Table of Contents

Home / Blog / Cryptocurrency

Cryptocurrency Market Making Bot: Revolutionizing Digital Asset Trading

July 5, 2024

July 5, 2024

The breakneck pace of innovation in the financial world extends to the realm of cryptocurrencies. Here, a revolutionary tool is emerging – the cryptocurrency market making bot. These automated programs are transforming digital asset trading by injecting much-needed liquidity and stability into a notoriously volatile market.

Imagine a marketplace where buyers and sellers struggle to connect, leading to wide price swings and frustrating delays. This is the reality for many cryptocurrency exchange, particularly for lesser-known tokens. Market making bots bridge this gap by acting as intermediaries, constantly placing buy and sell orders. This creates a more fluid trading environment, attracting more participants and fostering market growth.

The benefits extend beyond just liquidity. By tightening bid-ask spreads – the difference between the highest buy offer and the lowest sell offer – market making bots make trading more efficient for everyone. This translates to lower transaction costs and smoother execution for both novice and seasoned crypto traders. But how exactly do these bots work? Let’s delve deeper into the fascinating world of market making in the next section.

Understanding Market Making in Cryptocurrency

Market making is a cornerstone of any healthy financial market. In essence, market makers act as liquidity providers, ensuring there are always buyers and sellers willing to transact. This smooths out trading by minimizing price gaps and preventing large swings in value.

The mechanics of market making involve the concept of the bid-ask spread. Market makers constantly analyze order books – a real-time record of buy and sell orders for a specific asset – and strategically place their own bids (offers to buy) and asks (offers to sell) at calculated price points. This creates a buffer zone between buy and sell orders, ensuring there’s always someone willing to take the other side of a trade.

The cryptocurrency market, with its inherent volatility, presents a unique challenge for market makers. Prices can fluctuate wildly, and liquidity can be scarce for certain tokens. This is where market making bots come into play. These automated programs leverage sophisticated algorithms to continuously monitor markets, identify trading opportunities, and execute trades based on pre-defined strategies. In the next section, we’ll explore the advantages bots hold over their human counterparts and the core algorithms that power their operations.

The Role of Market Making Bots

Human market makers have traditionally played a vital role in financial markets. However, in the fast-paced world of cryptocurrency trading, their limitations become apparent. Here’s where market making bots step in, offering a compelling alternative.

The primary advantage of bots lies in their speed and efficiency. Unlike humans who are susceptible to fatigue and emotional biases, bots can react to market changes in milliseconds, capitalizing on fleeting opportunities. They operate tirelessly 24/7, constantly monitoring markets and executing trades based on pre-programmed logic. This eliminates the need for constant human supervision and ensures consistent execution of your trading strategy.

Furthermore, bots remove the element of human emotion from the equation. Fear and greed, common pitfalls for human traders, can lead to irrational decisions and costly mistakes. Bots, however, execute trades based on objective criteria defined within their algorithms. This allows for a more disciplined and potentially more profitable trading approach.

But how do these bots actually make money? Crypto market making bots employ a variety of algorithms to identify profitable trading opportunities. Some popular strategies include:

- Mean Reversion: This strategy assumes that prices eventually revert to their historical average. Bots buy when prices dip below the average and sell when they rise above.

- Arbitrage: By exploiting price discrepancies across different exchanges, bots can buy low on one exchange and sell high on another, capturing the price difference as profit.

- Statistical Analysis: Bots can analyze historical price data and market indicators to predict future price movements and place orders accordingly.

In the next section, we’ll delve into the key features of a cryptocurrency market making bot, exploring how these features translate into tangible benefits for traders.

Key Features of a Cryptocurrency Market Making Bot

Cryptocurrency market making bots offer a range of features designed to streamline your trading experience and potentially enhance your profitability. Here are some of the most crucial functionalities:

- Liquidity Provision: Bots can automatically place buy and sell orders at strategic price points. This injects liquidity into the market, tightening the bid-ask spread and facilitating smoother execution of your trades.

- Automated Trading: Eliminate the need for manual order placement. Define your trading strategy within the bot’s interface, and it will handle the execution based on your predefined parameters. This frees you up from constantly monitoring markets and allows you to focus on other aspects of your trading strategy.

- Risk Management: Many bots offer built-in risk management features that help mitigate potential losses. Stop-loss orders automatically sell assets when prices reach a pre-defined level, protecting your capital from sudden downward swings. Additionally, position sizing allows you to customize the amount of capital allocated to each trade, preventing overexposure to any single asset. Portfolio balancing helps maintain a desired asset allocation within your bot’s trading activity.

- Customization and Flexibility: Advanced bots provide customization options, allowing you to tailor strategies to your risk tolerance and market conditions. You can define parameters like bid-ask spreads, order sizes, and risk management features to create a strategy that aligns with your individual trading goals.

The availability of these features empowers you to take control of your cryptocurrency trading experience. However, with a multitude of bots available in the market, choosing the right one can be daunting. In the next section, we’ll explore some popular market making bots and provide insights on navigating the selection process.

Popular Market Making Bots in the Industry

The landscape of cryptocurrency market making bots is brimming with options catering to different needs and experience levels. Here’s a glimpse at a few popular platforms to whet your appetite:

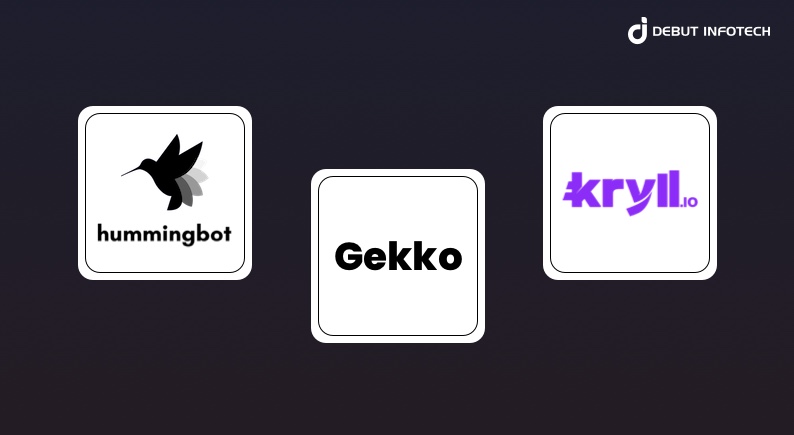

- Hummingbot: This open-source powerhouse offers a vast library of market making strategies and a high degree of customization. Seasoned traders who relish the ability to fine-tune their approach will find Hummingbot’s flexibility particularly appealing. However, the learning curve can be steeper compared to some user-friendly options.

- Gekko: Embracing a more user-friendly approach, Gekko is another open-source bot well-suited for those new to the world of automated market making. Its intuitive interface and features like backtesting – which allows you to test your strategies with historical data before deploying them with real capital – make it a great platform to learn the ropes.

- Kryll: If the idea of coding or configuring complex parameters seems daunting, cloud-based platforms like Kryll offer a compelling alternative. Kryll provides pre-built strategies you can deploy with a few clicks, along with a drag-and-drop interface for crafting your own custom strategies. This ease of use comes at the expense of some customization options compared to open-source platforms.

Choosing the right bot hinges on your experience level, risk tolerance, and desired level of control. For beginners, a user-friendly platform with pre-built strategies might be ideal. As you gain experience, you can explore more customizable options. Regardless of your choice, conducting thorough research and understanding the bot’s features are crucial before entrusting it with your capital.

Curious about how a market making bot can enhance your trading strategy?

Reach out to Debut Infotech to get started on your custom solution today.

Implementing a Market Making Bot

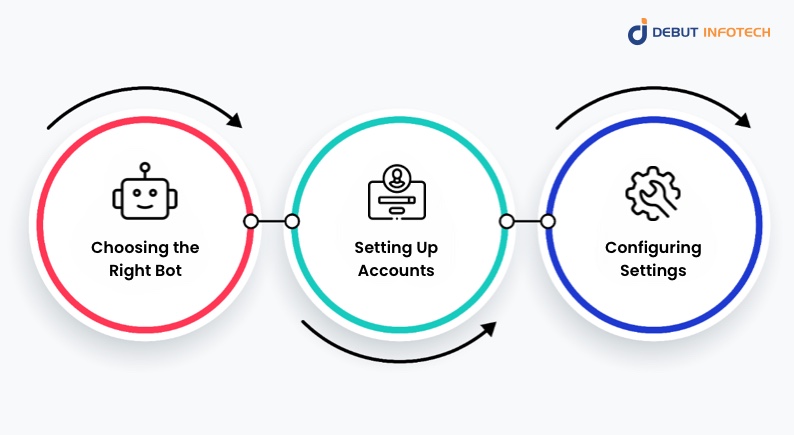

Embarking on your journey with a market making bot involves a few key steps:

- Choosing the Right Bot: As discussed earlier, research different platforms, considering factors like features, complexity, fees, and ease of use. Explore online reviews, tutorials, and user communities to gain insights into each bot’s strengths and weaknesses.

- Setting Up Accounts: Connect your exchange account to the bot via API (Application Programming Interface). This grants the bot permission to place orders on your behalf. Ensure you understand the security implications of API access and only connect your bot to reputable exchanges with robust security measures.

- Configuring Settings: Define your trading strategy by setting parameters within the bot’s interface. This might involve specifying the cryptocurrency pair you wish to trade, the desired bid-ask spread, order sizes, and risk management features like stop-loss levels and position sizing.

Remember, market making bots are powerful tools but are not without risks. The next section will delve into the technical considerations, market risks, and regulatory landscape surrounding the use of market making bots.

Challenges and Risks

While market making bots offer exciting possibilities, venturing into this realm necessitates a clear understanding of the associated challenges and risks. Here are some key considerations:

- Technical Challenges: Running a bot effectively might require some technical know-how. A reliable computer with sufficient processing power and a stable internet connection are essential. Additionally, depending on the bot’s complexity, you might need to grapple with configuration settings and potential software bugs.

- Market Risks: The cryptocurrency market is inherently volatile, and sudden price swings can lead to unexpected losses. Even with robust risk management features in place, unforeseen market events can disrupt your market making bot strategy and potentially erode your capital.

- Regulatory Considerations: The regulatory landscape surrounding cryptocurrency trading bots is still evolving. Stay informed about regulations in your jurisdiction to ensure your bot’s activities comply with current legal frameworks.

Despite these challenges, market making bots hold immense potential for those willing to navigate the learning curve and manage the associated risks. In the concluding section, we’ll explore the future of market making bots and their potential impact on the cryptocurrency landscape.

Want to revolutionize your cryptocurrency trading with a state-of-the-art market making bot?

Contact Debut Infotech today to get started on your custom solution and take your trading strategy to the next level!

Conclusion

Throughout this blog, we’ve explored the fascinating world of cryptocurrency market making bots. These automated programs are transforming digital asset trading by injecting liquidity, tightening spreads, and offering traders a potentially more efficient and profitable approach. We’ve delved into the core functionalities of bots, explored popular options, and discussed the steps involved in getting started.

Remember, market making bots are powerful tools, but they are not without risks. Technical challenges, market volatility, and evolving regulations necessitate a cautious and well-informed approach. Thorough research, a clear understanding of the risks involved, and ongoing monitoring are essential for success.

For those willing to embrace the learning curve and manage the risks, market making bots offer a compelling way to potentially enhance their cryptocurrency trading experience. As the technology continues to evolve, driven by advancements in AI and ML, we can expect even greater sophistication, efficiency, and risk management capabilities from these automated market makers.

Debut Infotech stands at the forefront of this technological revolution as a premier crypto trading bot development company. Our team of skilled developers excels in creating advanced cryptocurrency market making bots that cater to a wide range of trading strategies. With a deep understanding of market dynamics and a commitment to innovation, our developers have successfully implemented numerous projects, driving significant market maker bot profits for our clients.

Our expertise spans various aspects of crypto market making bots, including developing robust market making bot strategies, integrating AI and ML for enhanced decision-making, and ensuring seamless operation across platforms like Solana. By focusing on providing liquidity, managing market volatility, and maintaining compliance with evolving regulations, we help our clients navigate the complexities of the cryptocurrency market.

The future of market making bots is undeniably intertwined with the future of cryptocurrency markets themselves. By fostering increased liquidity and market stability, these bots have the potential to pave the way for wider adoption and mainstream acceptance of digital assets. With Debut Infotech as your development partner, you can confidently step into the future of cryptocurrency trading, leveraging cutting-edge technology to achieve your trading goals.

Leave a Comment