave’s TVL reaching $23.5 billion across multiple chains. At the same time, Compound maintains a substantial TVL of $2.08 billion, underscoring its role in the DeFi lending space. These platforms are integral to a broader financial ecosystem, attracting retail users and institutional players. DeFi lending offers greater transparency, operational efficiency, and accessibility, all powered by smart contracts that eliminate human discretion and reduce transactional overhead.

In this guide, we’ll dive into the meaning, features, and how DeFi lending works. Furthermore, we will discuss its differences from traditional systems and the top DeFi Lending platforms in 2025.

Build Your Own DeFi Lending Platform—No Guesswork, Just Results

Why start from scratch when we’ve already cracked the code? Let’s turn your idea into a secure, scalable DeFi lending app that actually works and makes users want to stick around.

What is a DeFi Lending Platform?

A DeFi lending platform is a blockchain-based protocol that enables users to lend or borrow cryptocurrencies without relying on traditional financial intermediaries. These platforms operate using smart contracts that automate lending terms, manage collateral, and facilitate interest payments.

In contrast to conventional systems, they offer open access, meaning anyone with a digital wallet can participate. DeFi lending protocols remove geographical and institutional barriers, paving the way for a more inclusive financial ecosystem that aligns with the decentralized vision of Web3.

Features of DeFi Lending

1. Security

Security is fundamental to the design of DeFi lending platforms. These platforms rely on open-source smart contracts that must undergo rigorous code audits to minimize vulnerabilities.

Many blockchain ecosystem protocols integrate third-party verification and real-time monitoring tools to detect anomalies or breaches. A strong emphasis is placed on transparency, with all contract logic and updates publicly visible. However, despite these measures, users must still assess the credibility of audit firms and the platform’s incident history before committing funds.

2. Liquidity

Liquidity ensures that users can easily borrow or withdraw assets without facing excessive slippage or delays. In DeFi lending, liquidity pools are formed by user deposits, and their depth directly impacts the platform’s efficiency.

Platforms like Aave and Compound have introduced liquidity mining and yield incentives to attract participants and maintain high pool volumes. Encouraging continuous liquidity provision helps borrowers access assets quickly while rewarding lenders with competitive returns.

3. User Experience

User experience in DeFi lending has evolved rapidly. Many defi lending platform development services now incorporate sleek, mobile-friendly dashboards, clear APY breakdowns, real-time performance data, and educational guides for beginners.

Wallet integrations have also improved, making it simpler for users to connect and transact. As more retail users enter the space, intuitive interfaces and seamless interactions are becoming key factors for platform adoption.

Criteria for Selecting Top DeFi Lending Platforms

1. Security and Smart Contract Audits

Thorough security audits by reputable firms are essential. Top DeFi protocols often publish detailed audit reports and maintain bug bounty programs to incentivize community scrutiny. Continuous monitoring and timely patching are signs of a security-first platform.

2. Interest Rates and APY

Effective platforms offer transparent and competitive interest rates for lenders and borrowers. Dynamic rates—driven by supply-demand models—maximize user returns and enhance borrowing flexibility. Look for platforms that optimize yield through lending pools or algorithmic interest-rate adjustments.

3. Range of Supported Assets

Defi lending platforms that support diverse assets—including stablecoins, ETH-based tokens, and newer cross-chain assets—cater to a broader audience. Diversity in assets also mitigates concentration risk for lenders and borrowers.

4. User Interface and Experience

A well-structured and intuitive interface lets users track deposits, loans, and returns in real-time. Tools like gas fee estimators, protocol analytics, and in-platform help centers improve transparency and usability.

5. Liquidity and Volume

Blockchain platforms with high total value locked (TVL) and daily trading volume offer better slippage protection and quicker order execution. Look for consistently high liquidity metrics and healthy lending-to-borrowing ratios.

6. Collateralization Alternatives

Innovative platforms are exploring undercollateralized lending through credit scoring models, social staking, or reputation-based lending. While overcollateralization remains the norm, this space is evolving toward more flexible collateral mechanisms.

7. Governance and Community Involvement

Decentralized Autonomous Organizations (DAOs) are crucial in shaping DeFi platforms. Transparent governance mechanisms—such as token voting and forum-based proposal discussions—encourage community trust and sustainability.

8. Integration of Advanced Financial Instruments

Integration with derivatives, leverage, and synthetic asset tools is becoming a defining feature of modern DeFi lending platforms. These features broaden user strategies and create avenues for additional yield or hedging opportunities.

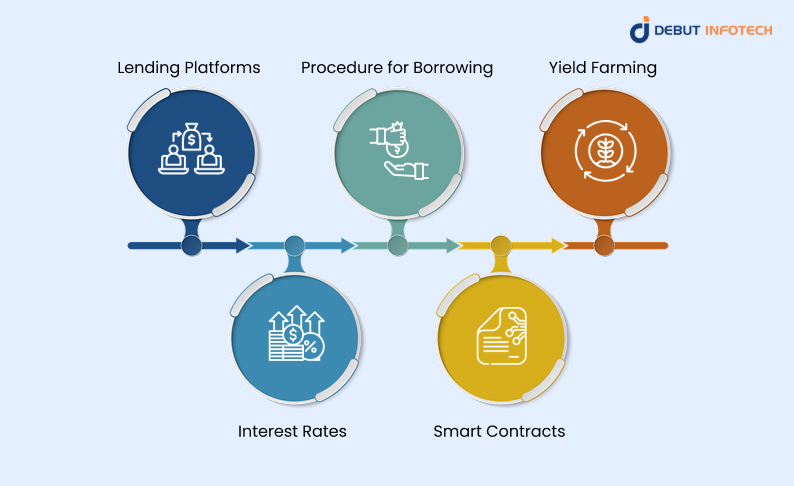

How Does DeFi Lending Work?

1. Lending Platforms

Users deposit assets into decentralized lending pools via platforms like Aave or MakerDAO. These assets are then made available to borrowers, who must lock up collateral. The protocol manages everything—from matching borrowers to adjusting interest—through automated logic encoded in smart contracts.

2. Interest Rates

Interest rates in DeFi are dynamic and fluctuate based on the asset supply and demand within the platform. High borrowing demand increases rates for borrowers but offers a greater yield for lenders. Real-time rate tracking helps participants make informed choices.

3. Procedure for Borrowing

Borrowers typically select an asset, deposit approved collateral (often over 100% of the loan value), and initiate a loan. The collateral is locked within the smart contract. If the value drops below a certain threshold, liquidation mechanisms kick in to protect lenders.

4. Smart Contracts

Smart contracts are the operational backbone of DeFi lending. They handle everything from collateral management to loan disbursal, repayment tracking, and liquidation. Their transparency and automation eliminate the need for human oversight, reducing errors and operational costs.

5. Yield Farming

Yield farming involves moving assets across protocols to capitalize on the highest possible returns. Some lending platforms offer additional incentives, like governance tokens, to users who contribute liquidity, effectively stacking yield opportunities across multiple services.

Main Differences Between Traditional Financial Intermediation and Decentralized Finance Lending

1. Access and Permissioning

Traditional finance requires users to pass identity verification, credit checks, and often geographic eligibility criteria before accessing lending services. In contrast, DeFi operates on a permissionless basis—anyone with a crypto wallet can lend or borrow assets without intermediaries. This open-access model eliminates barriers like banking exclusion, enabling global participation regardless of socio-economic status or government-issued identification.

2. Intermediary Involvement

Traditional lending relies on central entities like banks or credit unions to handle loan approvals, fund disbursement, and risk assessment. These intermediaries often introduce bureaucratic delays and fees. DeFi removes the need for middlemen entirely, using autonomous smart contracts to manage lending, collateral, and repayment. This not only reduces costs but also speeds up execution and minimizes reliance on institutional discretion.

3. Collateralization and Credit Assessment

In TradFi, borrowers are often approved based on credit scores, income history, and relationships with institutions. Collateral may not always be required. But thanks to advancements in blockchain technology, DeFi uses overcollateralization—users must lock in more value than they borrow, with no credit checks involved. Risk is algorithmically managed through smart contracts that automatically liquidate positions if collateral ratios fall below safety thresholds.

4. Transparency and Data Control

DeFi lending platforms provide full transparency via public blockchain records, allowing anyone to audit interest rates, liquidity reserves, and loan histories in real time. In contrast, traditional institutions operate in closed environments with opaque financial data, risk exposure, and lending decisions. DeFi also gives users control over their data, avoiding centralized databases that are vulnerable to misuse or breaches.

5. Operational Hours and Settlement Times

Banks and financial institutions operate within fixed business hours and often require days for settlement and fund clearance. DeFi operates 24/7 globally with instant or near-instant settlement, regardless of weekends or holidays. Smart contracts facilitate real-time execution, reducing delays and giving users immediate access to borrowed funds or interest returns without needing manual processing or approval queues.

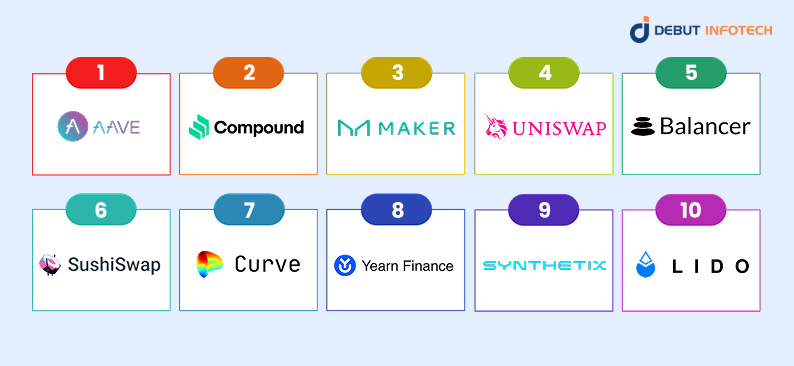

Top 10 DeFi Lending Platforms in 2025

1. Aave

Aave remains one of the best DeFi lending platforms in 2025, offering variable and stable interest rates, flash loans, and collateral swapping. It supports over 30 assets and operates on Ethereum, Polygon, and Avalanche. Its v4 upgrade enhances cross-chain liquidity and introduces modular governance. Users benefit from its Safety Module for protocol insurance and seamless user experience through its intuitive interface and improved gas efficiency.

2. Compound

Compound uses algorithmic money markets to allow users to earn interest or borrow crypto without intermediaries. It supports automated interest rate adjustments based on supply-demand dynamics and integrates with major wallets. Its COMP governance token empowers community-driven upgrades. With strong liquidity across multiple markets and a secure, audited infrastructure, Compound continues to serve institutional and individual users seeking predictable yields and permissionless borrowing at competitive collateral ratios.

3. MakerDAO

MakerDAO powers the DAI stablecoin ecosystem through its overcollateralized lending model. Users lock ETH, wBTC, or other assets in smart contracts to mint DAI. Maker governance, powered by MKR token holders, adjusts stability fees and risk parameters. In 2025, Maker has expanded collateral options and real-world asset integrations. It stands out for offering decentralized loans with long-term stability, appealing to borrowers needing non-volatile assets without liquidating crypto holdings.

4. Uniswap

Originally known as a decentralized exchange, Uniswap’s v4 ecosystem introduces UniswapX, enabling seamless lending, flash loan bundling, and liquidity routing across protocols. Its concentrated liquidity model boosts capital efficiency. Through smart contract composability and third-party integrations, Uniswap allows developers to build lending functions directly on top of liquidity pools. Backed by deep liquidity and a strong governance model, Uniswap remains a foundational layer in DeFi financial tooling.

5. Balancer

Balancer enables custom liquidity pools with up to eight assets and adjustable weighting, making it a flexible solution for DeFi asset management and lending vaults. Users can earn yield by supplying to optimized smart pools, while developers can launch algorithmic trading strategies or lending modules. Balancer’s new veBAL model enhances long-term governance and incentives. It appeals to advanced users seeking efficient liquidity provisioning and programmable asset distribution in lending ecosystems.

6. SushiSwap

SushiSwap has evolved from a DEX into a multi-feature DeFi suite, with lending services offered via Kashi. Kashi allows users to create isolated lending pairs, reducing systemic risk while increasing capital efficiency. SushiX, its cross-chain swap feature, also supports collateralized movement across blockchains. With a community-focused DAO, multichain compatibility, and aggressive innovation, SushiSwap continues to serve borrowers and lenders with tailored lending markets and risk-segregated pools.

7. Curve Finance

Curve specializes in stablecoin and pegged asset liquidity pools, offering low-slippage swaps and interest-bearing opportunities. Its lending mechanism, built on the crvUSD framework, allows users to borrow against stable assets with soft liquidation to mitigate losses. Curve’s unique AMM structure optimizes rates for stable asset pairs. With deep liquidity, DAO-led governance, and integration into major DeFi strategies, Curve remains a top choice for secure and efficient stablecoin lending.

8. Yearn Finance

Yearn automates yield generation through “Vaults” that deploy user deposits into optimized lending and farming strategies across DeFi platforms. It aggregates returns from protocols like Aave, Compound, and Curve. With minimal manual input, users benefit from auto-rebalancing, fee minimization, and risk-adjusted APYs. In 2025, Yearn expands to include RWAs and modular strategy layering, serving both retail and institutional DeFi lenders seeking passive income through automated portfolio management.

9. Synthetix

Synthetix allows users to mint synthetic assets (Synths) representing fiat, commodities, and crypto through overcollateralized staking. Its lending mechanism ties into liquidity provisioning and derivatives trading, enabling exposure without ownership. The sUSD stablecoin powers its loan issuance. With perpetual futures, a growing partner ecosystem, and modular debt pools, Synthetix is ideal for advanced users looking to lend against derivatives exposure while managing on-chain leverage in a decentralized environment.

10. Lido

Lido provides liquid staking solutions for Ethereum and other PoS chains, allowing users to stake assets while retaining liquidity via stTokens like stETH. In 2025, Lido integrates lending functions by enabling stETH as collateral across major protocols. Its DAO governs staking strategies and rewards allocation. With deep integrations, institutional-grade audits, and a growing role in Ethereum’s staking economy, this best defi lending platform serves as a key player for lending against yield-generating staked assets.

DeFi Lending Trends for 2025 and Future Predictions

1. AI Integration

DeFi platforms are leveraging AI to power advanced credit risk assessments, automate fraud detection, and enhance protocol governance. Machine learning models will tailor lending terms to borrower behavior, creating more accurate collateral requirements and reducing default rates—all while preserving decentralization and protecting user data through on-chain computation.

2. Improved Interoperability

Protocols are moving beyond isolated chains through Layer 2 scaling solutions and cross-chain bridges. This interoperability allows assets and liquidity to move freely between networks like Ethereum, Arbitrum, and Solana. It enhances composability, enabling users to deploy assets across ecosystems without wrapping tokens or sacrificing transaction speed or security.

3. Enhanced Security Measures

Security is being fortified through formal verification of smart contracts, decentralized insurance coverage, and continuous on-chain anomaly detection. Platforms are also integrating AI to detect suspicious behaviors. This multi-layered approach is designed to reduce vulnerabilities, restore user confidence, and minimize the risk of devastating exploits and protocol failures.

4. Regulatory Compliance

With global regulators showing interest in DeFi development, platforms are adapting through tools like zero-knowledge KYC, jurisdiction-specific access controls, and compliant stablecoin use. By balancing regulatory requirements with decentralization principles, these platforms aim to legitimize DeFi and unlock institutional partnerships without compromising open access and censorship resistance.

5. Integration with Traditional Finance

DeFi and TradFi are converging through tokenized real-world assets (RWAs), bank-grade APIs, and compliance-focused partnerships. Stablecoin settlements, custody services, and blockchain-based credit infrastructure are laying the groundwork for institutional adoption. This blockchain integration aims to extend DeFi’s benefits—efficiency, transparency, automation—into conventional financial systems without regulatory friction.

Conclusion

DeFi lending is no longer a fringe experiment—it’s a powerful and maturing alternative to traditional finance. With smart contracts automating lending processes, users gain instant access to liquidity, competitive returns, and full control over their assets.

If you’re a retail investor exploring passive income or an institution seeking decentralized liquidity, understanding how platforms like Aave, MakerDAO, and Compound work is crucial. As the industry adapts to tighter regulations, expands into real-world applications, and becomes more user-centric, the future of DeFi lending looks increasingly stable, scalable, and mainstream.

Therefore, to confidently participate in this growing financial frontier, you need to choose platforms that prioritize security, usability, and innovation.

FAQs

A. They open the door for anyone with an internet connection to borrow or lend—no credit checks, no banks judging you. It’s invaluable for people in places where traditional banking isn’t easy to access. DeFi basically gives more people a shot at managing their money.

A. With decentralized governance, users actually get a say in how the platform works, like voting on updates or rule changes. It can feel empowering, but also a bit chaotic if too many cooks are in the kitchen. Still, it beats decisions coming from just one company.

A. Yield farming lets users earn extra crypto by lending or staking their assets. It’s kinda like putting your money to work 24/7. The rewards can be pretty decent, though it’s not risk-free. Rates change fast, and if the market dips, your earnings might too.

A. No banks, no middlemen, and no paperwork. Everything runs on code. You can lend or borrow in minutes, usually with better rates. It’s faster, more transparent, and often cheaper—but you’ve got to be more hands-on and know what you’re doing. No hand-holding here.

A. Smart contracts are the brains behind DeFi lending. They handle everything—from loans to repayments—automatically and without bias. No need to trust a person or a company; you trust the code. Of course, if that code has bugs, well… that’s a whole different problem.

Talk With Our Expert

Our Latest Insights

USA

2102 Linden LN, Palatine, IL 60067

+1-703-537-5009

info@debutinfotech.com

UK

Debut Infotech Pvt Ltd

7 Pound Close, Yarnton, Oxfordshire, OX51QG

+44-770-304-0079

info@debutinfotech.com

Canada

Debut Infotech Pvt Ltd

326 Parkvale Drive, Kitchener, ON N2R1Y7

+1-703-537-5009

info@debutinfotech.com

INDIA

Debut Infotech Pvt Ltd

C-204, Ground floor, Industrial Area Phase 8B, Mohali, PB 160055

9888402396

info@debutinfotech.com

Leave a Comment